(Version française disponible ici)

The themes of inflation, purchasing power and the cost of living have become omnipresent in Canadian and Quebec news.

Of course, Quebec and Canada are not alone in experiencing inflationary pressure. The COVID-19 pandemic, the effects of the war in Ukraine and problems in supply chains are experienced on a global scale. But how has the purchasing power of Canadians, and Quebecers in particular, evolved compared to other developed countries?

The answer lies in comparing the purchasing power of typical Canadian and Quebec wage-earning households with that of the developed countries of the Organization for Economic Co-operation and Development (OECD). The annual publication Taxing Wages includes detailed information on the situation of salaried employees with regard to income tax, social transfers and contributions.

For the purposes of international comparison, the OECD calculates disposable income for typical wage-earning households in each country. Each component of the calculation is defined in a similar way from one country to another, making it possible to include Quebec.

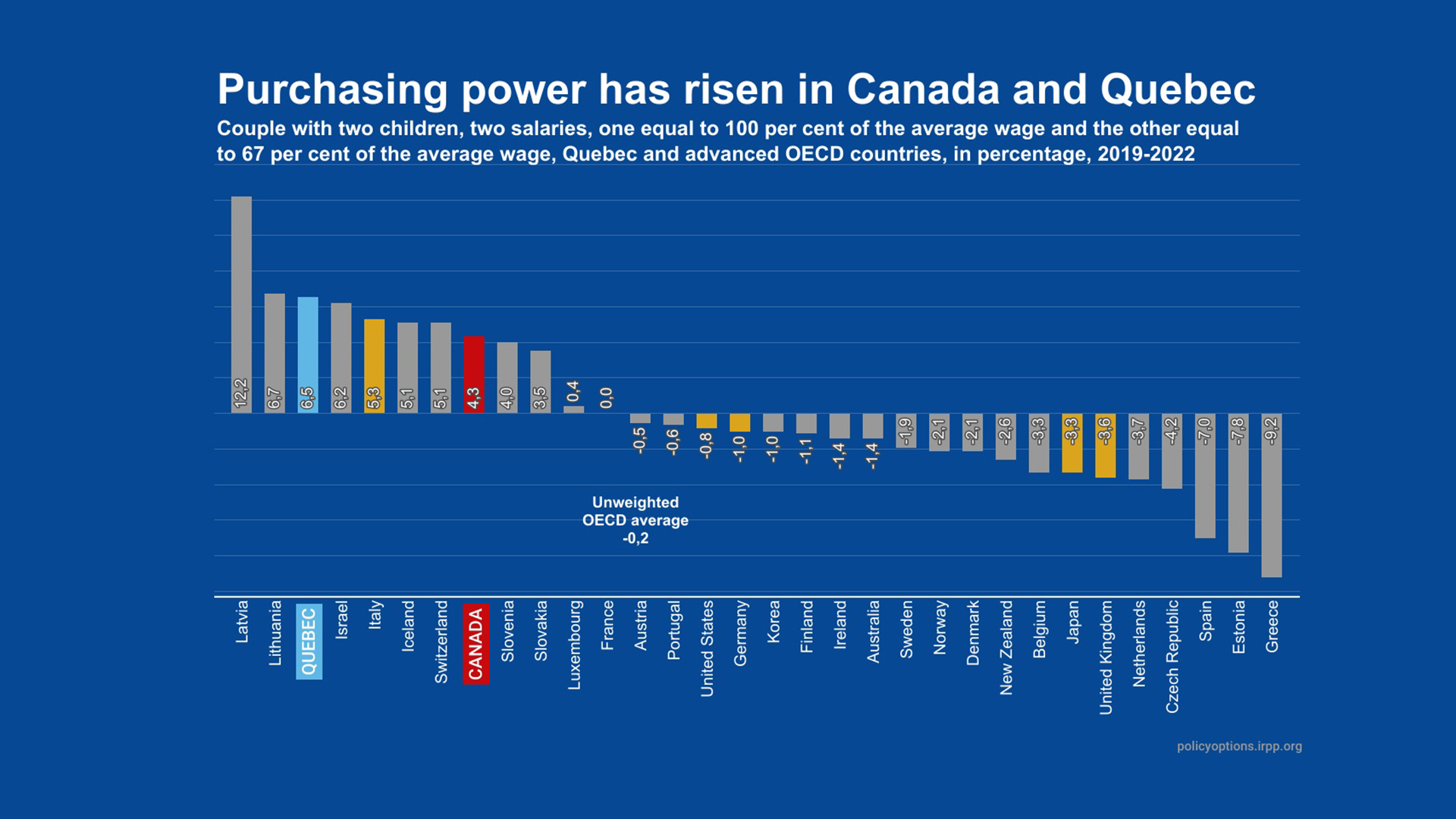

This analysis looks at different types of households with varying wage levels, and focuses on two situations in particular. The first is that of a single person earning the average wage. The second is that of a couple with two children and two wages, one equal to the average wage and the other representing 67 per cent of it.

The OECD methodology also assumes that taxpayers are under 65; that these households have no sources of income other than wages paid and benefits received; and that children, if any, are aged between 6 and 11, and that no child-care costs are considered.

A positive result represents an enrichment in real terms or an improvement in purchasing power in 2022 compared to 2019, while a negative result indicates an impoverishment or a decrease in purchasing power.

Single person earning average salary

Between 2019 and 2022, the purchasing power of a single person earning the average wage fell in 20 of the 31 advanced countries surveyed. The unweighted average change in purchasing power for this type of household fell 0.3 per cent.

Estonian singles saw their real purchasing power deteriorate the most over the same period (-7.4 per cent), while Latvian singles enjoyed the biggest real increase (+10.9 per cent).

Canadian (and Ontarian) singles, meanwhile, saw their purchasing power improve by 5.4 per cent between 2019 and 2022, the highest increase among G7 countries, and fourth highest overall. Quebec singles do even better: they outstrip their Canadian counterparts and rank second when included among advanced OECD countries, with an 8.1 per cent increase in purchasing power.

Couple with two children earning 100 per cent and 67 per cent of the average wage

For couples with two children earning a total of 167 per cent of the average wage, purchasing power also fell in 20 out of 31 countries. The unweighted average change in purchasing power for this household is a decline of 0.2 per cent between 2019 and 2022. Greece is the country with the biggest drop (-9.2 per cent), and Latvia shows the biggest increase (+12.2 per cent).

In Canada, couples with two children enjoyed a 4.3 per cent increase in purchasing power, the second highest increase among G7 countries, behind Italy, and eighth overall. Quebec, meanwhile, came third among the countries surveyed, with an increase in purchasing power of 6.5 per cent, ahead of the Canadian average and Italy.

Overview: Canada does well, Quebec even better

Table 1 shows how Canada and Quebec rank among advanced OECD countries for six household and income situations. The table shows that Canada ranks in the top quarter of countries for all situations, with the exception of single-parent families.

Quebec, on the other hand, consistently outperforms Canada and occupies an enviable position among the 31 countries studied: three times in second place and once each in third, fourth and fifth place. Quebec is ahead of all G7 countries in all six household situations.

In the light of international comparisons, households in both Quebec and Canada achieved an enviable improvement in purchasing power. This is all the more true given that, for each household situation analyzed, more than 60 per cent of advanced countries saw their purchasing power decline between 2019 and 2022.

Despite the inflationary surge of recent months and the perception that purchasing power is contracting, Quebec’s results in terms of real purchasing power trends since 2019 are relatively positive. These results do not, however, invalidate the financial difficulties experienced by some households. In addition, inflation fears, expectations and perceptions remain high.

The bottom line remains that despite inflation, each of the six types of Quebec and Canadian households analyzed saw their purchasing power improve. This is good news we should not hesitate to share.

A few notes on our methodology

- Results for Canada were calculated based on the Canadian average wage and applying the Ontario tax and transfer system.

- For Quebec, the average wage used ($78,108 in 2022) is based on the Canadian average wage.

- As the most recent OECD data are for 2022, the purchasing power indicator is calculated for both 2019 and 2022.

- Where applicable, one-off tax measures and benefits relating to the COVID-19 pandemic or inflation are taken into account in the OECD calculations, and therefore also for Quebec.

- Finally, to construct the purchasing power indicator, 2019 disposable income is brought down to constant 2022 dollars for each country, using World Bank CPI data.