In the slow recovery from the financial crisis, growth in Canada and abroad has been disappointing.

The fall in commodity prices since 2014 has been a major shock for Canada, primarily felt through weaker terms of trade, a lower Canadian dollar, reduced domestic income and resource sector activity.

Before this shock, Canada had excess capacity of about 1% of GDP. The shock will slow Canada’s actual output and its productive capacity — but the Bank of Canada estimates larger impacts on the former through to 2017. These developments, therefore, will delay the economy’s return to its potential. Without new policy measures over the next few years, our economy likely will not perform as well as it could.

Macroeconomic policy considerations

A painful and lengthy adjustment process is underway, and policymakers are being asked to respond. Finding the right macro policy mix requires carefully weighing the benefits and risks of additional measures against the status quo.

Accommodative monetary policy has clearly helped thus far, but lowering interest rates further will provide little economic stimulus and involves risks of overheating housing markets, encouraging more borrowing by over leveraged households, and broader financial stability concerns.

Fiscal policy is now a more promising way to support the economy because:

1. the federal government has fiscal room available, as the PBO recently estimated:

The federal government…has fiscal room of 1.4% of GDP…(and) could reduce taxes or increase spending by $28 billion in 2015 (and maintain that policy as a proportional share of GDP) while returning to a net debt-to-GDP ratio of 34% after 75 years.

2. monetary policy seems to be signalling that it would accommodate fiscal policy. If so, this would greatly enhance the effectiveness of fiscal policy, see here and here including:

In a situation of sustained weak aggregate demand, relying primarily on monetary policy to provide stimulus may lead to financial vulnerabilities…in such circumstances, fiscal policy may be called upon to provide stimulus, particularly since it is likely more effective at lower interest rates.

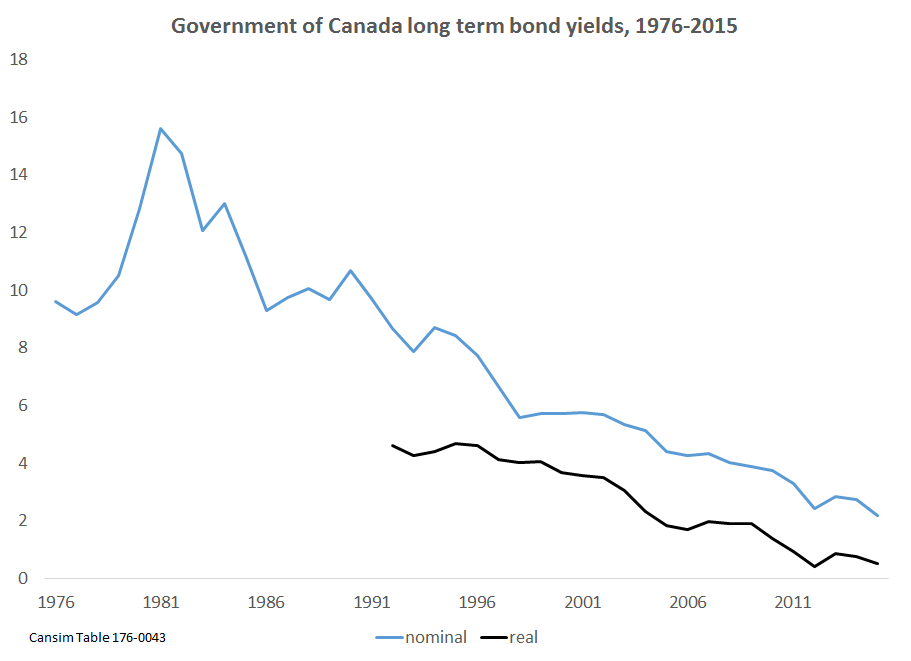

3. the opportunity cost of long-term government borrowing is near historic lows; and

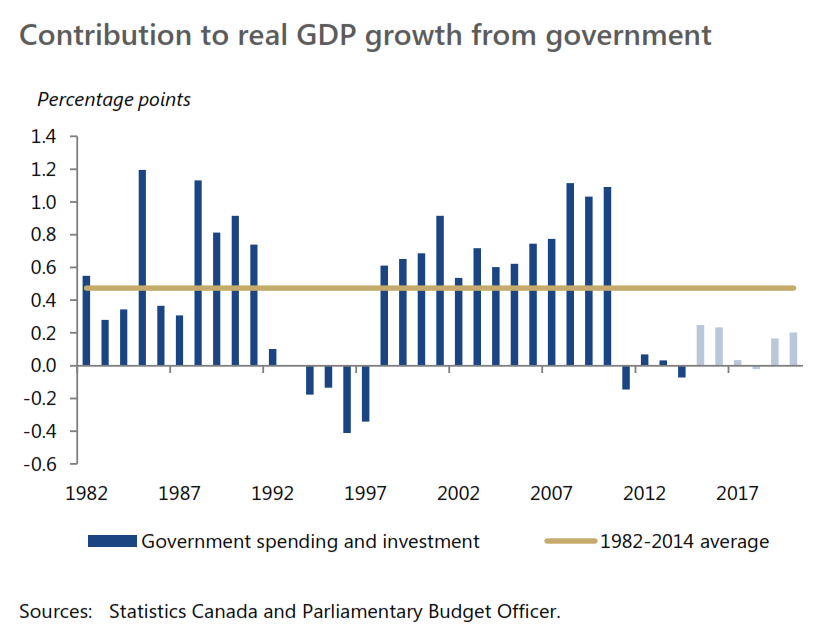

4. with restraint being applied for the last five years, spending needs have likely built up in some areas.

4. with restraint being applied for the last five years, spending needs have likely built up in some areas.

Of course, new fiscal measures also have risks. Programs and budget deficits are easier to start than end; the evidence of robust short-term fiscal “multipliers” is mixed; larger deficits will increase debt charges; and perhaps any economic boost will arrive too late due to lags in implementation.

Of course, new fiscal measures also have risks. Programs and budget deficits are easier to start than end; the evidence of robust short-term fiscal “multipliers” is mixed; larger deficits will increase debt charges; and perhaps any economic boost will arrive too late due to lags in implementation.

But I see bigger risks from passively assuming that oil prices will rebound over the projection or driving interest rates even lower.

Managing expectations

Canada’s economic and fiscal performance depends on global developments that domestic policymakers can’t directly control. Therefore, Budget 2016 should manage expectations of what fiscal policy can deliver in the near-term — particularly for cost-shared infrastructure. The last round of fiscal stimulus showed that we shouldn’t overestimate how quickly these projects get going. New announcements will mostly hit the ground after the 2016 construction season. And that’s okay. “Shovel-worthy” should take precedence over “shovel-ready”. The main rationale for infrastructure is not short-term stimulus, but improving Canada’s longer-term economic potential, which takes time.

Enhancing budget credibility and improving analytical capacity

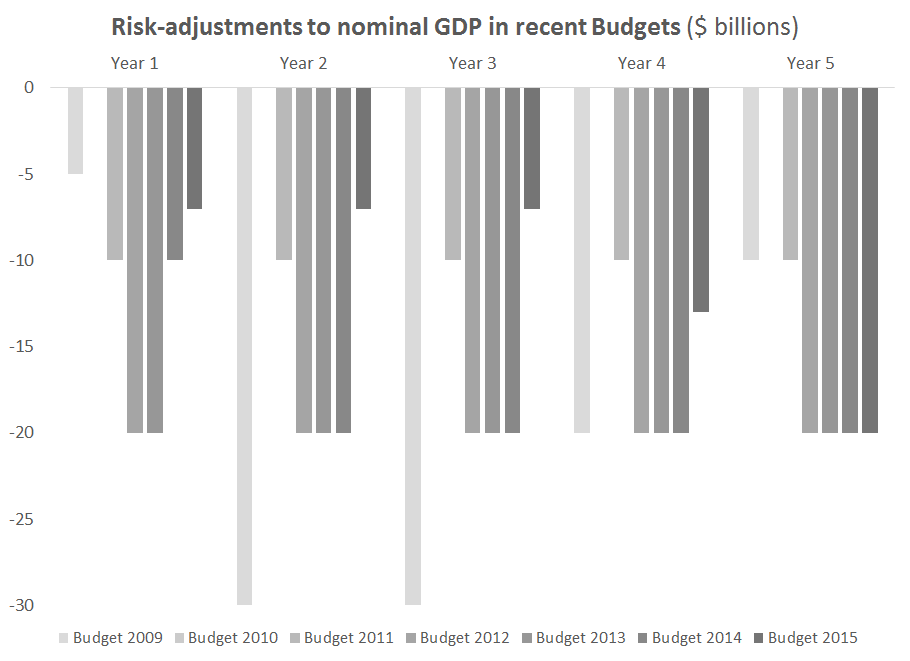

The consensus GDP forecast was revised down in six of the last seven budgets.

It is prudent, therefore, for Budget 2016 to explore the prevailing downside risks in detail. For example, what are the implications of oil prices staying at, say, $30 a barrel over the projection? Reporting such a scenario would illustrate the challenges we face, how oil prices affect federal finances, and show alternative policy responses.

It is prudent, therefore, for Budget 2016 to explore the prevailing downside risks in detail. For example, what are the implications of oil prices staying at, say, $30 a barrel over the projection? Reporting such a scenario would illustrate the challenges we face, how oil prices affect federal finances, and show alternative policy responses.

Demonstrating transparency in the government’s first budget will help build fiscal credibility — for instance, by including more internal analysis and technical details. Finance Canada’s analytical capacity could be augmented by revamping the publication of internal staff working papers and encouraging researchers to present their work externally.

Fiscal policy targets

The government has stated two fiscal policy targets: first, to reduce the federal debt-to-GDP ratio each year, and second, to balance the budget in fiscal 2019.

The first target rightly shifts the focus away from the annual nominal budget balance. However, rather than requiring annual reductions in the debt ratio, it might be better to target the debt ratio over a longer period (such as 5 years — though, it’s hard to argue for any specific numerical target within the range currently envisaged over the medium term in the ballpark of roughly 25% to 35%). Whichever medium-term policy target is used, it should be complemented with a longer-term one that looks ahead over several decades, underpinned by fiscal sustainability analysis.

The 2019 budget balance target was likely chosen to show that the government will fully fund its new initiatives by the end of the mandate. However, it’s hard to reconcile a goal to balance the budget, on the one hand, with directives to repeal the Balanced Budget Act, on the other.

Beyond Budget 2016

Many complex issues require attention over the medium-term, let me highlight just one: eventually, the Canadian federation will probably need to raise more tax revenue as a share of GDP. If so, this should be done carefully to avoid unduly restraining growth. The government already intends to review tax expenditures. This is worthwhile, but the scope of the exercise should be broadened. What’s needed is a more comprehensive examination of Canada’s tax system to make it more efficient and equitable.

********

After serial disappointments, Canada’s economy is adjusting to a major oil price shock. The outlook is weak and highly uncertain. Downside risks prevail and the economy will likely operate below its productive capacity over the next few years.

To manage these risks, expectations should be tempered and the macroeconomic policy approach should be adjusted. Hoping for a rebound in oil prices is not good enough. Fiscal policy needs to be more active. This would help cushion the ongoing adjustment and ease the burden on monetary policy (which deftly cut interest rates and allowed our flexible exchange rate to encourage a needed sectoral reallocation, but should now take a pause).

In the short-term, timely and targeted automatic stabilizers should be allowed to work — such as unemployment benefits or federal stabilization transfers to resource-rich provinces — and could even be temporarily strengthened. Any new discretionary measures should focus on enhancing Canada’s slowing economic capacity over the medium term, and they should eventually be funded as part of a longer-term plan that preserves fiscal sustainability.