(Version française disponible ici)

By 2022, the Quebec economy was emerging from a pandemic-induced slowdown and performing to its full potential. From this point of view, 2023 was more of a mixed bag. At the time of writing, statistical data revealed that Quebec’s real GDP had contracted for a second consecutive quarter.

In purely technical terms, by traditional definition, this means Quebec is entering a recession. However, Quebec Finance Minister Eric Girard was quick to point out that this is not the case “since the decline in economic activity is not widespread.” A number of economists have also qualified the notion of recession, pointing to the resilience of the labour market and domestic demand.

Be that as it may, the most recent analysis by the Chaire de recherche en fiscalité et en finances publiques indicates that the Quebec economy will operate below potential in 2024.

Despite these downward growth forecasts, it seems too early to call for additional government intervention (such as new lump sums). It’s better to await the effects of any reductions in the Bank of Canada’s key interest rate. One thing is certain, however: governments at both the federal and Quebec levels must stay the course on fiscal consolidation.

Ottawa: finance spending rather than go deeper into debt

Since taking office, Justin Trudeau’s government has never presented a balanced budget, preferring the deficit approach while ensuring that the debt-to-GDP ratio follows a long-term downward trend. At no time was a date set for a return to balanced budgets.

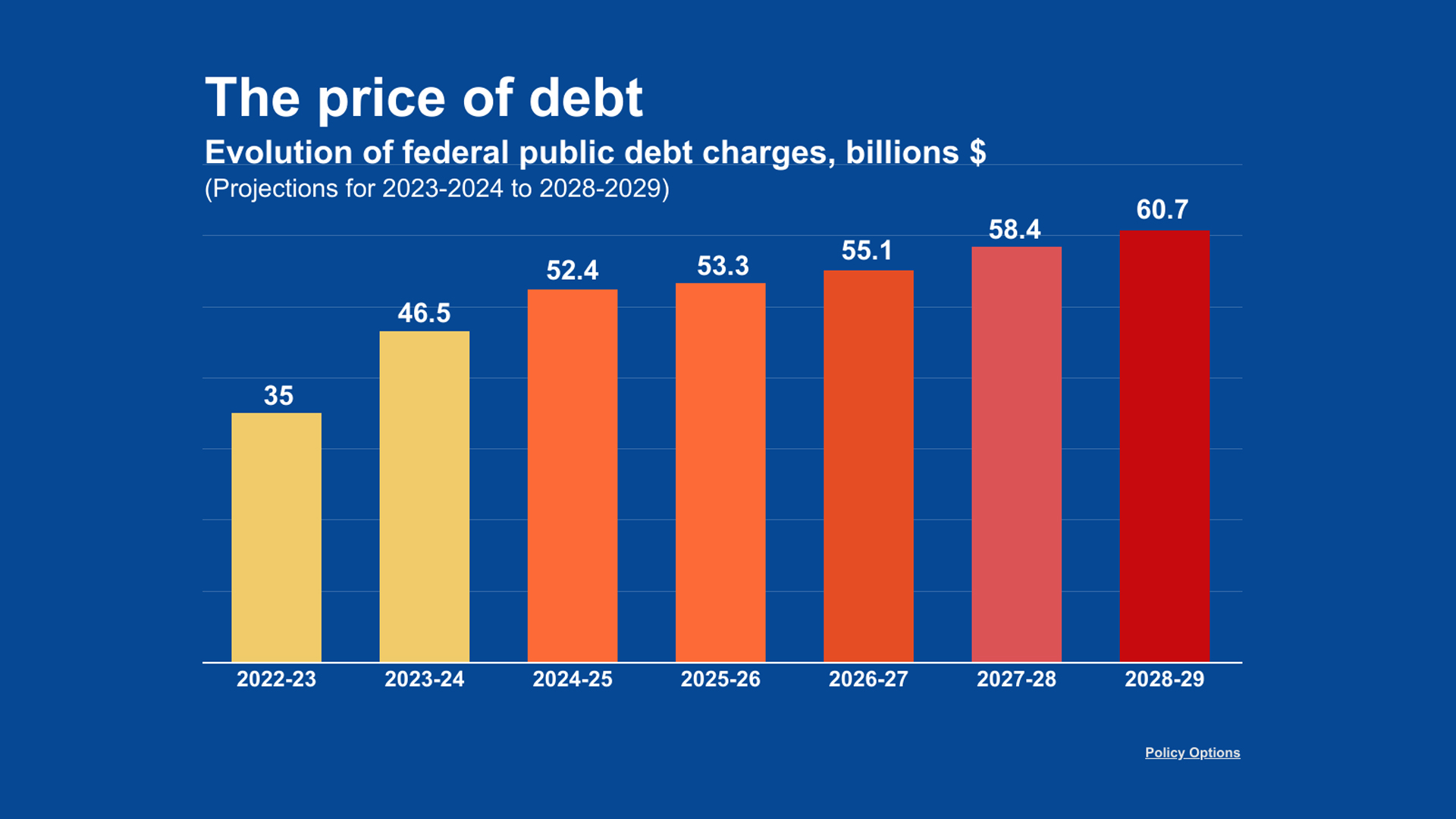

Of course, the large deficits caused by COVID-19 coupled with rising interest rates have contributed to the deficit situation, increasing interest on the debt from $20.4 billion in 2020-2021 to $46.5 billion in 2023-2024. By 2028-2029, it could reach $60.7 billion. (By way of comparison, the federal government’s total spending for the current year will be around $490 billion).

In addition, the agreement signed with the NDP provides for the deployment of new public services (notably via a new dental-care program and a pan-Canadian drug plan). A government obviously has the right to increase the coverage of services. However, without criticizing these additional interventions, in the current budgetary context, the federal government must identify a source of funding for each of these new initiatives, especially as they are of a permanent nature.

Québec: a harder-than-expected return to balance

For its part, Quebec has revised the Balanced Budget Act to better withstand the economic ups and downs, and the Act to Reduce the Debt and Establish the Generations Fund to meet new debt targets for 2032 and 2037.

In the last budget, Minister Girard tabled a plan to return to a balanced budget, under which the deficit – as defined in the Balanced Budget Act – will fall from $5 billion in 2022-2023 to a balanced situation in 2027-2028, a reduction of $1 billion per year. To meet this plan, the budget stated in black and white that spending growth would be matched by revenue growth. The budget also included provisions for contingencies.

However, more recent data from the fall economic update and the quarterly financial report show that the downward revision of the economic outlook is affecting the provision for contingencies. This provision, which was $6.5 billion over five years when the plan was tabled last March, has completely disappeared for the years 2023-2024, 2024-2025 and 2025-2026, leaving only $500 million per year for 2026-2027 and 2027-2028.

The Trudeau government needs to get straight with people about its budget

The pay-as-you-go proposal on cutting federal spending not as simple as advocates say

It goes without saying that, regardless of their relevance, the bonuses offered by the government as part of the new collective agreement for public-sector employees (in addition to the initial offers already included in the budget provisions) will have to fit into the government’s financial framework.

Prior to the bonuses, compliance with the plan to return to a balanced budget already required revenues to grow at an annual rate of $1 billion more than spending. The finance minister’s task was already considerable. Now it is now even greater.

A necessary support

Should the budgetary situation worsen, both Trudeau and François Legault will have to use all their leadership skills to give their full support to even the least popular actions of their finance ministers. History shows that a prerequisite for sound public finances is the unwavering support of the prime minister, as former prime minister and former finance minister Jean Chrétien and former premiers René Lévesque and Lucien Bouchard did in the past.

Further findings on Quebec’s public finances and spending can be found in Bilan de la fiscalité au Québec – Édition 2024.

This is the first of two articles analyzing Quebec and Canada’s taxation. The second part is here.