Recently there has been a resurgence of interest in Canada in the idea of a guaranteed or basic income. The essential idea is that everyone would be entitled to some minimum income, provided by regular payments from the government. As individuals’ incomes from other sources increased, whether wages and salaries from paid work, interest and dividends on investments, or income from social insurance programs like employment insurance, the regular guaranteed income payments would phase out (be “taxed back”), and at some point this other income would be taxed under the income tax system, as at present.

The idea of a guaranteed income as a right of citizenship or residence in a country has been waxing and waning in public discussions for decades ─ in the 1960s in the US with its War on Poverty, and in the 1970s in Canada, with the Social Security Review and Mincome experiment. The idea is rather unique as a policy option, in that it has strong adherents across the political spectrum. They are nevertheless motivated by a variety of goals, ranging from reducing poverty and increasing income edistribution, providing an economic cushion for technological unemployment, and reducing the costs and bureaucracy of administering the modern welfare state’s many programs.

Unfortunately, however, these discussions are far too often characterized by vagueness and imprecision regarding the particulars of the guaranteed or basic income proposed. Proponents and opponents often talk past each other, because they have different but unshared notions of just what a guaranteed income would be.

As a result, there are two main questions that need to be addressed: can Canada afford a basic income, and how should it relate to the income tax system?

The short answers are, first, of course Canada can afford a basic income guarantee. The real issue is can we afford one that would actually raise most people out of poverty, incentivize them to join or stay in the paid labour force, be not too complicated for our tax system to administer, and not result in too many people experiencing unpalatable changes in their disposable income, which could be politically challenging.

For the second question, it is absolutely essential for the basic income design to be closely integrated with income taxes. In short, the basic income needs to be treated as a negative income tax. The basic income guarantee would be a refundable income tax credit like the Canada Child Benefit.

In order to demonstrate that there is a clear and fiscally feasible option for a guaranteed income integrated with the income tax system, I have returned to the idea of a guaranteed income/simplified tax (GIST), which I first wrote about in Policy Options over 30 years ago. Using simulations based on Social Policy Simulation Database and Model , I focus on a proposal that would not raise or lower the government’s deficit.

Problems with the status quo income tax/transfer programs

Before describing the GIST option, it is important to understand Canada’s current income tax/transfer programs. It is a misnomer to call them a “system” since they are in fact an incoherent hodgepodge that arose from a series of incremental policy changes. Ottawa and the provinces had different priorities over the years, and governments have repeatedly shown themselves unable even to do the necessary “horizontal” policy analyses, let alone take initiatives that would have brought more coherence to this complex array of transfer programs and income tax provisions.

Despite all this, when we stand back, some general patterns are apparent. When examined from the perspective of whether one has low, middle or high income, this collection of programs and income tax provisions shows a proclivity to be tough on those with low incomes, and lax for those with high incomes, as shown in table 1.

It is critical to recognize that one major program, provincially administered social assistance (SA), reduces benefits by up to one dollar for every added dollar of income. Indeed, it can be worse if the recipients are also living in rent-geared-to-income housing, or if other income causes them to cross an income threshold above which they lose benefits like dental care. In effect, the poor can face effective marginal income tax rates higher than 100 percent. This situation is often called the “poverty trap,” as it creates a strong disincentive to work.

These confiscatory tax rates do not incite the kind of outrage amoung the poor that high-income individuals showed after the finance minister announced in July 2017 his intention to clamp down on income-splitting and tax deferral planning through private corporations. In this situation, these well-off individuals feared they might have to pay income taxes at the top marginal income tax rate of about 50 percent, which is nowhere near the rates the poor face of up to 100 percent and higher.

EMTRs are more complex than the statutory rate brackets in the income tax system might suggest. Other marginal rates are used to claw back the GST credit, the Child Tax Benefit (CTB), and the Canadian Workers’ Benefit (CWB) over certain income ranges. These other marginal taxes on income are stacked on top of the general statutory tax rates.

(Note that many individuals aged 65 and over with low incomes face high marginal tax rates from the reduction formulas in the Guaranteed Income Supplement, combined with provincial top-up programs. However, in order to simplify the analysis, I have excluded individuals over 65 and families that include members over 65.)

Based on simulations that use Statistics Canada’s Social Policy Simulation Database and Model (unpublished), I find that the majority of people (excluding those over 65) face effective marginal tax rates (or EMTRs, the rate of income tax for an extra dollar of income) ranging from 25 to 40 percent.

However, over 1.2 million families with incomes under $10,000 face EMTRs in the 70+ percent range; these are SA recipients. Aside from this group of low-income families, there is almost no one facing EMTRs over 50 percent. And, as one would expect, most of those whose EMTRs are lower than 10 percent have incomes in the $10,000-$30,000 range.

The demographic unit on whom income taxes are levied and the rate at which benefits are reduced, which amounts to a tax, starts out as a family at the low end of the income spectrum and gets narrower moving up the income spectrum, so those with the highest incomes try to be taxed as less than one individual by splitting their incomes with others in lower tax brackets. (For example, before the 2018 tax changes, those with incorporated businesses could easily make their spouse or children shareholders and pay them dividends, so that much of the business owner’s income is splintered and taxed at a lower rate).

Guaranteed income/simplified tax (GIST)

In order to support a more informed discussion of a guaranteed or basic income and my claim that a basic income is plausible, I have developed a specific GIST option. It is fiscally neutral; and it explicitly integrates the basic income with the income tax collected. Table 1 above can be viewed as background. My GIST would

- Simplify the income tax/transfer programs

- Introduce much more equitable EMTRs with a flat tax for the majority of the population

- Completely remove incentives to create new family units or break up existing ones for all but those at the top and very bottom of the income spectrum”

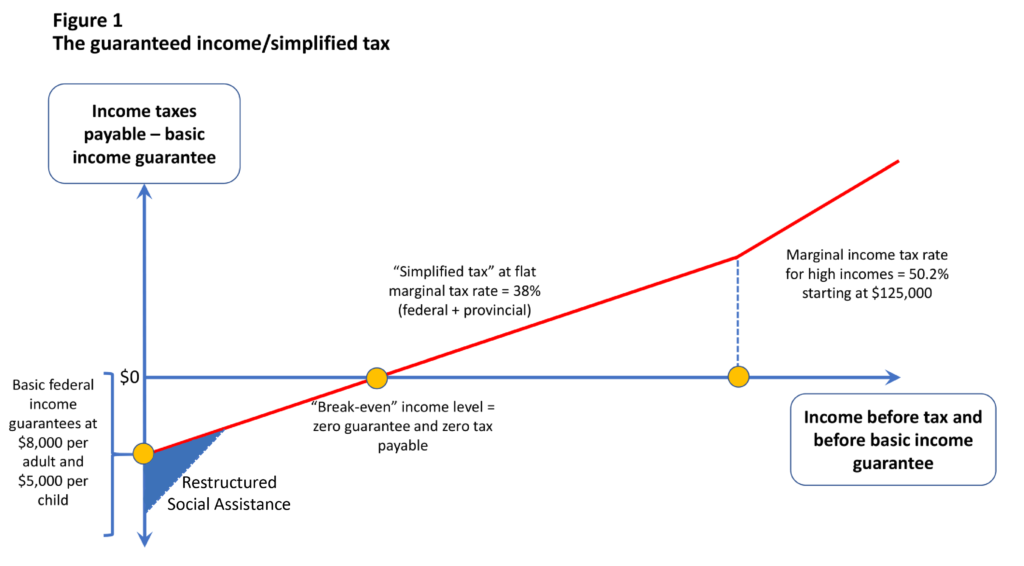

Under this system, everyone would have a basic federal income guarantee: $8,000 per year for those age 18 to 64, and $5,000 for those under age 18. (While these amounts per child are somewhat less than those provided by the Canada Child benefit, this is more than offset by the income guarantees for parents. These amounts are also less than the guarantees under Ontario’s guaranteed income experiment; however, for those with the lowest incomes there would be provincial benefits on top of my proposed GIST (see below regarding SA). Income tax would be levied starting with the first dollar of income received from any source other than the basic income guarantee.

Assuming continuation of the Tax Collection Agreements with the provinces, there would be only two tax brackets, thereby flattening out the system. The higher tax bracket would start at $125,000 per individual. The tax rate for this group (15.4 percent of individuals, not including those over 65) would be 31.0 percent federally, and the average of combined federal and provincial tax rates would be 50.2 percent.

The basic flat tax rate for the large majority ─ 84.6 percent ─ of Canadians with incomes below the top bracket (excluding those over 65) would be 23.5 percent federal, and an average of 38.0 percent federal and provincial.

To fund the guaranteed income and simplify the system, in addition to the simplified tax rate structure, many provisions of the current income tax would be abolished, including the personal exemption and refundable tax credits, such as the Canada Child Benefit. Tax incentives for RRSPs and RPPs would be capped at tax deductible contributions of $10,000 per year. And capital gains income, currently at half-taxation, would be fully included as income.

Further, the federal government would withdraw from any fiscal transfers to fund a portion of provincially administered SA. It would instead fully fund the basic income guarantee, leaving the provinces to fund fully a reduced SA, on the assumption that with the new federal basic income in place, the provinces would be able to cut their spending on SA in half.

These changes would constitute a form of federal-provincial “disentanglement,” reminiscent of finance minister Marc Lalonde’s Social Security Review (SSR) in 1973-75. As Al Johnson, Lalonde’s deputy minister during that period, said, “The ideal guaranteed income system, it was suggested, should be made up of two elements: first, a ‘full’ guaranteed income to people who are unable to work or to find employment; and, secondly, income supplements for people who are working but whose incomes are, by reason of family size or insufficiency of work, inadequate.” This policy was agreed by all federal and provincial welfare ministers in 1975, and the next step would have been for federal and provincial officials to work out the financing, operational and implementation details.

In my GIST proposal, the basic federal income guarantees correspond with the SSR’s supplementation tier, while my proposed reduced and restructured provincial social assistance corresponds with its support tier. These changes, together with amendments to other provincial programs to remove the income- or means-testing stacked on top, could eliminate the “poverty traps” that act as disincentives for people to join or stay in the workforce.

This GIST proposal does not suggest any change to EI or the Canada/Quebec Pension Plans, though some portion of EI benefits might reasonably be reallocated into funding a more generous basic income.

Note that the basic income guarantees and the flat tax rate are largely neutral with regard to family composition. Except for those at the top or bottom of the income spectrum, income for all is taxed at the same 38 percent rate, while the guarantee levels depend only on age, so there is no incentive to get married or divorced in order to reduce taxes.

However, these benefit levels do not recognize the idea that two people living together need less income than if they lived apart. A fiscally neutral alternative would be to start with an income guarantee of $10,000 for a single individual, and then scale benefits for second and subsequent family members using the same factors as are used in Statistics Canada’s Low Income Measure (LIM), Employment and Social Development Canada’s Market Based Measure (MBM), and by the OECD in its income distribution and poverty studies.

Finally, it is important to avoid rhetoric about the huge “costs” and unaffordability of a basic income. Of course, it is possible to multiply the basic income guarantees by the population of Canada and come up with a figure of hundreds of billions of dollars. But any sensible basic income guarantee, as with the GIST, would be phased out depending on individual’s other (nonguaranteed) income. If these clawbacks (reductions in basic guarantees based on income from all other sources) were counted as income taxes, there would be a huge increase in apparent government tax revenues. With the growth of “tax expenditures,” especially refundable income tax credits, the line between government spending and tax provisions has become blurred to the point even informed parliamentary scrutiny is challenged. Rather, the focus should be on net amounts of redistribution.

The GIST I have outlined is fiscally neutral – it will not change federal or provincial deficits. As a result, the “cost” of this GIST by design is essentially zero.

It is important to ask, first, how many individuals and families would gain or lose “net income,” i.e., income after taking account of income taxes paid, cash transfers received, and the new GIST amounts; and second, what would the changes mean for effective marginal tax rates and hence the incentive to work? The answers to these questions will require an analysis that is beyond the scope of this initial sketch.

Challenges and conclusions

A plausible basic income, coherently integrated with the income tax, is entirely possible. For a GIST to become a reality, there would still be many challenges. One is whether this option would have popular or political appeal. Some may say the guarantee levels are too low; others that the tax rates are too high, and still others that the federal-provincial negotiations it would entail would not succeed. Still others might argue that new revenues from corporate or sales or carbon taxes should be used to help fund the basic income guarantees. Another challenge is whether, even if the GIST is very appealing, it is possible to envisage a politically plausible transition toward it from the status quo, which is so complex and heterogeneous that the change would generate large numbers of losers, as well as gainers.

This GIST proposal shows that if we focus on net fiscal impacts rather than scary gross costs, and if we explicitly integrate income transfers and income taxes, sensible options exist. Using Statistics Canada’s simulation model, I show that a GIST, based on empirically grounded quantitative estimates, is feasible in fiscal terms. Of course, this GIST proposal is only a sketch, and many reasonable variations are possible. Still, I have laid out the core analytical features of a GIST to set the stage for a more informed discussion.

Photo: Shutterstock, by Minichka.

Do you have something to say about the article you just read? Be part of the Policy Options discussion, and send in your own submission. Here is a link on how to do it. | Souhaitez-vous réagir à cet article ? Joignez-vous aux débats d’Options politiques et soumettez-nous votre texte en suivant ces directives.