The Finance Minister delivered a stay-the-course 2011 budget with few surprises, and the “goodies” it contained were more in the interest of the government’s survival than sound economics. As it turns out, they were not enough to attract New Democratic Party support, and the rapid and unequivocal rejection by all three opposition parties rendered the document dead on arrival and virtually guaranteed the fall of the government. But as a statement of economic and social priorities it remains relevant in the ensuing election campaign and merits examination.

Jim Flaherty’s lead quote in the news release accompanying the budget asserts, “As the private sector moves ahead as the engine of growth and job creation, our Government will foster the right conditions for long-term economic prosperity, while staying on track to return to balance in the medium term.” This is a good start as a vision statement, but the budget is chock full of measures to support job creation, families and communities (some less economically justified than others) that bear an uncanny similarity to those in the previous two budgets (in style if not magnitude), betraying an erroneous belief that the economy still needs the support of government to exit a crisis and move into a higher gear.

The fundamental problem with the 2011 budget is that it can’t seem to decide whether the recession is over or not. Its very description as the “next phase” of Canada’s Economic Action Plan (whose raison d’être was to combat the recession) is coupled with a rosy — and in my view largely accurate — appraisal of Canada’s medium-term outlook for the recovery. There is no doubt that Canada is the strongest among the G7 nations on virtually all the headline indicators of economic activity, whether it be jobs, GDP or incomes, and this despite a strong dollar and a lacklustre recovery in the United States that have put a crimp in our exports.

While the government can certainly take some credit, to the extent that a strong financial system and a relatively timely and well-targeted stimulus package helped weather the worst of the storm, the main structural driver is rapid economic growth in China and other emerging giants, which barely hiccuped during the global recession. As a result, prices and demand for the natural resources that Canada is fortunate enough to possess have again begun to soar. As I noted in last month’s Policy Options, this trend improves the terms of trade and transfers billions of extra dollars into the Canadian economy. It is no accident that the only other industrialized country that rivals Canada in post-recession macroeconomic performance is Australia, which like Canada has large natural resource reserves. One can justifiably question whether a next phase of the anti-recession plan is even necessary.

The budget continues the practice of using tax preferences to encourage certain activities ranging from children’s arts programs to family caregiving to volunteer firefighting. Independent of the tenuous economic rationale for excluding these (rather than other equally worthy activities) from income tax, such tax expenditures disproportionately benefit those with higher incomes (since they are not refundable) and more often than not simply pay households to undertake activities they would do irrespective of whether the credit exists. At a broader level, the more the tax base is poked with holes, the less efficient and more complex it becomes and the higher the tax rate required to raise a given amount of revenue.

It is no accident that the only other industrialized country that rivals Canada in its post-recession macroeconomic performance is Australia, which like Canada has large natural resource reserves. One can justifiably question whether a next phase of the anti-recession plan is even necessary.

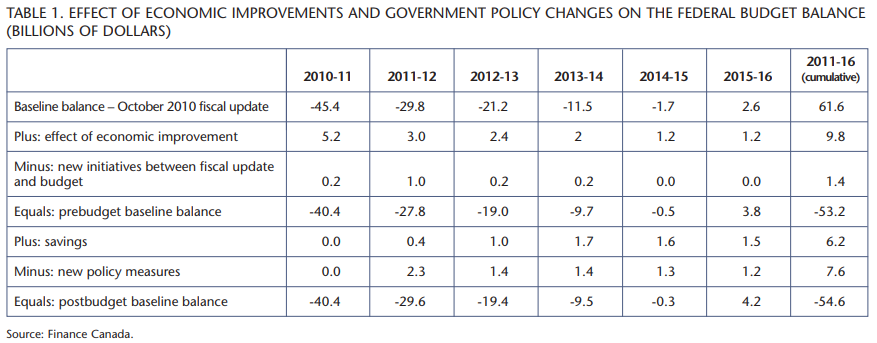

For all of the talk about the need to take measures to restore fiscal balance, the new budget measures actually add slightly to the cumulative projected deficit over the next five years (table 1). Front-loaded new spending and tax breaks will cost an additional $2.3 billion in 2011-12 (thus increasing, not decreasing, fiscal stimulus at an aggregate level) and thereafter the policy-induced deficit reduction is minuscule. Announced savings from already completed program spending reviews as well as closing of a number of tax loopholes will reduce spending by at least $1.5 billion annually within three years, but the savings are insufficient to offset the cumulative cost of new initiatives. Put more simply, economic growth rather than effective fiscal management is doing the heavy lifting on deficit reduction.

To be fair, these numbers do not take into account the potential savings from a government-wide strategic review of approximately $80 billion in program spending to be undertaken over the next fiscal year. The budget has targeted 5 percent of this base, or $4 billion, in annual savings by 201415. If this additional saving materializes, it would be sufficient to move Canada into surplus a year ahead of schedule and have it flirting with double-digit surpluses by 2015-16.

But such hopes are more wishful thinking than realistic estimates, which may be one reason why the budget studiously avoids including them in its published forecasts of program spending. It is important to bear in mind that nearly all government departments and agencies have already been through rolling annual strategic reviews at some point over the past four years. In 2010, for instance, $33 billion of spending across 12 departments and agencies was reviewed, yielding an estimated $1.6 billion in annual savings (almost 5 percent of the total) by 2013. It is hard to believe that those same agencies are going to find an additional 5 percent in savings — the law of diminishing returns sets in quickly when looking for efficiency gains and other cost-cutting measures without compromising service delivery.

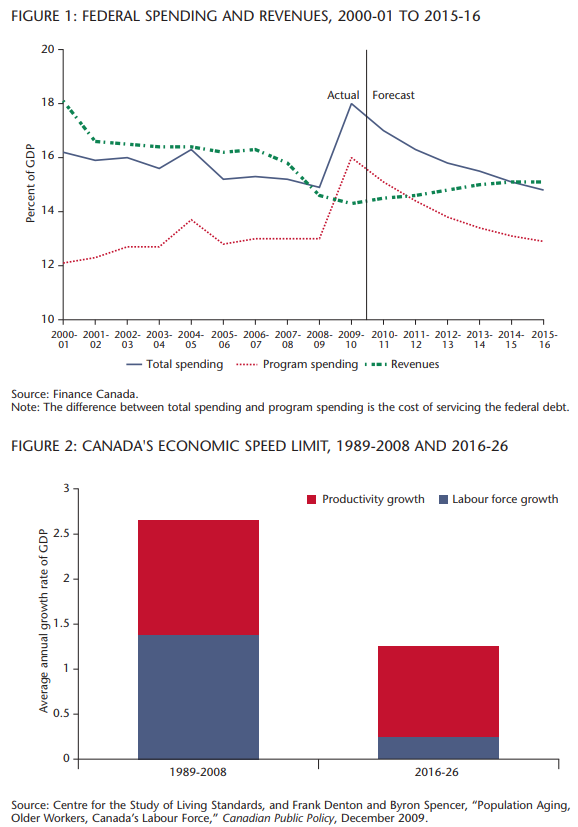

As a result, the budget would succeed in bringing program spending down to precrisis levels, but not until 2015 (figure 1). One would have expected withdrawal of the bulk of temporary stimulus funding to accelerate this process, but the government on actively pursuing a policy of deficit reduction.

Looking beyond the rosy headlines of the near term with regard to output and jobs, demographic forces are conspiring to paint a much more sombre economic picture over the budgetary horizon. The nub of the matter is that the “speed limit” of sustainable economic growth is slowing. The growth potential of any economy is the sum of growth in the labour force and growth in productivity. In lay terms the economy can grow only as fast as the quantity and quality of work effort it has to offer. For the past 20 years, economic growth has been shared more or less equally between the two. But as the baby boomers start to retire in larger and larger numbers, labour force growth is projected to drop to only 0.25 percent annually by 2016, even taking into account the partly offsetting effect of immigration and higher labour force participation of older workers. Without a marked acceleration of productivity growth, Canada’s economic speed limit could be cut in half over the next several decades (figure 2).

This will pinch federal coffers ever more dramatically on both the spending and the revenue sides. On the spending side, aging will perforce increase demands on the Canada and Quebec Pension Plans (the subject of much-needed attention in both jurisdictions), but the big wild card is health care spending. The 2004 health transfer accord expires in 2014, and with provincial budgets at the breaking point and the federal share of total spending flat, there will be tremendous pressure on Ottawa to share the health care cost burden more equitably.

On the revenue side, total revenues are first and foremost a function of economic growth: the budget uses nominal GDP as the potential government revenue base. For any given set of tax rates, a decelerating economic speed limit means slower growth in government revenues.

For this reason, the measures designed to improve Canada’s productivity performance merit careful attention.

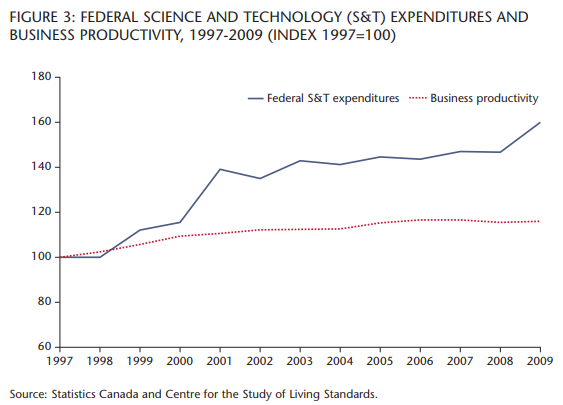

In terms of additional dollars, the amounts are not significant: $250 million for digital innovation, $216 million for scientific research and $51 million for commercialization. This allocation of new funds remains very much in the “science-push” mode, which depends on the premise that federal investments in the “supply of knowledge” (via increases in funding to the granting councils, Canada Excellence Research Chairs, etc.) will eventually lead to inventions that are commercialized and result in productivity gains, in the form of either highervalue products or more efficient production processes. But figure 3 shows that the sharp increases in R&D spending in the late 1990s and early 2000s did not lead to any meaningful increase in productivity in the ensuing years.

Despite this, the budget contains a number of measures that seek to bridge the wide divide between university research (where Canada is an international leader in terms of research intensity) and business innovation, particularly among small and medium-sized enterprises (SMEs). Recent IRPP research has demonstrated two fundamental policy shortcomings on this score: businesses are insufficiently involved in determining the recipients of government support for university research, and small businesses do not have the resources or knowledge to form partnerships with post-secondary institutions. As a result, relatively few firms use universities as major sources of innovation, and those that try often find that the research is of limited relevance to their business activities. This is a market failure that warrants active government policies.

Viewed in this light, several pilot programs in the budget are a step in the right direction. A pilot initiative within the Industrial Research Assistance Program to develop partnerships between SMEs and colleges with the goal of accelerating adoption of information and communication technologies, as well as efforts to connect businesses with research performed at colleges, addresses many of these issues head-on but involves tiny amounts of funding. The budget also extends for two additional years accelerated depreciation for investment in machinery and equipment, the vehicle by which much new innovation is incorporated into production processes.

But the missing link in the science-productivity equation is the lack of demand for innovation on the part of businesses. Part of this may be cultural, reflecting quintessential Canadian qualities of risk aversion, but part of it relates to factors that can be affected by government policies.

One important factor in the demand for productivity-enhancing innovation is the competitive environment. For Canadian manufacturers, the rising Canadian dollar has dramatically increased the competitive disadvantage they face in American markets, and this pressure has led to a resurgence in sectoral productivity coming out of the recession. Independent of the budget, the government has recently injected more competition into the historically protected telecommunications sector and (the rejection of the PotashCorp takeover notwithstanding) taken a more hands-off approach to foreign takeovers and investment in Canada. Policies to increase competitive pressures on Canadian firms have a proven track record in improving productivity and should be pursued.

A second factor behind demand for innovation is the business tax burden. Although not explicitly included in the 2011 budget because it has already been legislated, the drop in the statutory corporate tax rate from 21 percent to 15 percent over four years may be the single most important policy move by the government in support of future business productivity. These reductions increase investment and — contrary to popular belief — do not adversely affect corporate tax revenues over the medium term. The fact that all opposition parties want to see these cuts rescinded is a fundamental policy difference on which the Conservatives have the economic high ground.

With the economic crisis behind us, the time was ripe to depart from the crisis-management reactive stance of the budget over the past two years and turn toward the more difficult task of offering a coherent vision around some basic questions: What are the economic and social goals that Canada and Canadians should aspire to? What is the role of government in meeting them? These questions, pushed aside by the global recession and financial crisis, can no longer be swept under the rug. If the government was not willing to raise them in its 2011 budget, one hopes that an election campaign will.

Photo: Shutterstock