Every five years, the Bank of Canada reviews and renews its inflation-control agreement with the Government. To prepare for the upcoming 2016 agreement, the Bank recently hosted a conference with presentations and discussion largely focused on two main policy questions:

Q1: Is 2% still the right level for Canada’s inflation target?

Interestingly, at the last review in 2011 the Bank considered whether the target should be lower than 2%, and concluded that it shouldn’t.[1] Now the conversation has shifted to whether we might want a higher inflation target.

The shift in thinking is due to recent episodes in several advanced countries where monetary policy has been largely stuck at its effective lower bound (ELB) for a prolonged period. The ELB is acts as an asymmetric policy constraint, because it can prevent monetary policy from being as stimulative as it might like, whereas there’s less constraint on how contractionary monetary policy can be by raising rates. Modeling exercises suggest that a higher inflation target would reduce the frequency and duration of ELB episodes.

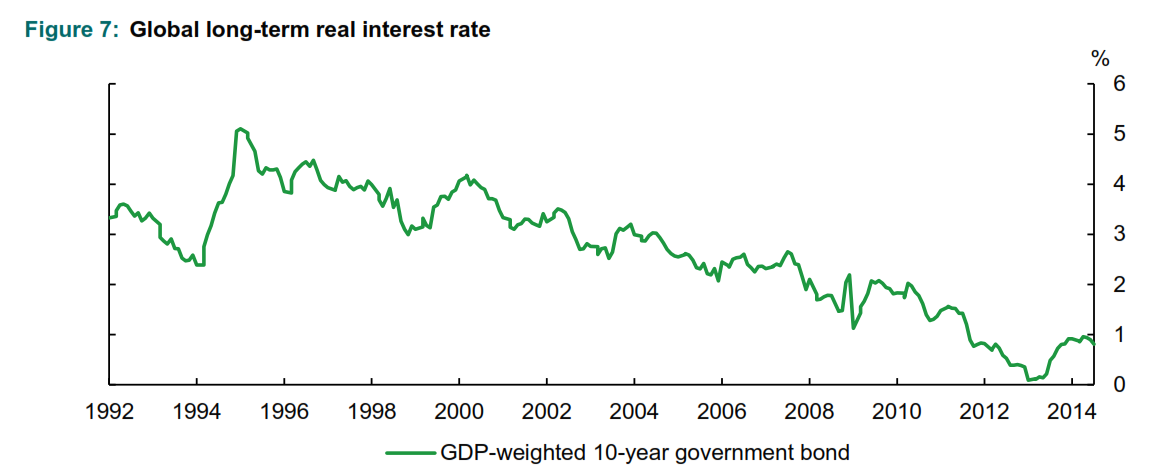

We also have a better sense that the ‘neutral’ interest rate has fallen globally in recent decades — perhaps by as much as few percentage points. In this new environment, having a higher inflation target, say of 4% rather than 2%, would simply restore some of the monetary policy room that has effectively been lost.

A higher inflation target might even improve economic performance in the steady-state. With higher inflation, the real value of nominal wages is eroded faster. This matters because workers are averse to nominal wage cuts (so-called downward nominal wage rigidity), so when a negative shock hits the labour market, higher inflation makes real labour costs fall faster, which might avoid larger spikes in unemployment. This would be a good thing, and might avoid ‘hysteresis’ effects that depress potential output — whereby unused capital might become obsolete or idle worker’s skills might atrophy.

Things are complicated by on-going debates about where the effective lower bound really is. Maybe we don’t actually need the new conventional monetary policy space that a higher inflation target would bring, we just need to be more creative. Consider the recent, widespread use of unconventional monetary policy, including: forward guidance on rates (as used in Canada, the US and UK); quantitative easing (in the US and Europe); or even negative interest rates (in Switzerland and Sweden on loans with financial institutions).

While these unconventional tools aren’t fully tested or without risks, they seems to have offered some additional monetary policy stimulus, when it otherwise looked like policymakers were tapped out. So if you support the use of these alternative approaches, you’re far less likely to think that a higher inflation target is necessary. Alternatively, if you dislike these tools, than you may view a higher inflation target as a way to minimize the risks of having to rely on these unconventional approaches.

We also need to consider, not just steady-state comparisons, but the transition to the higher inflation target. If inflation expectations are slow to adjust — which seems plausible — then this could entail a large redistribution of wealth from households to governments, which could be viewed as arbitrary and unfair. Particularly hard hit would be those with non-indexed defined benefit pensions. At the same time, higher inflation helps debtors by reducing the real value of their repayments (including the government, who also benefit from more seignorage with higher inflation).

There are also risks that a higher inflation target would erode the central bank’s hard-fought credibility. For instance, what if the Bank couldn’t actually generate higher inflation? What if people thought that the Bank would be more likely to change the inflation target again in the future, so that expectations became unanchored?

One of the more interesting suggestions was that, in light of the fact that the Bank of Canada will likely under-shoot its inflation target during this five-year mandate, it should consider setting an asymmetric target for the next mandate, say, in the 2-3% range, rather than sticking with the wider 1-3% band for inflation.

Q2: Should monetary policy take more account of financial stability considerations?

This issue was also considered back in 2011 review. Since then in Canada, household debt has increased; interest rates have been lower-for-longer-than-expected, which can exacerbate financial sector risk-taking in the search for yield; and there are elevated risks of a housing price correction.

The longstanding concern with trying to use monetary policy to slow the housing market is that it’s too blunt a policy instrument. To slow the housing market you’d have to raise rates considerably, thereby imparting considerable collateral damaging on the rest of overall economy.

So if you can’t really “lean” against asset price bubbles (or if it’s simply too hard to identify them in real-time), this suggests a focus on improving our ability to “clean” them up. It also suggests a clearer delineation of policy tools and objectives: use the policy interest rate to target inflation, and rely on macroprudential tools to target specific financial stability concerns.

For instance, we may require counter-cyclical capital requirements for financial institutions to ensure their solvency, or we may adjust in loan-to-value ratios for home buyers to cool off the housing market. While the former may not be that politically controversial, the latter would be. It might make sense to impose tighter down-payment requirement in the specific housing markets that analysts are most concerned about (Vancouver and Toronto), but this could elicit a public backlash from those priced out of these expensive markets.

There’s a far bigger outstanding policy issue at play here: the need to better align the overall institutional structure in Canada for financial stability concerns. The system now has related, overlapping (and perhaps inconsistent) responsibilities among the Department of Finance, the Bank of Canada, OSFI and CMHC. In the direct aftermath of the financial crisis, it seemed like there was a stronger appetite to address this issue, but unfortunately it doesn’t seem very high on the policy current agenda.

******

Canada’s approach to monetary policy has generally worked well over the past two decades, and this sets a high bar for any policy adjustments. It’s fair to characterize central bankers as a calculating and cautious bunch, so I wouldn’t expect any radical adjustments for the Bank’s next mandate.

Even though Canada has a strong monetary policy framework in place, it might still be improved on the margin and so these are important policy discussions to be having. The Bank of Canada should be commended for its open discussion and solid research contribution to these issues. This work instills confidence that any changes that might be taken, and their associated trade-offs, will be thoroughly examined.

[1] The Bank also considered whether price level targeting might be a better approach — which unlike inflation targeting that essentially ignores past policy misses, PLT tries to correct them. To work well, PLT would entail more difficult policy communications and require more responsive inflation expectations by the public. Because of these complications, the adoption of price level targeting in Canada seems unlikely any time soon.