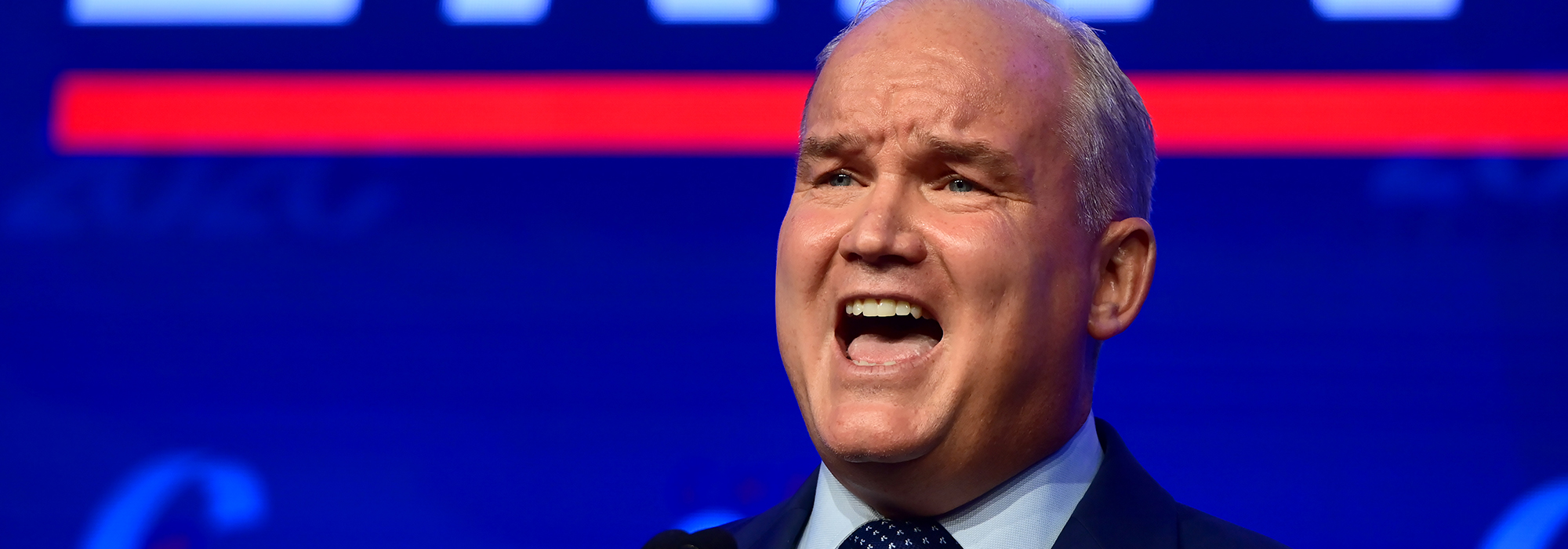

Out of a party leadership race that seemed perpetually overshadowed by the COVID-19 pandemic and protests for racial justice, Canada’s Conservatives elected as their leader a mild-mannered, former air force officer and lawyer. Erin O’Toole, a cabinet minister in the Harper government, now has the tough job of convincing Canadians that he is markedly different than the two previous Conservative leaders. In his maiden speech as leader, O’Toole assured Canadians that he would lead a Conservative Party where anyone — regardless of race, sexual orientation or length of time in Canada — could feel welcome.

While that rhetoric is helpful when running for the leadership of a political party, over 95 percent of Canadians don’t join political parties and Conservatives would be better served to focus on delivering on Canadians’ priorities. And with the potential of a fall election on the horizon, there has never been a better time for bold and courageous policies that would provide support to Canadians who are still struggling. These policies should be funded by raising taxes on those who have been unfairly avoiding it for decades.

The vast majority (80 percent) of people in Ontario, a province the Conservatives desperately need to win if they are to form government, believe that the Canada Emergency Response Benefit (CERB) should continue. Of the 8.66 million applicants for CERB across the country, the greatest proportion (1 in 4 applicants) have been those aged 25-34 years. The pandemic is clearly hitting younger Canadians the hardest — another group Conservatives have struggled to attract.

Promoting a guaranteed income for Canadians of all ages would help to both ease Canadians’ fears about their own and the country’s financial uncertainty, and give the Canadian economy an essential boost. Canadian economists have noted that because CERB effectively replaced people’s lost wages, it helped increase consumer spending. This demonstrates that when low-income people — who were most impacted by job losses — receive government transfers, they spend it. The potential fallout of removing meaningful government aid could be enormous. Canada’s biggest banks have earmarked billions in loan loss provisions for their personal and business customers, who they fear may not be able to make regular payments on their credit cards, mortgages, and lines of credit.

Rather than simply extending CERB, a one-size-fits-all policy with little due diligence to reduce fraudulent claims, Conservatives could propose a universal basic income (UBI) that is not only indexed to inflation, but also indexed to the local cost of living. That way, a person living in Toronto or Vancouver, where average rent for 1-bedroom apartments is over $2,000 per month, would receive more than a person living in a more affordable city like St. John’s, NL.

While many view UBI as too expensive and impractical, Canada already has a universal income program, but it’s only available to seniors. The Guaranteed Income Supplement is a non-taxable monthly benefit for Canadians over 65 years who collect Old Age Security and fall below maximum income thresholds.

Not only would UBI address Canadians’ pressing affordability concerns, it would also greatly benefit women and children, particularly those who are victims of domestic violence. Financial abuse — using money to control a partner or child — is common in many domestic violence situations. US studies have found that 94 to 99 percent of women in abusive relationships have also experienced financial abuse. And with domestic violence incidents increasing since the beginning of the pandemic, this policy is important now more than ever.

Domestic violence isn’t the only social problem spiking during the pandemic. The social isolation and economic uncertainty that have become ubiquitous during pandemic life can have a detrimental impact on Canadians’ mental health. The Canadian Mental Health Association has warned of an “echo pandemic” of mental illness as a result of Canada’s underfunded and resourced-starved mental health system, with a survey showing the number of people thinking about suicide has increased almost three-fold.

To stave off this echo pandemic and showcase itself as a party that cares about the country’s most vulnerable people, Conservatives should propose bringing mental health services under the Canada Health Act. This would allow mental health services to be covered under Canada’s publicly funded health care system. A new Mental Health Transfer payment could provide provinces with dedicated funding that would cover billing of social workers, counsellors, psychologists and other mental health services at pre-determined rates. Providing accessible services could prevent people from experiencing mental health crises and would divert those experiencing mental health crises from the police — where they may be assaulted or killed.

Big spending on social programs is not typically considered conservative. Many are opposed to increased spending on social programs because they fear one (or both) of two things: an astronomical national debt and high taxes. There are, however, some specific tax changes that would target those who are currently not paying their fair share — and would be very popular even with Conservatives.

A home vacancy tax and foreign buyers’ tax would both help to generate necessary revenue and temper overheated housing markets in Canada’s biggest cities. The city of Vancouver collected $38 million in 2017 and $39 million in 2018 since its vacancy tax took effect in 2017. With a national vacancy home tax and a tax on foreign buyers, the federal government could share revenues with provinces and territories as is currently done with the gas tax. This money could go toward affordable housing or even lead to a decline in vacant homes as was the case in Vancouver.

Tax avoidance is a major issue around the world. The Organization for Economic Co-operation and Development estimates it costs governments US$100 to $240 billion each year (C$131 to $314 billion). Corporate profit shifting, the practice whereby a multinational company earns income in one country but declares it in another country with a lower tax rate, should be abolished. Any company earning income in Canada should be told to declare that income in Canada and pay Canadian income taxes. Corporate profit shifting not only robs the country of essential revenue, it’s also harmful to small businesses because it renders them unable to compete.

Lastly, the Conservatives should do what the Liberal government failed to do and implement a tax on stock options at the same rate as income from wages and salaries. The government announced changes to employee stock options would come into effect January 1, but those changes were postponed and slated to be announced in the 2020 budget. Canada, of course, didn’t have a budget this year, and the government instead released a fiscal and economic “snapshot” on July 8, which omitted any reference to employee stock options.

Not only would all these measures deliver on tax fairness, they would also present the party as the one that fights for the everyday Canadian rather than overprivileged elites.

When Erin O’Toole delivered his inaugural speech as leader, he spoke specifically about wanting Liberal and NDP supporters to consider voting for Conservatives. But it isn’t enough for the party leader to say the right things. The party must also deliver on the financial and economic issues that are top of mind for Canadians and would benefit those who might otherwise lean toward other parties. At a time when millions of Canadians are struggling to pay their bills, the country needs a Conservative party that will not simply complain about rising national debt, the growing size of government, and lecture about the importance of personal responsibility.

Photo: Conservative Party of Canada Leader Erin O’Toole speaks after his win at the 2020 Leadership Election in Ottawa on Aug. 23, 2020. THE CANADIAN PRESS/Sean Kilpatrick