As the pandemic has shown, Canada’s old and creaky Employment Insurance (EI) system is in need of some major upgrades. The speech from the throne calls for a modernization of EI for the 21st century, including provisions for gig workers and the self-employed. We agree that improvements are needed for these workers under EI. However, the pandemic is a unique event, and we caution the federal government to not dramatically redesign EI in response to this somewhat temporary situation.

In addition to a new, voluntary EI benefit program that would allow self-employed workers to pay into EI for a modest degree of income security, we encourage simultaneous reforms to labour laws that more clearly state whether gig-workers are truly self-employed or rather employees. This would push some of these workers under the existing safety net.

Compared to 30 years ago, EI today covers many fewer unemployed workers. In fiscal year 2018-19, only 39 per cent of unemployed Canadians received EI benefits, down from 84 per cent in the early 1990s. The top reason why such a large share of unemployed Canadians today does not collect EI, however, is because they did not recently pay into the program. In 2018-19, 36 per cent of unemployed Canadians did not pay into EI during the prior 12 months. Five per cent of unemployed Canadians not paying into EI are self-employed or gig workers. Their income support program in the event of unemployment is bare-bones provincial social assistance.

Gig work and self-employed over time

The self-employed are business owners, owners of a farm or of a professional practice that may employ other people. Over the past forty years, the share of self-employed among total employment has increased modestly from just over 12 per cent in 1977 to just over 15 per cent in 2019. Self-employed workers are currently not eligible for EI regular benefits in the event of job loss, but they can opt-in to access EI special benefits, like maternity and parental benefits.

Gig work – namely short duration, contract, or self-employment jobs – has existed for many years. However, the introduction of online work platforms and app-based work – for example, Uber and DoorDash – is expanding the number of these jobs. Statistics Canada’s analysis of gig work shows that these jobs have increased from 5.5 to just over eight per cent of all employment between 2005 and 2016, and are most common among new arrivals to Canada.

Misclassified self-employed and gig workers

Many self-employed or gig workers (legally known as independent or dependent contractors) fall into a rather vague section of federal and provincial labour laws. Arguably, many employees are misclassified as self-employed contractors. This can happen by accident or by a conscious decision to avoid paying certain taxes or EI premiums. But the implications are important. Unlike self-employed independent contractors, employees have the right to vacation pay, statutory holidays and, of course, coverage by the EI regime.

Trucking is one example of a job where drivers are regularly classified as self-employed contractors. This is because under the labour law, they have some control over the hours they work, they often own the capital to complete the task (a truck), and they (not their employer) incur expenses directly related to the work performed (fuel, repairs, etc,). App-based employers and other ridesharing or delivery services enterprises, classify their workers as self-employed contractors, although recently some worker groups have been challenging this classification in court.

Federal and provincial governments, as well as many U.S. states, are rethinking these outdated employee classification rules. Many are using the “ABC test” to determine whether a worker is considered an independent contractor or an employee. Modifications to this test, like those in California, are raising the bar for employers who seek to demonstrate that an employee is a contractor, requiring that employers show that a worker is free from the employer’s control and direction and is working outside the usual course of the employer’s business but is not operationally integral to the employer. In recent months, California included a number of worker exemptions to this test, and in a November 2020 plebiscite, app-based delivery drivers are now excluded from the test.

In Canada, clearer and more comprehensive rules to classify modern workers are needed as technological innovation and digital platforms risk creating more jobs that fall outside of employment protections and key income support programs of the safety net. Stronger rules stipulating who is an employee would result in a number of currently classified self-employed workers to start contributing to the EI regime.

A voluntary EI program for the self-employed

For those self-employed or gig workers who do not pay into EI, the creation of a new program must be carefully designed. Many self-employed Canadians run their own business and have no intention of ever paying into EI. A voluntary program is needed.

A voluntary program would be different from the standard EI program. The financing is challenging because those who choose to pay into the program are likely to be those more at risk of losing their work (plus some might also have the ability to lay themselves off), while their counterparts who face a lower risk of job loss opt to self-insure.

Furthermore, workers and employers would alter their behaviour in response to the regime’s provisions and regulations. With EI coverage, employers might end the jobs sooner than they otherwise would or pay less knowing that the EI regime is there as a backstop. On the other hand, once workers lose work, they might be tempted to search less intensively for the next one to commence as long as they are still receiving benefits.

Even with modest benefit entitlements, transfers from general revenues or from the general EI program will be necessary. We urge that these transfers be set as a share of annual EI revenues so that the plan for self-employed workers does not become too expensive.

A worker might have to contribute for a full year to qualify. This would discourage them from joining the program just prior to being laid off. After contributing for a year, a set number of weeks of benefits (for example, 25 weeks) could be claimed. After an initial claim, individual contributions amounts would rise in order to qualify for a future claim.

There are few instances of unemployment insurance regimes targeting gig workers in other countries. One well-known example is the “intermittents du spectacle” program designed for theater and media performers (as well as their technicians) in France. The program is expensive, and its beneficiaries exhibit high levels of dependence over time, facing few incentives to work more than the minimum qualifying thresholds.

Our proposal is modest because not only is the program design tricky, but we worry that if the EI system stretches too far to accommodate self-employed and gig workers, it would encourage greater creation of these kinds of jobs and increase dependence on the program.

Plugging the gaps in EI

Some of the workers unemployed in 2018-19, are self-employed contractors who should be classified as employees and be pushed back under EI. This requires the provinces to play a greater role in the broader social safety net redesign, and they should work with the federal government to try to agree on a more universal, common set of labour laws. For the remaining self-employed Canadians, the feds should design a voluntary plan to give a small segment of the workforce some degree of coverage from the risk of unemployment. Due to the inherent solvency risks, it might first be implanted as a pilot project.

We applaud the recent government’s willingness to bring EI into the 21st century. EI is an old program designed mainly to cover full-time/full-year or seasonal workers in certain regions. Although efforts to further support the self-employed and gig workers is needed, we see this as just a starting point. Getting these people who have not been working back into a job and back under the safety net is an even greater challenge that the federal government and provinces must turn to next.

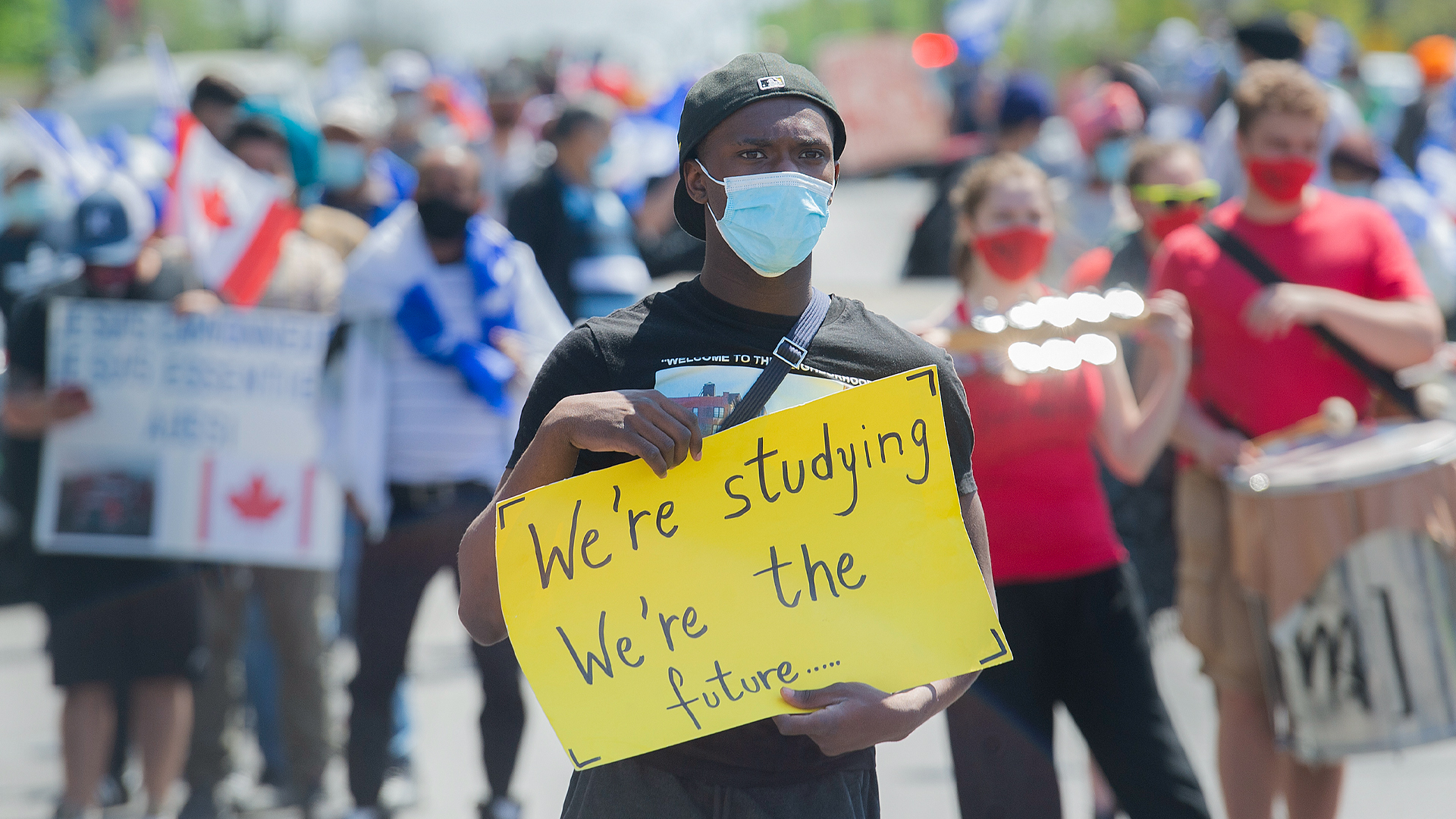

Photo: A Foodora courier is pictured as they pick up an order for delivery from a restaurant in Toronto, on Feb. 27, 2020. THE CANADIAN PRESS/Nathan Denette