“Politicians like to tell people what they want to hear — and what they want to hear is what won’t happen.” Paul Samuelson

In September 2006, a then relatively unknown academic named Nouriel Roubini gave a now famous if turgid and depressing speech to the International Monetary Fund in which he argued the US economy was headed for a deep and protracted recession that would spread globally. Subsequently labelled Dr. Doom, Roubini was one of the few experts to predict the global economic and financial crisis of 2008-09.

Roubini is at it again, confidently forecasting another global recession that will begin in America and proliferate around the world. One difference today is that Roubini is now regarded by many as an oracle, a celebrity economist whose insights, wisdom and advice are sought the world over by investors and governments. Another difference is that his voice is not in the minority these days, but rather part of an emerging chorus of economists, investment advisors and market watchers who think a US and European, if not global, recession, is in the cards. These prognostications are owing to several factors, chief among them the effects of what Roubini calls “the Sino-American Trade and Currency War,” for which there seems no imminent peace nor even adults willing to negotiate the terms of armistice.

One similarity, however, between 2019 and 2008 is that in both years Canada was heading into a general election. Then as now the governing party — the Conservatives then, the Liberals now — argued the economy had grown in strength on their watch, with unemployment dropping, wage growth rising, interest rates at historic lows and inflation quiescent. Neither then nor today did the government want to talk about the risks of a recession.

On the eve of the fall 2008 election, Stephen Harper, prime minister at the time, and Jim Flaherty, his finance minister, went so far as to deny that an American or global recession would push Canada into a slump. They implied that this country had de-coupled from global economic forces in the age of globalization owing to demand for our commodities, principally oil. Canada would be the eye in the storm, according to this line of argument. It proved to be wishful thinking in the extreme, as commodity prices inevitably dropped when global growth stalled. Recession then hit Canada, with real GDP declining by 2.5 percent in 2009 and unemployment spiking to almost 9 percent (table 2.1 in this document).

This was by no means the worst recession Canada had faced in living memory (that distinction goes to the slumps of 1981-82 and 1990-92), but it was a recession nonetheless. And one of its chief and enduring hallmarks was an end to 10 years of federal government fiscal surpluses, due to declining government revenue and increased public spending aimed at “stimulating” the economy out of its doldrums. The result was deficits that peaked at 3.5 percent of GDP in 2009-10 (chart 4.1.5 in this document). Ten years on, the federal government is still in the red.

It’s an avoidance that will continue through the campaign because recession doom and gloom is considered off message, off putting, and impolitic.

As this election approaches, we see a similar avoidance of talk from the current government about the risks of economic misfortune befalling Canada. It’s an avoidance that will continue through the campaign because recession doom and gloom is considered off message, off putting, and impolitic. We will instead be treated to arguments to the effect that re-electing the Liberals will ensure the historically low level of unemployment that has occurred during their tenure will be reduced even further, and prosperity shared even more broadly should they be returned to office.

Though the opposition parties will claim the government’s economic record is vastly exaggerated, they, too, will paint a picture of Canadian prosperity if they are elected, owing to the policies they say they will implement. We already see this in television advertisements from Conservative leader Andrew Scheer, who claims to have a plan to reduce the cost of living for average Canadians.

In both the government and opposition economic narratives, the implication will be, therefore, that Canada has full sovereign control over its economic performance and is immune from the contagion of recession afflicting other countries, an antediluvian notion if there ever were one.

The parties are likely putting great effort into crafting manifestos with economic growth (and hence federal revenue growth) assumed in the short-medium term, and an implicit promise that enduring prosperity will be the result if the manifesto is so acted upon. Considerable care will be taken in costing the numerous promises the parties make to ensure everything is affordable and adds up. This exercise is especially important in the 2019 election, as it is the first time that the Parliamentary Budget Officer is legislatively mandated to verify party platform costing.

But no party platform will contain any policy or revenue contingencies to account for the risk of a recession hitting Canada in the near term. Global recession risk and its spillover into this country will be totally ignored by the political class in this election cycle, irrespective of mounting evidence and an emerging consensus among experts that recession in the US and Europe is looking inevitable in 2020, not to mention a view among some, Roubini included, that it will be a severe and lengthy slump. The electioneering will also ignore Canada’s economic history, which tells us that recessions occur on average about every nine years (it has been 10 years since the last recession ended).

In other words, all parties will present to the Canadian electorate a kind of Alice in Wonderland view of Canada and its economic prospects. We will be told we can have butter and guns, lower taxes, shrinking deficits, and all manner of federal spending initiatives, paid for chiefly by a growing economy and the revenues it generates for federal coffers.

But if Dr. Doom and his growing ward of followers are correct, the next Canadian government will be consumed with the challenge of fighting a recession whose origins lie in other countries, and it will whack this country’s economy, driving up both unemployment and federal deficits and putting those carefully crafted election manifestos in the deep freeze.

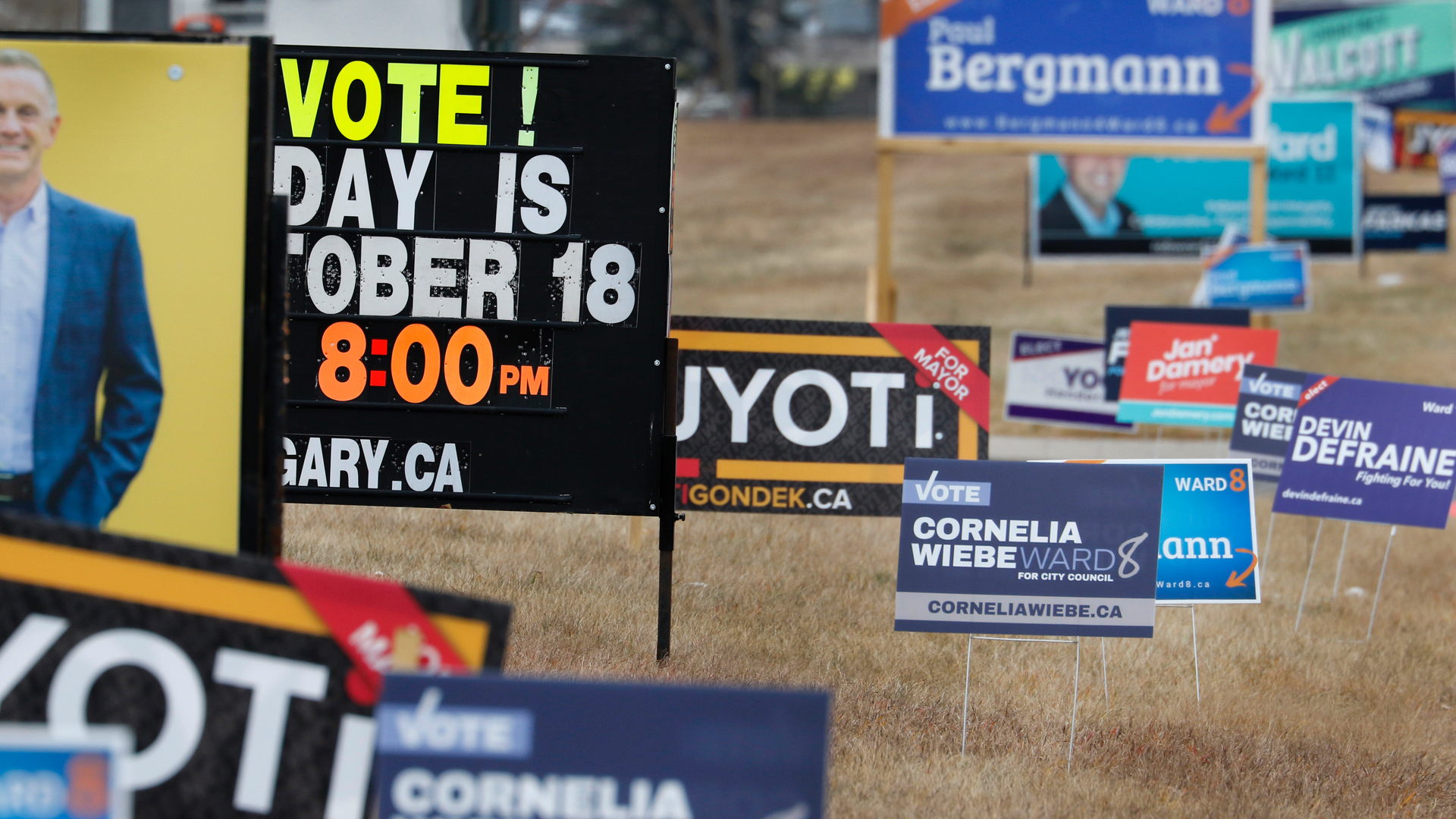

Photo: Shutterstock by Immersion Imagery

Do you have something to say about the article you just read? Be part of the Policy Options discussion, and send in your own submission. Here is a link on how to do it. | Souhaitez-vous réagir à cet article ? Joignez-vous aux débats d’Options politiques et soumettez-nous votre texte en suivant ces directives.