The defeat of the HST in British Columbia in the August 2011 referendum was a unique and remarkable event in the history of policy making in Canada. The people of the province rejected the HST, adopted on July 1 2010, in a referendum carried by a convincing margin of 55 to 45 percent. Never before in Canada has a federal or provincial tax been struck down by a popular vote of this kind.

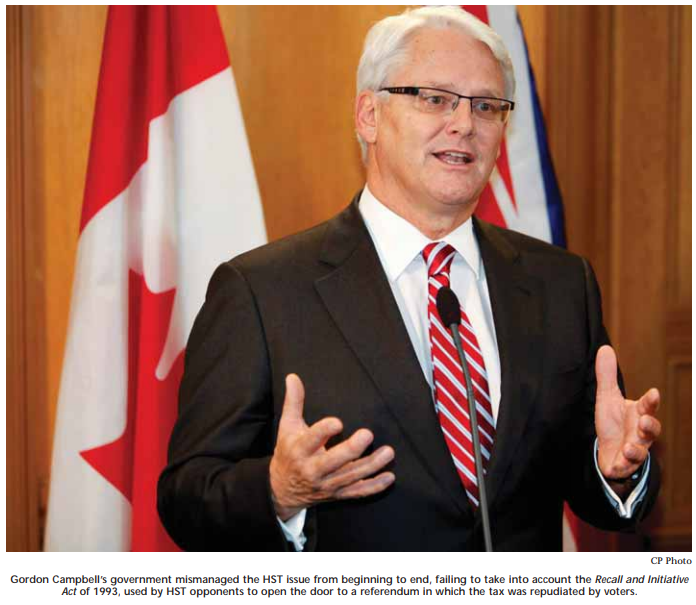

When the provincial government announced that it was adopting the HST in July 2009, slightly two months after a provincial election, the possibility of a referendum seems not to have been considered. The government’s blindness to the implications of BC’s recall and initiative legislation is, in retrospect, one of the greatest political blunders in the province’s history.

The opposition used the legislation as a platform to organize and mobilize. It succeeded for a number of reasons. The government proved to be extraordinarily inept. So too did its business and academic supporters. The opponents on the other hand displayed a sure sense of BC populist politics and of the weaknesses in the government’s position. Voters themselves proved to be remarkably informed and interested. A debate that the government and its supporters did not want took place with results that they did not predict. In the end the government and its supporters were out smarted and out organized by highly motivated opponents.

The successful challenge to the HST relied heavily on the Recall and Initiative Act. The legislation is unique to British Columbia in Canada. It was enacted by the NDP government of Mike Harcourt in 1993, following a referendum in the 1991 election calling for such legislation. It has two parts, the first providing for the recall of MLAs and second providing for popular initiatives to force government to consider legislation not on the government’s agenda. With an initiative, a registered voter may organize a petition under a set of precise procedures that can result in voters asking the legislature to consider a proposed legislative bill. Under these rules, proponents have 90 days after the petition Is issued to obtain the signatures of at least 10 percent of the registered voters in each and every provincial constituency. If they do so the legislation is submitted to a special select committee of the legislature.

The committee must do one of two things. It can either refer the proposed legislation to the legislature for a vote or it can put it to a referendum. If referred to the Legislature, the legislative vote is final. If it chooses to have a referendum, a vote in favour by 50 percent +1 of the registered voters in the province overall and by more than 50 percent of the registered voters in each of at least two-thirds of the constituencies means the government must take the bill to the legislature for a vote. If that requirement is not met, the matter is dead.

Members of the legislature are not bound by a referendum if that is the route chosen. If a referendum passes the government is required only to take the bill to the legislature. A majority vote in the legislature determines the fate of the matter, regardless of the outcome of the referendum.

A referendum campaign is governed by stringent campaign financing rules including limits for the proponent and the combined opponents.

Only one proponent is permitted. Two things are worth noting. First, a referendum must meet a very high bar to be approved, in that those who don’t vote are in effect counted as nays. Second, the legislature and thus the government, if it has a majority, has the final say.

Both features, reflecting a high regard for normal parliamentary democracy, are integral to the design of the legislation. Initiatives are intended to act only as a check and balance on government in particularly egregious situations. They are not intended to be common place or frequent. Further they are not to over ride legislative sovereignty. They are set firmly within the constitutional rules of Canadian democracy which are based on legislative rather than popular sovereignty.

Under the Act, extra-parliamentary politics does not over-ride a legislature’s power ultimately to decide public policy. A referendum under the Act is simply a political tool voters may turn to under certain circumstances to force a government to reconsider its position.

Voters themselves proved to be remarkably informed and interested. A debate that the government and its supporters did not want took place with results that they did not predict. In the end the government and its supporters were out smarted and out organized by highly motivated opponents.

Before turning to the debate and the issues, one other feature of British Columbia’s legislative structure should be mentioned. The province also has a separate Referendum Act. The rules under this Act are completely different. Referenda under this Act are at the discretion of the government, there are no financing rules, they require a simple majority of votes cast to be approved and when approved they are binding on the government.

A curious feature of the HST vote is that it was eventually held under this legislation, not the Recall and Initiative Act. In the spring 2011 session of the Legislature, the government passed an act cancelling its application to the HST and substituting in its place a vote under the Referendum Act.

The government had three reasons for doing so. First, it was clear that it was political suicide to apply the standards under the Recall and Initiative Act requiring a majority of registered voters to defeat the HST. Second public opinion strongly supported a call that the results be binding. Third, the government did not want the supporters of the HST to be constrained by the controls on spending in the Recall and Initiative Act.

One thing that virtually everyone can agree on is that the government mismanaged the issue from the start. During the election campaign a little more than two months before the tax was announced, the governing Liberal party said there would be no HST. At the time of the announcement of its introduction, it said that it only decided the matter after the election. The vast majority of voters either did not believe this was true or believed that it was wrong to break a campaign promise. Either way they did not accept the legitimacy of the tax. As the voices of opposition grew the government made it clear that there would be no reconsideration and no further consultations. These views poisoned the political climate from the beginning of the debate.

The main focus of the government’s argument was, as is stated in the announcement, “that the HST will remove over $2 billion in costs for B.C. businesses. That includes an estimated $1.9 billion of sales tax removed from business inputs.” Key to the government’s argument was the claim that the tax is “neutral.” It argued that because the in excess of $2 billion in tax cuts for business and low income tax payers was to be paid for by increased taxes for middle income taxpayers including from the sales of previously sales tax exempt producers of business products and services, the tax was neutral. The fundamental difficulty with the HST, which most taxpayers realized very early, is that this means a redistribution of the tax burden to a middle class that already perceives itself to be heavily burdened. Apart from the belief that it had deceived the voters, a large problem for the government was the realization by middle class voters that the tax cuts were to be paid for by them.

The neutrality argument thus proved to be a difficult sell. Many middle income earners resisted paying these higher taxes. An attempt to argue that compensating efficiency gains in the economy will either be passed on or “trickle down” to middle income earners never gained credibility. The task of making the government’s case was made more difficult by the fact that many people were more aware and sceptical than once was the case because corporate tax cuts introduced in the previous ten years by the same government do not appear to most to have fulfilled similar promises made.

The government was supported in its case by a large number, although by no means all, of the major business organizations in the province. A number of academic economists also came out in favour. By early fall 2009, the issue had shifted from the merits of the tax to the government’s integrity and arrogance. The premier and ministers displayed a particularly tin ear. The anti-tax populist ear of former premier Bill Van der Zalm needed no prompting. He immediately stepped up to seize the limelight and the leadership of the opposition groups. The NDP and some important business sectors such as tourism, bars and restaurants, and construction signed on to the general opposition.

Polls showed a vast majority of voters wanted an admission by the government that it had made a mistake and a promise that it now supported a withdrawal of the tax. Neither was forthcoming.

The opposition focussed their efforts on a campaign to force a reconsideration by the government by mounting a petition. The government seemingly could do nothing to slow its momentum. Sign-ups for a petition to extinguish the HST and bring back the PST commenced April 5, 2010. Over the next 90 days, the anti-HST forces were successful in getting the signatures of more than 10 percent of voters in all constituencies. The petition succeeded beyond the expectations of many including the government.

At the end of August 2010 the successful petition was sent to the special legislative committee. Rather than taking the matter to the full legislature for a vote, the government decided to put it to a referendum. It did so in part to avoid forcing its MLA to vote for the HST in the Legislature.

Having now lost faith in its ability to convince British Columbians that the HST was a good thing, it was also desperately afraid that some MLAs might abandon it if a vote were held.

By the fall the premier’s polling numbers were in free fall. He attempted to reverse his and his party’s collapsing fortunes by announcing middle class tax cuts and other enticements. But he was seen as the leader of a government on the run. Deeply unpopular and discredited, the premier announced on November 3, 2010 that he would be resigning. The debate over the HST thus proceeded at the same time as the Liberals fought out a leadership contest. The government subsequently decided to hold a mail ballot during July, 2011 under the Referendum Act, for reasons previously mentioned. The enabling legislation was passed in April 2011.

The official referendum campaign started after the legislation was passed in April 2011. Both sides followed their script closely. The government spent heavily to argue its case, allocating over $7 million to its campaign. The official yes and no sides were each given $250,000 by the government. Other groups including organized labour, business and the NDP also spent considerable sums of money, although the government and business groups were by far the biggest spenders. Most of the government money went into an expensive advertising campaign and to supporting a hand-picked review panel that was later found to have worked closely with the government.

The government and business campaign in support of the HST was reasonably effective. Opposition to the HST in the fall of 2010 was reported in most polls to be in the range of 75 percent; by the time the vote was held opposition was predicted to have dropped to about 55 percent.

When the ballots were counted and the count released at the end of August, 2011 the opposition to the HST prevailed. The government and its supporters lost the campaign for public support. The governing Liberals were not able to prevail in many of the constituencies it held in the last election. The HST had relatively low support among South Asian and Chinese Canadian. It also received some of its weakest support from among middle and lower income earners. The NDP campaign against the tax found a responsive audience; not one constituency held by the NDP voted for the HST.

An argument made by some supporters of the HST is that people opposed voted against their individual interests and thus voted irrationally. The contrary is almost certainly true. Many people had legitimate interest based reasons for the opposing the tax. The government and the advocates for the tax were never able to convince people that tax cuts do not have to be paid for. The widespread middle class resistance is thus not an example of people behaving contrary to their own interests and thus irrationally. Whatever else may be said about the result of the referendum, it is hard to sustain the irrationality argument.

Other critics of the process argue that deciding policy in a parliamentary democracy by popular vote is a denial of the basic principle that in a parliamentary system elected representatives deliberating in the legislature are and must be ultimately responsible for policy decisions.

The premier and ministers displayed a particularly tin ear. The anti-tax populist ear of former premier Bill Van der Zalm needed no prompting. He immediately stepped up to seize the limelight and the leadership of the opposition groups. The NDP and some important business sectors such as tourism, bars and restaurants, and construction signed on to the general opposition.

Referenda they argue are extra-parliamentary, inconsistent with the supremacy of the legislature and perhaps even unconstitutional. Others argue that referenda are poor tools for making complex decisions. With referenda, voters seldom consider the knock-on effects of their decisions and don’t engage in the sophisticated deliberations that occur in legislatures and related bodies. Many tax policy advocates, deeply invested in the HST, raise questions about the ability and capacity of ordinary voters to understand taxation policy, often suggesting in an only slightly veiled way that expert elites are the only ones that can be trusted with such questions. And numerous pundits suggest that the HST referendum is a reflection of the quixotic nature of BC politics and part and parcel of the tyranny of a kind of populism in BC that makes considered policy analysis and reasoned debate very difficult.

I would argue that most if not all of these concerns are misplaced. They result from a failure to understand why people objected to the HST in BC, to appreciate the government’s incredible bungling of the initiative and to understand the legislative regime in BC that made the referendum possible in the first place. They also seriously underestimate voters. There are lessons to be learned, but they are not those advanced by most of the critics. The legislation resulted in legitimate, intelligent and much needed debate. The opponents of the HST understood the issues, communicated effectively and honestly by the standards of political campaigns, and voters responded rationally. The legislation helped to force a recalcitrant government into a review that was legitimate and indeed healthy.

It is widely off the mark to blame either the process or the opponents for the faults of a government that proved incapable of managing the issue.

Indeed the process and the outcome speaks to the health and vibrancy BC politics and its institutions, and not to its dysfunction as alleged by some. While some modest improvements might be considered the legislation should be retained. Having gone through its own test by fire, it has proven to be a legitimate and effective part of the BC policy process that could well be emulated by others.

It is hard to understand how the Campbell government failed to consider the implications of the BC legislation when it decided to proceed with the HST. But fail it did. From the very outset, it proceeded as if the legislation did not exist. From the beginning it is clear that the government misread public sentiment and the possibility that the HST could be effectively resisted by angry voters.

In assessing what happened it is clear that many people had legitimate and well-considered reasons for objecting to the HST. The BC government badly bungled its introduction and was never able to regain the trust of a majority of voters. While widely misunderstood by some, the initiative legislation provides a sophisticated and innovative tool to enhance accountability and to give people a voice when government fails. The referendum process in BC is not contrary to the constitution and the conventions of parliamentary democracy. While the constitutional and political bases for the referendum are much misunderstood, it could very usefully be emulated by other jurisdictions.

Having said that, two adjustments should be considered by BC. One, the threshold for approving a petition should be lowered so that 10 percent of voters do not have to sign up in every constituency. 10 percent of the overall electorate should be sufficient. Second the percentage voter required to pass a referendum should be reduced from a majority of registered voters to either 50 percent or 60 percent of those voting. It is clear that popular opinion does not and will not in the future accept the existing rule requiring the support of a majority of registered voters. While some now claim in retrospect that the government could have salvaged the HST by sticking with the threshold now in the legislation, this ignores an important political reality. If the government had done that, its political fortunes would have been destroyed. Election defeat would be unavoidable and its successor government could never have continued the tax.

The HST could have been salvaged. But the route to doing was not to have insisted on opposition by a majority of registered voters as the initiative act now requires. Instead, if the government had decided to let debate proceed over the fall of 2010 and the winter of 2011, and then taken the issue to a vote in the legislature, it arguably could have supported the HST in the Legislature and survived the political opposition. The fateful decision was to agree to a referendum rather than a vote in the legislature. Having made that decision the fate of the HST was pretty much sealed.

Photo: Shutterstock