In his 2011-12 budget, Finance Minister Jim Flaherty faced the daunting task of balancing the need to produce a credible fiscal plan for Canada with the political reality that the measures in his budget might well have to be used to rally voters in an upcoming election.

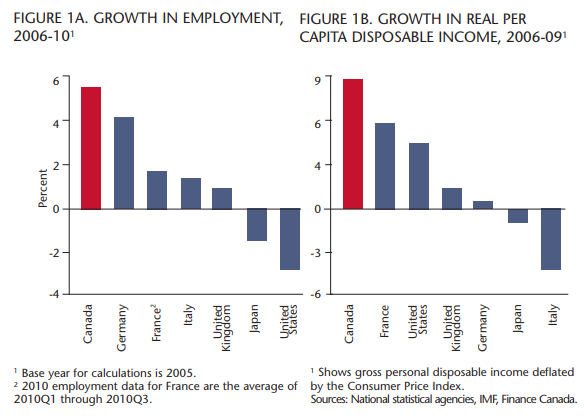

The budget’s overarching message — Canada is doing well fiscally and economically relative to other industrialized countries, but there are uncertainties on the horizon — was the foundation for the government’s fiscal plan and a key part of its political pitch to voters. The budget provided ample evidence of Canada’s relative fiscal and economic strength: the strongest employment growth among G7 countries since 2009, the fastest growth in incomes of any G7 country since 2006, and among the best fiscal situations in the industrialized world. Moreover, private sector economists revised their October 2010 projections for growth upward, predicting an expansion of 3.5 percent in the first quarter of 2011 as well as nominal GDP growth that will be $20 billion higher over the forecast horizon.

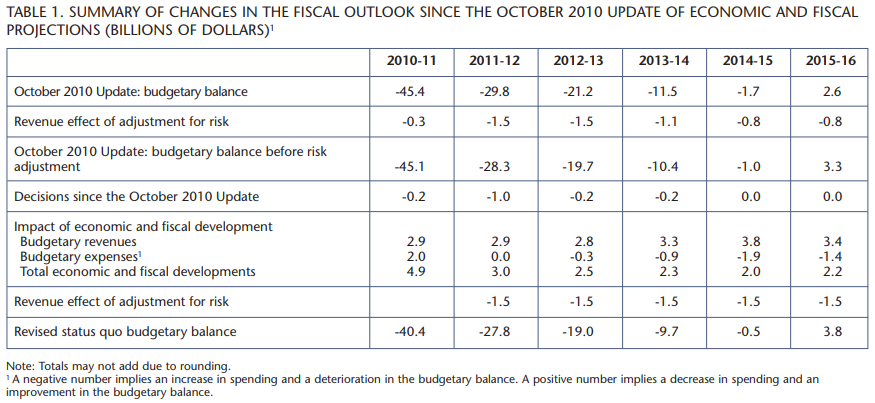

On the fiscal front, the deficit for 2010-11 is projected to be 25 percent lower than that of 2009-10, and the October 2010 deficit projection of $45 billion was lowered to $40 billion in the budget. Critics of last year’s budget, who called its deficit reduction targets optimistic, were effectively silenced by the fact that the government more than met its targets for 2010-11 and by the current projections showing that the budget might be balanced sooner than was projected last year.

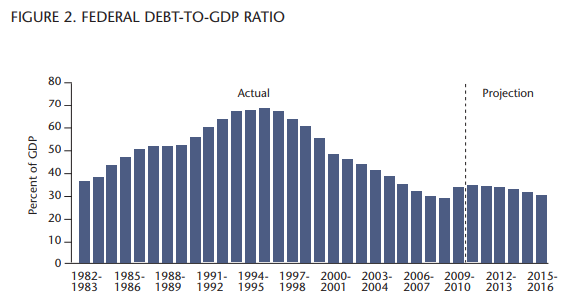

On the other hand, there are uncertainties and causes for concern: the sovereign debt crisis in Europe, instability in the Middle East, the rising price of oil, and the long-term effects of the earthquake and tsunami in Japan. Although private-sector forecasters concluded that the downside risks were balanced by other upside possibilities, the budget adjusted downward the private sector forecast for nominal GDP by $10 billion in every year of the forecast, which represents a downward adjustment of $1.5 billion in revenue forecasts. Based on cautious assumptions, the budget outlines a deficit reduction plan with targets for each year. By 2015-16 at the latest, the budget is projected to be balanced and the federal debt relative to GDP is forecasted to decline to 29.7 percent, its prerecession level.

The underlying political message to voters is that the government has done a good job of shepherding the Canadian economy through turbulent economic times, but that there are still threats, uncertainties and challenges, so the best choice is to stay the course both fiscally and politically. As Canadians glance southward and see the weighty fiscal and economic challenges facing the Obama administration, they see our relative good fortune. Also, the Conservatives’ overall stewardship of the economy will be their strongest selling point going into an election.

The majority of the budget consists of small, targeted tax or spending measures directed at specific groups or problems. To help the unemployed and encourage job creation, there are extensions to enhanced Employment Insurance benefits, and a continuation of the Work-Sharing Program and of the tax benefits for manufacturers, processors and mineral exploration. Further, there is a new hiring credit of up to $1,000 for small businesses, against an employers’ increase in 2011 Employment Insurance premiums to help with the costs of hiring more people.

There is more money for research and development and for post-secondary institutions. There will be new research chairs for universities, new industrial research chairs at colleges, support for joint college-university commercialization projects, an increase in funding for the three federal granting councils, a new brain research fund to support research into brain disorders, more money for Genome Canada, money for green technologies and Canada’s Clear Air Agenda, as well as increased funding for the Industrial Research Assistance Program, to help small and medium-sized businesses speed up their adoption of information and communications technologies through collaborative projects with colleges. The Canada Student Loan and Grant Program will be expanded for full- and part-time students, and some tax benefits will be offered to apprentices who are skilled workers in regulated professions.

Several of the budget’s new measures benefit primarily women. There will be a targeted increase to the Guaranteed Income Supplement (GIS) for low-income seniors, which will assist mainly single seniors who rely almost exclusively on Old Age Security and the GIS (the majority of this group is made up of older women). A new family caregiver tax credit that will provide tax relief to caregivers of all types of infirm dependent relatives, including spouses, common-law partners and minor children, was introduced. As well, the limit on the amount of eligible expenses caregivers can claim under the medical expenses tax credit in respect of financially dependent relatives has been lifted. And there will be a new children’s arts tax credit for up to $500 of eligible expenses for programs associated with children’s artistic, cultural, recreational and developmental activities.

Some new budgetary measures target rural, northern and remote communities. For example, there will be a volunteer firefighters tax credit for volunteer firefighters who perform at least 200 hours of service. A major issue in smaller communities is the difficulty in attracting and retaining doctors and nurses. To help address this problem, a new initiative to forgive a portion of the federal component of student loans for doctors, nurses and nurse practitioners who locate in these communities was introduced.

In sum, this much is clear: this budget is not designed to advance grandiose ideas or long-term strategies to address Canada’s major challenges, such as productivity or climate change. Rather, it is a preelection budget that provides small but symbolic monies to a variety of voters. Indeed, if one can imagine an extended family sitting around a dinner table, at least one of its members would likely be a beneficiary of an initiative in this budget.

The new spending and tax measures cost only about $2.6 billion, and theses costs are partially offset by ongoing reductions in spending — with promises of more to come — and the closing of some tax loopholes. As well as the continuation of the freeze on departmental budgets, there is $500 million in annual savings from the 2010 round of strategic reviews. Also, the budget announced a comprehensive one year strategic and operating review designed to improve the efficiency and effectiveness of government operations and programs (none of the savings from this initiative are included in the 2011-12 budget).

The budget needed the support — or abstention from voting — of at least one of the other political parties. In light of the fact that the Liberals and the Bloc Québécois signalled before the Budget Speech that they would probably oppose the budget, all eyes turned to the NDP. In the budget, the government mentioned three of the five items on the wish list of Jack Layton and the NDP. Minister Flaherty quickly rejected the idea of eliminating the federal sales tax on home heating fuels as being too expensive, and he stated that the NDP’s demand for dramatic increases in the Canada Pension Plan (CPP) could not be accommodated because such a change required the consent of two-thirds of the provinces representing two-thirds of the population. However, the budget reinstated the ecoENERGY Retrofit-Homes program, which helps homeowners make their homes more energy efficient.

The budget partially addressed two other NDP demands. The NDP asked that all seniors receiving the GIS be given an increase; that is, the NDP wanted a universal, across-the-board increase in benefits for lowincome seniors. Instead, the government provided a targeted benefit to the poorest of seniors, arguing that targeted programs are more affordable and allow scarce tax dollars to be directed to those who need them most. The NDP also wanted more money to increase the number of doctors across the board, while the government responded with a targeted measure designed to entice doctors to rural, remote and northern communities, where the shortage of medical professionals is most acute.

Shortly after the budget was delivered, Jack Layton said that it did not go far enough to meet the NDP’s wish list and he would not support it. It is difficult to see how the government could have accommodated Layton’s wish list in its totality, when the overall increase in spending was less than $3 billion. In a minority parliament, an opposition party can legitimately ask that its views be taken into account and be reflected in some way in the budget; however, it is unrealistic to expect a government with very limited funds to adopt all of an opposition party’s budgetary proposals.

Interestingly, the Canadian Labour Congress, traditionally an ally of the NDP, issued a press release praising the budget’s modest increase in the GIS and taking some credit for pushing for it. The release also supported the government’s initiatives on Employment Insurance, the continuation of the Work Sharing Program, as well as actions to help older and unemployed workers. One wonders if Layton might have acted too quickly in rejecting the budget on the basis that it did not fully embrace his wish list. Perhaps he should have considered other expenditures in the budget that benefit individuals and groups that traditionally support his party.

Layton’s main concern — that there was not enough money being spent on priorities that he wanted to see in the budget — was echoed by other interest groups commenting on the budget, a fact that I found troubling. As someone who was a finance minister during the fiscal crisis in the 1990s, I view with great alarm requests by groups for significant increases in new spending at this time. I believe that the data in this budget show that it will be possible, with solid economic growth, to balance the budget by 2015-16 without the need for the painful spending cuts of the 1990s. But this view rests on the critical assumption that new spending will be limited, as it is in this budget. If in fact the spending tap is opened again and major, expensive new initiatives are introduced, there is a risk we will return to the difficult and painful choices of the 1990s. Hence, voters should be wary of parties promising expensive new initiatives, because they could prove to be short-term gain for long-term pain.

Under normal circumstances, a moderate budget that offers modest but important spending and tax measures for many groups and includes a credible plan to take the country from deficits to a balanced budget would pass easily. Indeed, it would be considered not newsworthy within days. However, in this Parliament, which is beset by hyperpartisanship, such a budget was rejected by all opposition parties, paving the way for an election. This election will give voters the opportunity to express their views on Budget 2011-12 and how it has been received by the opposition parties.

Photo: Shutterstock