Steve Jobs was exasperated but determined. It was 1983 and Jobs was in New York City meeting with PepsiCo executive John Sculley, whom he was attempting to persuade to join a struggling Apple. Negotiations having stalled, Jobs cut to the heart of the matter. Staring intensely at Sculley, Jobs asked, “Do you really want to sell sugar water for the rest of your life or do you want to come with me and change the world?”

Jobs would change the world many times over, though not before Sculley and the board of Apple were to oust him from the company he had co-founded. To consider Jobs a visionary entrepreneur is to understand that an entrepreneur’s attitude toward risk and ability to overcome adversity has everything to do with their ultimate business success or failure.

Is there anything that Canada can learn from Steve Jobs? We believe so. First, however, it is key to understand the nature of Jobs himself and the organization he created.

When Steve Jobs died on October 5, 2011, early media reaction to his death was consistent: he was near-universally hailed as a genius and a visionary. The general public’s reaction was no less filled with adulation. Spontaneous vigils sprung up outside Apple stores around the world. Glowing iPhones substituted for candles, and symbolic tokens of appreciation, like an apple missing a bite, were left alongside other mementos of thanks and remembrance. This was a fitting testament to a person whose trust in his own intuition, and belief in the value of merging design with technology, yielded paradigm-changing products like the iPod, iPhone and MacBook.

Jobs and his partner, Steve Wozniack, founded Apple out of Jobs’ parents’ garage. Jobs’ distinctive personality traits — obsessive perfectionism, for example — informed Apple’s product output and corporate culture from the outset. Unlike many of his technological contemporaries, Jobs was not content to bring an unfinished product to market. Rather, he would obsess over the most minute details. Google engineer Vic Gundotra recalls receiving an urgent telephone call from Jobs one Sunday afternoon. Jobs was distressed, having noticed that the shade of yellow used in the letter “o” in the Google logo was slightly off when displayed on the iPhone.

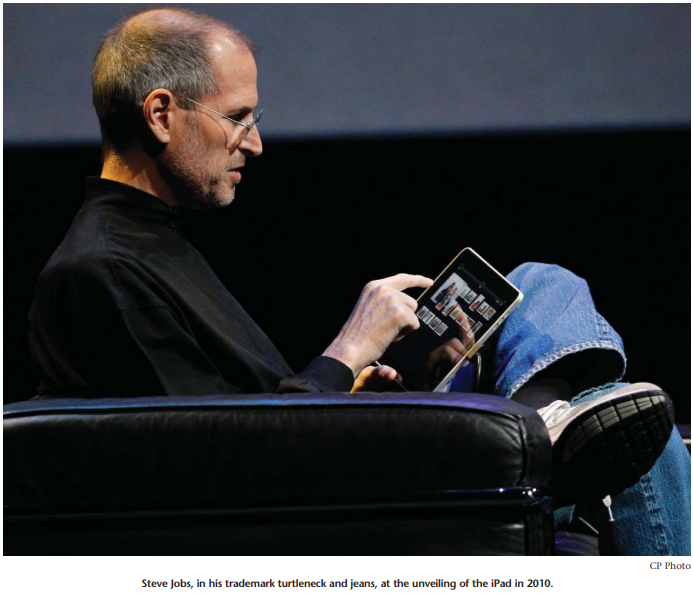

Under Jobs, Apple eschewed traditional market testing, believing that consumers couldn’t possibly know what they wanted from a product that did not yet exist. Jobs was always keen to quote Henry Ford, who said, “If I’d asked my customers what they wanted, they would have told me ‘a faster horse’.” In the absence of marketing research, Jobs relied heavily upon his own well-informed intuition. He designed products according to what he and other Apple staff would themselves want. For example, Apple designers and engineers’ universally disliked their cellphones. Bemoaning the unpleasant user interfaces and weak software of existing models, they concluded what they really wanted was a cellphone with a Mac inside. The result? The iPhone.

With Jobs no longer present, can Apple perpetuate its record of success? When a leader like Jobs departs an organization, two interrelated issues arise. The first issue revolves around whether success has been “hardwired” into the organization, while the second issue is one of succession.

Hardwiring success pertains to the challenges an organization faces in sustaining its record of excellence after a significant change of leadership. In the case at hand, the questions becomes this: Can Apple maintain its record of excellence while transitioning from a great intuitive visionary like Jobs to a CEO who is cut from a more everyday cloth? Though the jury will be out for at least another three years, it seems likely that Apple’s record of excellence can be sustained.

We earlier referred to Jobs’ near neurotic obsession with perfection. In the case of Apple, this obsession with perfection is now well ingrained within the company structure. Take Apple’s unique 10-3-1 model. For each new feature created, Apple designers invent ten possible prototypes. Unlike other companies, none of these prototypes are designed as throwaways. Nevertheless, seven of those prototypes will be discarded, thereby narrowing the batch to three. Finally, the three remaining prototypes are winnowed down to one. As you can see, the expectation that 90 percent of all preliminary work will be discarded has been firmly established. If it is executed properly, employees will understand and appreciate that this process is done in the pursuit of perfection.

A central way in which the zeitgeist of Jobs has been hardwired into the processes of Apple is evident in the kind of people that Apple hires. As is the case with many firms with strong and successful corporate cultures, Apple people tend to “know one when they see one.” This recognition allows Apple to hire better, thereby perpetuating a great culture. Of course, when a culture goes south, it can take longer for it to turn around. IBM is an example of a firm that, in the 1970s and 1980s, had a great culture. During those decades, company culture aligned wonderfully with what was needed to achieve success. However, by the 1990s, the world of high technology had changed drastically, and IBM’s culture needed to be rethought. It took IBM longer to reinvent its culture, all else being equal, than it would have taken other firms.

Spontaneous vigils sprung up outside Apple stores around the world. Glowing iPhones substituted for candles, and symbolic tokens of appreciation, like an apple missing a bite, were left alongside other mementos of thanks and remembrance. This was a fitting testament to a person whose trust in his own intuition, and belief in the value of merging design with technology, yielded paradigm-changing products like the iPod, iPhone and MacBook.

The second question is one of succession: can a company sustain excellence once the original visionary is gone? A firm must sustain excellence not only through its processes. A firm must also sustain excellence in its leadership, namely, in its CEO. In the case of Apple, Steve Jobs knew his own time was limited and groomed Tim Cook to succeed him as CEO. While Cook’s presentation of new products may not live up to Jobs’ natural showmanship, by most indications, Cook is an otherwise competent leader.

Yet the question goes considerably beyond Cook. Our initial sense of the new Apple team is that the organization does not depend on the CEO to the extent it did under Jobs’ leadership. This is not to criticize or praise Jobs. Indeed, it is unsurprising given Jobs’ visionary ability that this CEOcentric approach was adopted. Nevertheless, with Jobs’ passing, a more team-based approach for both the company executive and corporate culture is called for. But can the executive team still hit the product ball out of the park as they have in the past?

Taking over when a visionary has exited an organization brings its own set of challenges. Take the case of the iPhone. While Apple designers and engineers agreed that what they really wanted was a cellphone with a Mac inside, there was a real company debate on whether to pursue the creation of an Apple phone. In the end, the reason the iPhone exists today is that Steve Jobs said, “Let’s do it.” If Jobs hadn’t been in the picture, it is by no means certain Apple would have ever produced an iPhone.

In a large corporation with the natural attendant bureaucracy, a visionary, charismatic, legendary CEO or founder is afforded a great deal of latitude to indulge his or her intuition.

How to allow for the same kind of daring calls to be made in the absence of such leadership will be one of Apple’s central challenges. The world will watch with great interest to see if Apple’s senior team can continue to pull off future feats. Given the years Jobs spent handpicking his senior team and “hardwiring” the culture, it seems probable they will succeed.

What is most certain is that there will never be someone quite like Steve Jobs. Nevertheless, while Jobs may be inimitable, every generation produces at least a few geniuses with the potential to be great visionaries. The question that emerges from this is two-fold. The first question is relatively straightforward: How do we identify these geniuses as they emerge?

The second question is, by nature, more loaded. Once these geniuses have been identified, how do we discern which are visionaries willing to take the risks critical to success? This in turn leads to the quintessential question, one that is of arguably critical importance in the Canadian context. How do we, as a nation, support the entrepreneurial endeavours of identified visionaries?

Canada has already seen its fair share of business visionaries: Guy Laliberté, Murray Edwards, Laurent Beaudoin, Gerry Schwartz, Clay Riddell, Serge Godin, Frank Stronach, Jimmy Pattison, Paul Desmarais, Robert Brown, Galen Weston, Mike Lazaridis and Jim Balsillie, and Harrison and Wallace McCain are but a few tremendous Canadian entrepreneurs who have had an impact on the world.

And the world stage is increasingly the only stage that matters. The new reality of at least some Canadian small and medium-sized enterprises is that they are global from birth. Product life-cycles are shortening. Introducing a product to a domestic market before gradually introducing it elsewhere is no longer feasible. This is particularly true in the case of technology. What was once known as the “waterfall” model where ideas would cascade from the US and gradually move overseas has become a “sprinkler” model. Now an idea or new product spreads rapidly around the world in very short order, if not simultaneously everywhere. Fewer firms have the luxury of spending considerable time conquering their home market before heading out on the international stage.

In America, failure tends to be viewed more as a learning experience; in Silicon Valley, it is okay to fail. In Canada, the attitude is more along the lines of “What’s wrong with you? Why don’t you just go and get a job with the government?”

Growth of this scope introduces a set of financing demands to a degree that would be unrecognizable to previous generations of entrepreneurs. The challenge familiar to both groups remains that entrepreneurs are rarely blessed with an unlimited source of financing from the outset. Instead, they usually exhaust their own savings and those of friends and family during the initial stages of growing their business. Beyond this, there is usually a gap between the time when an entrepreneur has maxed out his/her own credit cards, and the time at which venture capitalists (VCs) are willing to lend sources of financing.

What entrepreneurs require in the meantime is finance and expertise. This is typically where Angel Investors step in. Angel Investors provide both knowledge/expertise and funding. A considerable hurdle for new entrepreneurs in Canada is the apparent lack of a sufficient number of eager Angel Investors. A further problem particular to Canadian VCs, and to a lesser degree to Angel Investors, is their risk adversity. Take VCs within Canada. In the words of one Canadian high-tech entrepreneur with respect to VCs, “In Toronto, it is a bizarre case of too much money in too few hands. As a result, bets are only placed on realized business plans, which discourages new blood.”

Canada diverges sharply from its southern American counterparts in risk aversion. There are attitudinal differences between Canada and the United States. For example, the two countries have very different interpretations of failure. In America, failure tends to be viewed more as a learning experience; in Silicon Valley, it is okay to fail. In Canada, the attitude is more along the lines of “What’s wrong with you? Why don’t you just go and get a job with the government?”

A further challenge is Canada’s lack of a Silicon Valley or Boston’s Route 128 equivalent. Silicon Valley and Route 128 are technology hubs: geographic areas where businesses specializing in technology tend to congregate. The amount of specialized knowledge within that one given area is tremendous. The fact that, arguably, RIM’s Lazaridis and Balsillie had more of an impact on Canada’s technology scene than Steve Jobs had on Silicon Valley is demonstrable evidence of how far Canada is away from having such a hub. These hubs are enormously attractive to entrepreneurs and can, in part, account for the exodus of Canadian technology entrepreneurs to the United States.

The reality is that Canada is, globally speaking, rather well placed to support the limited entrepreneurial risks needed to support future visionaries.

Canada’s fiscal fundamentals are solid: a conservative banking system, relatively low government debt, and sound fiscal and budgetary policy. By contrast, the American economy is comparatively stagnant to years past, while Europe is set to bear extraordinary challenges of its own. While this means that the models of the past are broken, it does provide an opportunity for Canada to pave a path of its own.

What would the Canadian path for encouraging a future Steve Jobs look like? For one, Canada as a nation needs to start seeing itself as a place where companies can launch into the world. We have weathered the financial crisis extraordinarily effectively, leaving us well positioned to do business in a global economy. We also benefit from geographic advantages related to resource endowments and global warming. Ironically, the very conservatism that saved our collective bacon is the very thing that we need to chip away, or at least strategic bits of it. At the core, what a robust Canadian entrepreneurial environment requires is more sources of finance. Canada needs more business angels — wealthy Canadians willing to take a bet on entrepreneurs. In the Canadian context, that means establishing a tradition of “giving back” that goes beyond donating corporate profits to charity. Sharing one’s expertise and resources must become more deeply ingrained. We also need sources of VC financing that are less risk averse. VCs needs to behave more like VCs and less like banks. This means that VCs must address the critical financing gap entrepreneurs face. VCs must concentrate less on supporting business that is already completely self-sustaining and more on businesses with strong fundamentals that need capital to grow.

So what does this discussion amount to? We began by discussing Steve Jobs, a brilliant visionary and a daring entrepreneur whose contributions to the world will not be soon forgotten. From there, the focus shifted to Apple, the corporation he left behind. In examining issues of hardwiring and succession, we concluded that Apple’s record of success is likely to continue. With a strong established culture and hardwiring of excellence, it seems likely.

From there, a contrast was drawn: we looked at the Canadian entrepreneurial scene. Could a Steve Jobs emerge from Canada? Problems of financing and expertise particular to Canada could act as obstacles. So what can we do about it? We need to escape our conservative mindset. Canada needs to support identified entrepreneurs who have a vision and the determination to pursue it. This is the best way of making sure that Canada’s own visionaries of a Jobs-like calibre don’t head south or watch their companies do so.

As a country, we need to support Canadian visionaries by being less risk averse in certain strategic areas. We need to recognize where Canadian fiscal conservatism has been an asset and where it has served to stifle innovation and business success. Jobs’ story is of the risks taken by an extraordinary entrepreneur in his quest to see the world differently. By adopting a similar mandate, Canada can ensure it does not stifle future Canadian visionaries.

Photo: Castleski / Shutterstock