Are these the best of financial times for ordinary Canadians, as some argue — or the worst, as others insist? The answer depends on whether you look at income or wealth.

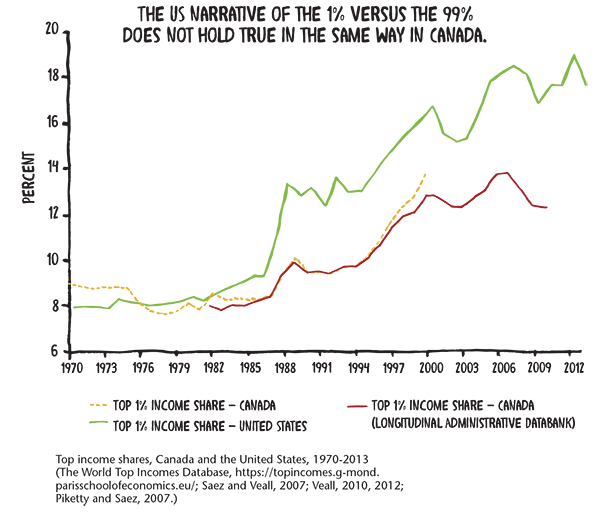

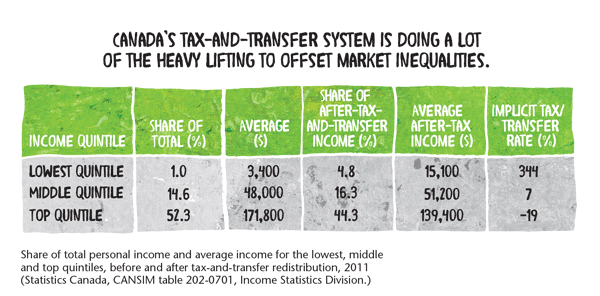

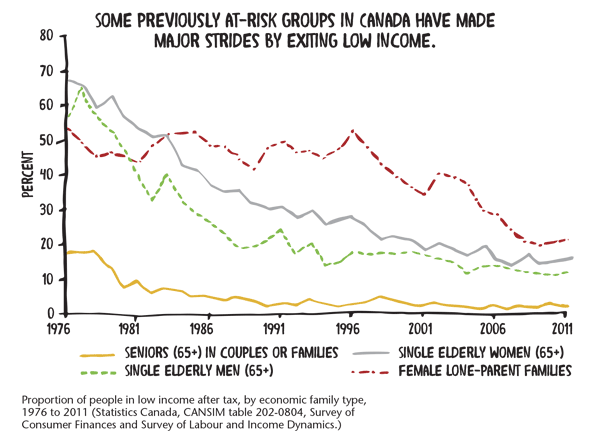

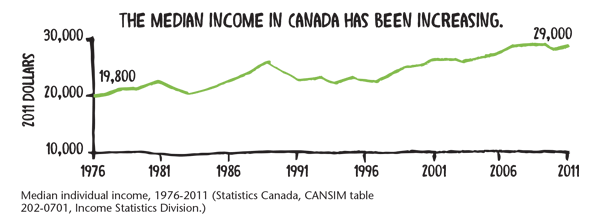

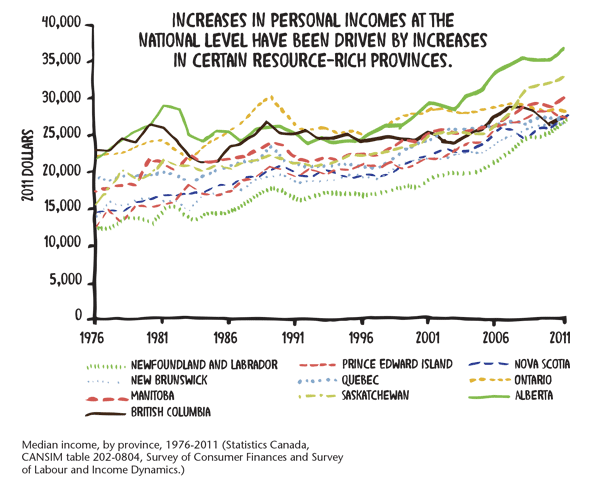

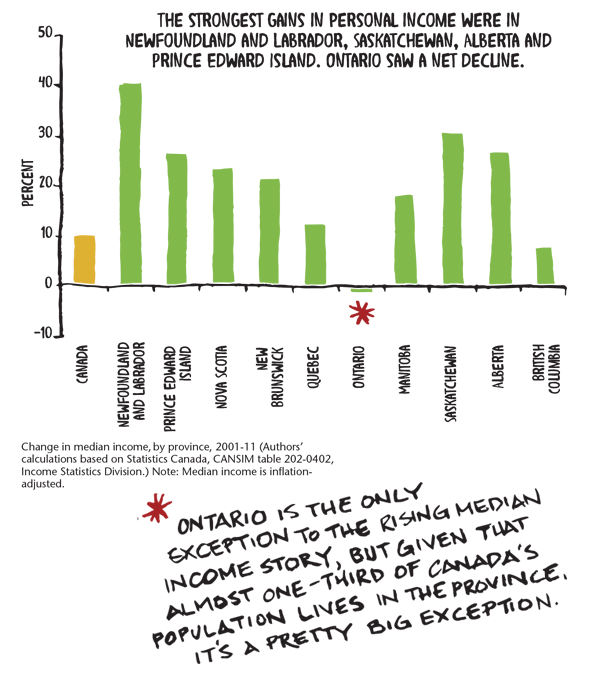

On the one hand, there’s been some very good news on indicators of household income. At the median, income levels are up, surpassing even gains made by our US neighbours. Taxation and transfers seem to have kept income inequality from skyrocketing the way it has in other countries. And perhaps the best news is that we’ve made important gains in reducing rates of low income for seniors and single parents. We even managed to reduce child poverty by a small but significant amount (down 2.4 percent) in the middle of a recession.

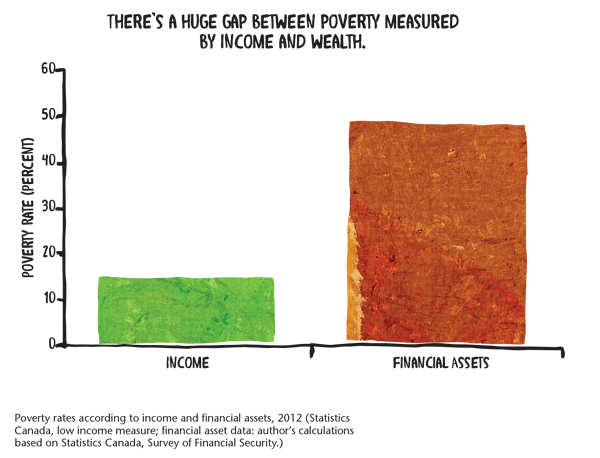

But this rosy view is based on the assumption that income is the only source of financial security. Of course we know, in our own life experiences, that having some savings and assets makes a world of difference. So we need to look at the other option too. And it shows something very different for Canadians — something that should be capturing far more attention in the public and among policy-makers.

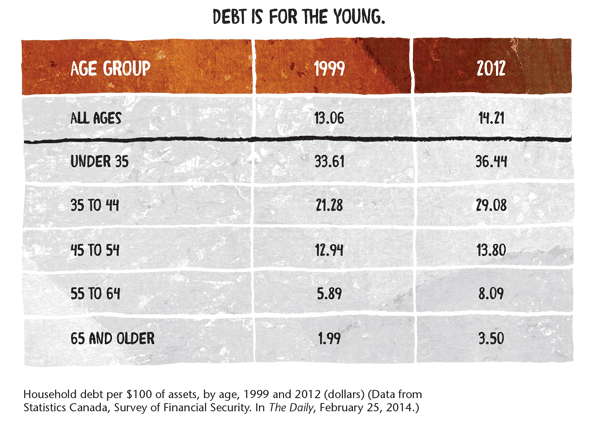

As an economic resource, income is a flow. Day-to-day consumption needs are paid out of that flow, and any money left over is categorized as “saving.” But households also save up, inherit, win or otherwise acquire assets: home equity, workplace pensions or cash in bank accounts. Assets not only protect us against unexpected shocks, they give us a foundation to take productive risks (like pursuing higher education or starting a business), and they give us a sense of hopefulness and inclusion in our community.

At first blush, the data on wealth look pretty rosy, too. Median household net worth (all assets less all debts) has been rising consistently in Canada since 1999. But those gains haven’t been shared or redistributed the way that income gains have.

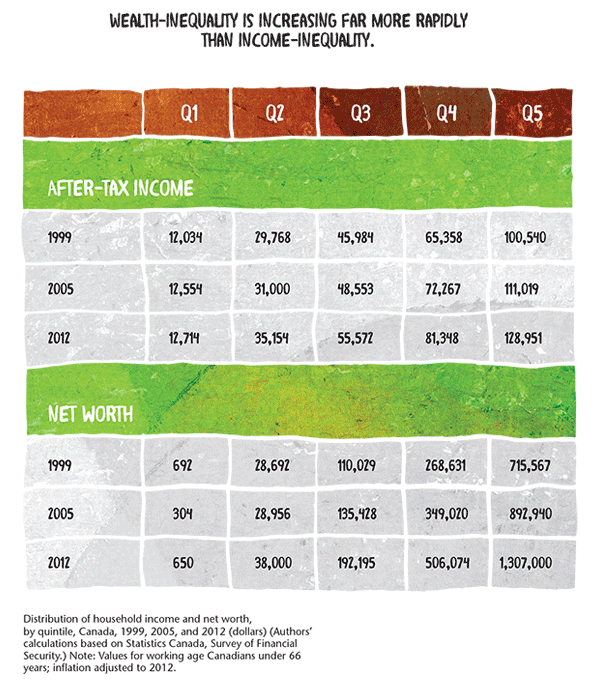

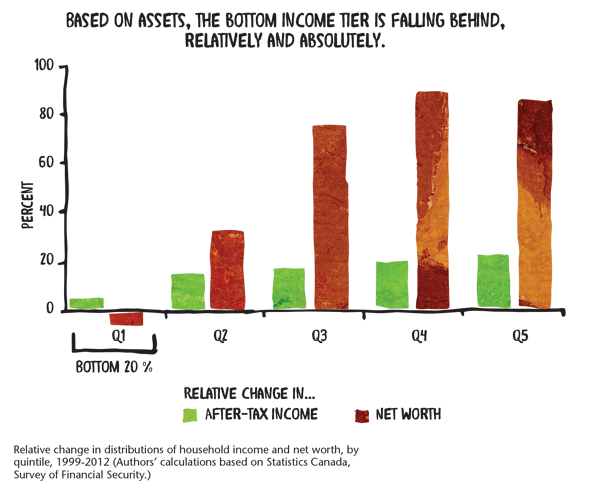

Between 1999 and 2012, households in all quintiles saw some increase in their after-tax incomes. The same is not true of household wealth. In that period:

- The bottom 20 percent of working-age households saw their after-tax income grow by 6 percent. By net worth, the bottom 20 percent of households saw their wealth fall by 6 percent.

- The top 20 percent of working-age households saw their after-tax income grow by 22 percent. By net worth, the top 20 percent of households saw their wealth grow by an astounding 83 percent.

Wealth gains have actually been greatest not for the top 20 percent but rather for the next 20 percent of households. These aren’t the very rich but instead are the already comfortable growing more so. They are the households most likely to have RRSPs, workplace pensions, housing equity and RESPs for their children, plus a host of other assets that are heavily subsidized by public policy. At the federal level alone, forgone tax revenues on these forms of saving and assets are now equal to $14 billion a year.

We’ve made important gains in reducing rates of low income for seniors and single parents.

Our analysis of data from Statistics Canada’s Survey of Financial Security shows that 49 percent of all Canadians are asset-poor, using a measure developed by US economists Robert Haveman and Edward Wolf. In other words, they don’t have enough financial assets to cover their own basic needs and keep themselves out of poverty for at least three months. This is more than three times greater than our estimates of insecurity based on income.

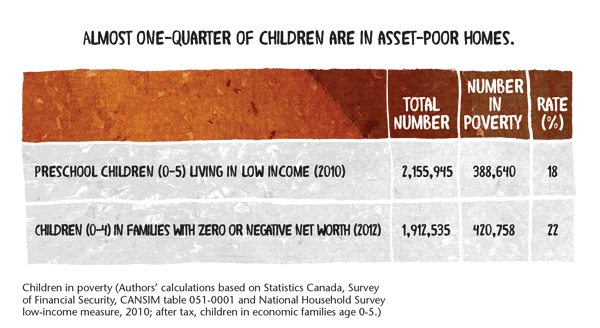

Our further calculations showed that 22 percent of Canadian children aged 0-4 are growing up in households with zero or negative net worth, what Haveman and Wolf call extreme asset poverty. In other words, over 420,000 young children in Canada are growing up in households that have no financial cushion at all. Families with low or negative net worth have more financial stress and more disruption in their parenting, and they are less able to invest in healthy child development. They live month to month and struggle to cover even a modest unexpected cost. The effects of asset poverty are at least as bad as those of low income; by contrast, the prevalence of low income among all children is substantially lower, at 18 percent for preschool-aged children and 14.5 percent for all children.

Our system of taxation and transfers has done a reasonably good job of offsetting the worst inequalities in market income and has meaningfully reduced income poverty. But our current policy architecture does little or nothing to help the asset-poor. In fact, clawbacks and rules in programs from student loans to provincial welfare to seniors’ benefits actually penalize the poor for having saved anything at all. The story of wealth in Canada is not so much a story of the top 1 percent or top 0.01 percent running away with extraordinary asset gains. Instead, the Canadian story has been one of a long, slow march toward a two-tier approach in the treatment of household savings and wealth. We have a policy architecture to redistribute income to the poorest, but on assets our policy is to encourage the already well-off to get wealthier without much regard for the bottom of the distribution.

Analysts are projecting rather anemic economic growth for the foreseeable future in Canada. Overheated housing markets in some pockets of the country, declining oil prices and the resulting tumult in Canadian currency and stock values may have more Canadians taking another look at their own household balances. If and when policy-makers decide to take action, what will they do for the asset-poor?