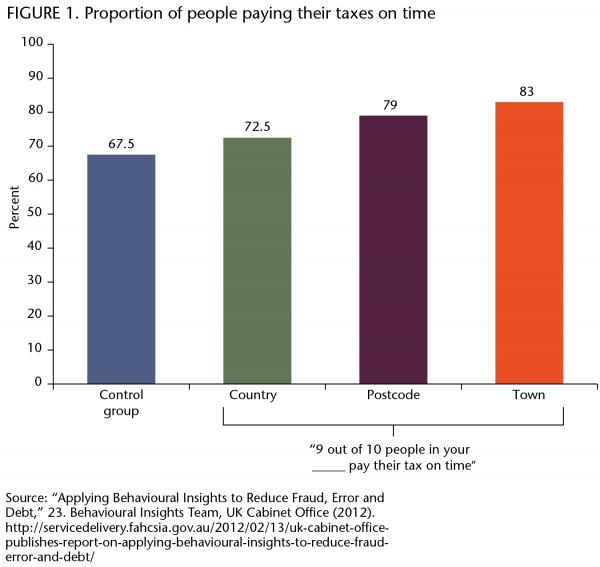

Is it better to tell taxpayers that they are late paying their taxes and face fines? Or are they more likely to comply when told that 9 out of 10 people in the country have paid their taxes on time? Better yet, does it help to tell them that 9 of 10 people in their hometown have already paid (figure 1)?

David Cameron’s government in Britain decided to find out. In 2011, a select group of laggard British taxpayers were sent a reminder-to-pay letter from Her Majesty’s Revenue and Customs office that referred to the fact that 90 percent of their fellow citizens paid their taxes on time. The results were significant. Those who received letters that included a reference to compliance rates in their hometown were 15 percentage points more likely to then pay their tax than those who received the customary form letter (figure 1). Had this touch of social pressure been applied across the board, the government estimated, it could have collected more than $250 million in outstanding tax, and freed another $45 million in money spent collecting it.

The trial was a brainchild of the Behavioural Insights Team, established by Cameron in 2010, which operates from inside his 10 Downing Street office. Popularly known as the nudge unit, it was an application of a theory that rose to prominence on the back of Richard Thaler and Cass Sunstein’s 2008 book Nudge, which speculated on the potential contribution behavioural ideas could have to better policy-making. Since then, the unit has run experiments ranging from ways to get more people to insulate their attics to improving traditional government forms and the ways people interact with bureaucracy. The results have been seen as promising enough that in May, Cameron’s government decided it would spin off the nudge unit into a public-private partnership.

Cameron is one of the strongest proponents of putting behavioural theory into public policy practice. One year he put Thaler and Sunstein’s book on a summer reading list for his Conservative members of Parliament, and he set up the nudge unit with a mandate to see if a tiny band of academics could improve government performance. The team of 10 is headed not by an economist but by David Halpern, whose training is in psychology.

There has been some criticism of a government initiative whose mandate has the paternalistic-sounding goal of ”encouraging and supporting people to make better choices for themselves” (from its Web site). But Britain is not alone in trying to tinker with people’s behaviour. In Ireland, the government revenue commissioners have been employing a range of treatment tools to address the failure of many pub owners to pay their taxes.

Starting with letters sent to pub owners asking them to renew their pub licenses, the Irish government has seen an increase of 6 percentage points in compliance by simplifying the letter’s wording and by informing the recipients of the their fellow pub owners’ compliance rates. According to Keith Walsh, an economist with Ireland’s revenue department, ”Insights from behavioural research offer new ways to tailor their approach to improve efficiency.”

It is not just governments that are using behavioural insights. The American electricity company Opower is appending smiley or frowning faces to monthly electricity bills for its customers, the message dictated by how much electricity customers consume relative to their neighbours. The 600,000 Opower customers who receive these messages use 2 percent less electricity than those who don’t, and these savings have been shown to persist over time and across regions.

Facebook has investigated whether its users’ voting behaviour is affected by their friends. On November 2, 2010, more than 60 million Facebook users were sent a standard message encouraging them to get out to vote. But two other groups of 600,000 each were established to test the impact of suggestion on voting behaviour. One group– the control group– received no message about election day; the other was told which of their friends had voted.

A postelection analysis published in the journal Nature found that the message group that was told of their friends’ voting behaviour resulted in an additional 60,000 votes being cast nationwide, and another 240,000 voters were indirectly spurred to go to the polling station by friends of friends. This is what psychologist Robert Cialdini calls in his book Influence ”social proof,” the urge to act as we see others acting.

Health care has become another promising area for nudges. In 2008, Kevin Volpp, founding director of the Center for Health Incentives and Behavioral Economics at the University of Pennsylvania, ran a three-month randomized trial to test whether daily lotteries could encourage older patients to take their Warfarin pills. Warfarin is an anti-coagulant prescribed to stroke victims, and failure to take it correctly can be fatal. Nonetheless, the trial indicated that the threat of dying is evidently not quite as effective a motivator as the excitement of a lottery. This daily lottery offered a 1-in-5 chance of winning $10 and a 1-in-100 chance of winning $100, and entry to the lottery was conditional upon the participants taking their medicine correctly. Patients in the control group, which was not offered the lottery option, failed to take their medicine correctly 20 percent of the time. But among those who were offered a shot at lottery winnings, just 2 percent took their medicine incorrectly.

Massachusetts Institute of Technology economist Esther Duflo has examined the use of behavioural nudges in her pioneering work on addressing policies and programs aimed at alleviating poverty in the developing world. In one case, she found that while 98 percent of Kenyan farmers questioned in 2009 said they intended to use fertilizer the following season, only 37 percent ended up doing so. The farmers displayed what economists call ”present bias,” which we all recognize as procrastination. In the Kenyan case, the gap between intention and action was addressed by offering vouchers to buy fertilizer in the future, with free delivery included.

That move resembled a nudge in which mothers in rural India were encouraged to attend free immunization camps for their children with the offer of a bag of lentils. The results: 39 percent took up the offer of immunization when it was accompanied by a bag of lentils; just 18 percent took it up when there were no lentils on offer.

Both these cases are examples of small nudges succeeding in altering personal behaviour to achieve a broader social policy good. They encourage us to ask whether a policy is failing, or if it is simply being implemented poorly. Is it designed to be as easy as possible to adhere to? Does it take advantage of the academic literature on what motivates human behaviour? If it does not, then there is a case for using behavioural insights to make or modify policy.

As we collect increasing amounts of data, it is reasonable to imagine behavioural interventions becoming ever more effectively tailored. As stores such as Target tap their customers with specific advertising based on their shopping history, we can expect in coming years to see policy-makers start to consistently apply social and cognitive psychology research to tailor tax messages, health care advice and encouragements to save more.

Photo: 360b / Shutterstock