The IRPP recently-released the first two chapters in an ambitious new research volume on Canadian trade. Those papers examined changing international business practices and the policy implications of ”global value chains” (or GVCs, see Van Assche and Blanchard).

The next chapter in the GVC section, titled Chasing the Chain: Canada’s Pursuit of Global Value Chains, is from Export Development Canada (EDC) researchers Daniel Koldyk, Lewis Quinn and Todd Evans, who analyze Canada’s economic links with the rest of the world. Here are some important points that I took from reading their paper:

Canadian commerce abroad involves more than exporting

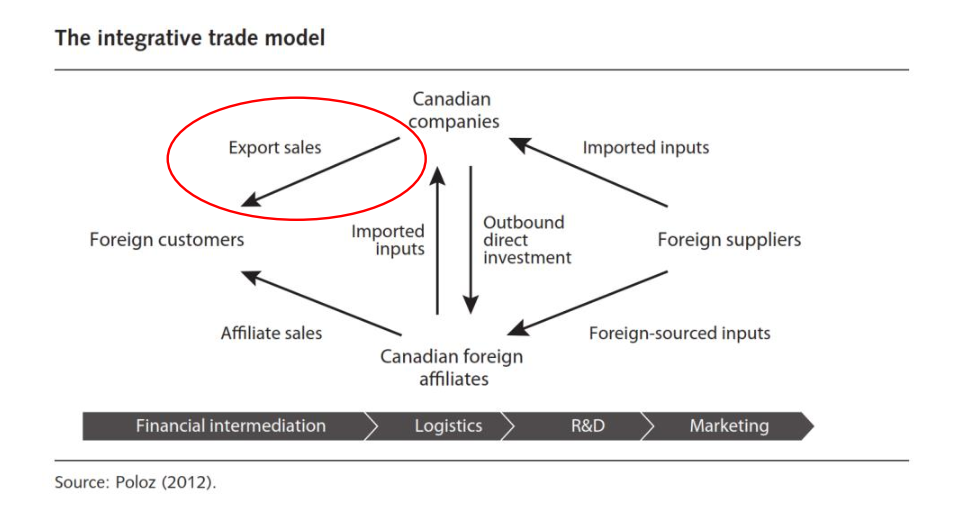

In international trade discussions, exports understandably receive plenty of attention. However, this chapter suggests we should be paying far more attention to how Canadian companies engage with the rest of the world via outward investment and the use of foreign affiliates. EDC calls their broader perspective on global business activities the ”integrative trade” approach (figure 1).

Figure 1

Seen in this way, it’s clear that looking at export data in isolation (circled in red) only gives a partial picture of Canada’s economic activities abroad.

By looking only at exports, you miss much of the overall action– Canada’s foreign affiliate sales have grown to be about the same size as our overall exports (estimates for 2013 are about $530 billion and $560 billion, respectively).

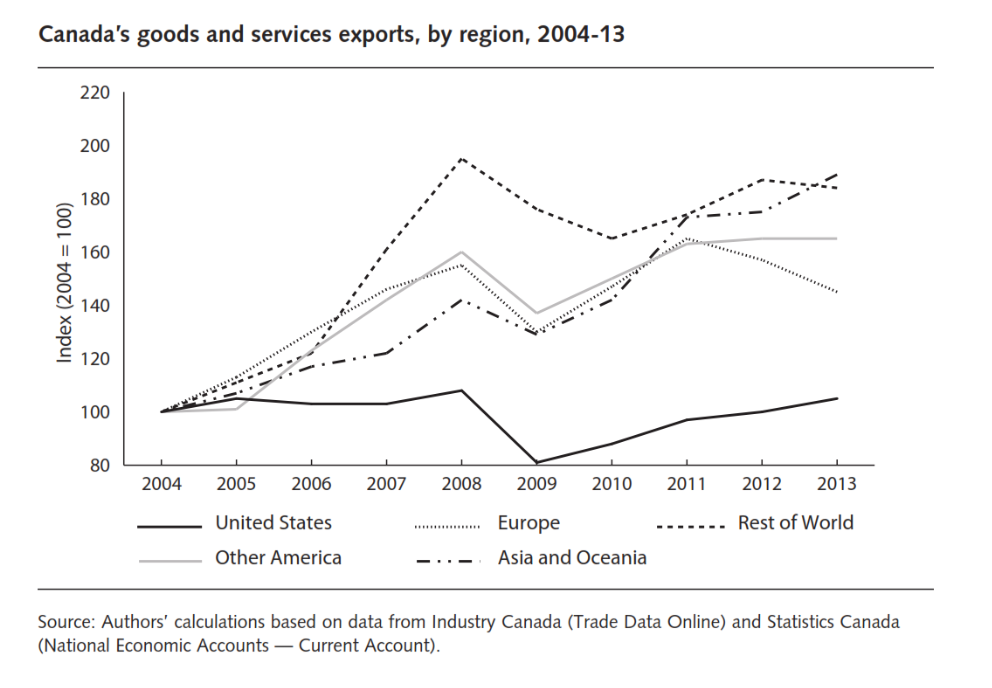

And you miss much of the growth– Canadian foreign investment and foreign affiliate sales have grown faster than our exports over the past decade (figure 2).

Figure 2

The narrow export-only perspective may help explain the typical story heard in Canada– namely, that our firms concentrate too heavily on the US market and aren’t taking advantage of opportunities elsewhere. An important contribution of the EDC chapter is to show that Canadian businesses are actually engaging more with overseas markets and are less dependent on the United States than is commonly understood.

The narrow export-only perspective may help explain the typical story heard in Canada– namely, that our firms concentrate too heavily on the US market and aren’t taking advantage of opportunities elsewhere. An important contribution of the EDC chapter is to show that Canadian businesses are actually engaging more with overseas markets and are less dependent on the United States than is commonly understood.

Look beyond exports and our US dependency is significantly reduced

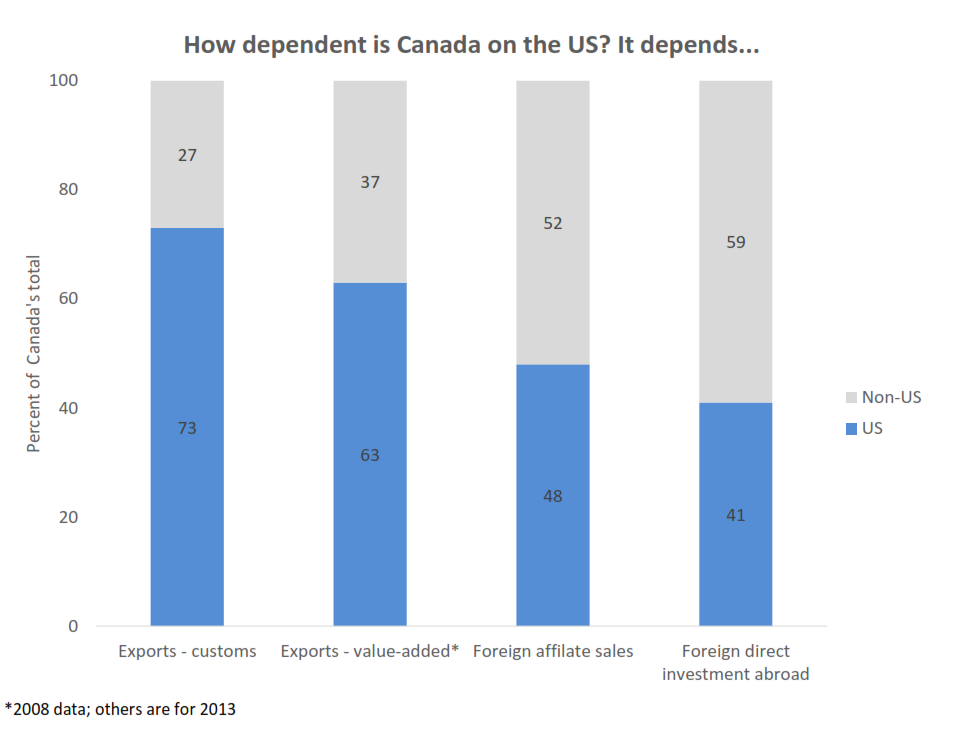

To illustrate this point, consider these shares of international activities going from Canada to the US and everywhere else (figure 3).

Figure 3

The usual customs-based export data– which allocate the entire value-added to the exporting country– show that the vast majority of our exports are US-bound (73% in 2013 for goods and services taken together; and 76% for goods and 56% for services taken separately).

The usual customs-based export data– which allocate the entire value-added to the exporting country– show that the vast majority of our exports are US-bound (73% in 2013 for goods and services taken together; and 76% for goods and 56% for services taken separately).

However, even here Canada’s two-speed export performance over the past decade has reduced our dependence on the US market. Essentially, our exports to the US suffered a “lost decade”, while our exports to other markets grew reasonably well, but from a low starting point (figure 4).

Figure 4

The second bar in figure 3 shows value-added exports, and relies on data that take better account of multi-country production processes and try to allocate the incremental value added to each source country. These data show more diversification for Canada’s exports with 63% going to US rather than 73%– and the difference between these two numbers suggests that a sizable amount of Canada’s exports to the US continue on to other markets.[1]

The second bar in figure 3 shows value-added exports, and relies on data that take better account of multi-country production processes and try to allocate the incremental value added to each source country. These data show more diversification for Canada’s exports with 63% going to US rather than 73%– and the difference between these two numbers suggests that a sizable amount of Canada’s exports to the US continue on to other markets.[1]

Interestingly, the third bar in figure 3, based on foreign affiliate data, shows more economic activity for Canada happening outside the US than inside it (48% to 52%, respectively). The authors say that if current trends continue, then Canada’s foreign affiliate sales in emerging markets alone will overtake those in the US within a few years.

The last bar in figure 3 shows that the majority Canada’s outward foreign investment also goes to non-US destinations (59% of the total, though there’s a caveat that some are tax havens).

Global business strategies are complex

Business strategies involve inter-related choices of which markets to engage with and how to engage them. You might expect that Canadian companies generally use exports to serve closer markets like the US and foreign direct investment (FDI) to reach farther markets like emerging economies.

This isn’t always the case and there’s plenty of Canadian FDI in the US. Like many other countries, Canada uses a combination of exports and FDI to serve a variety of foreign markets. Some companies even use both approaches simultaneously and operate in multiple markets, so it’s not always a simple question of ”either/or”, sometimes it’s a question of ”and/both”.

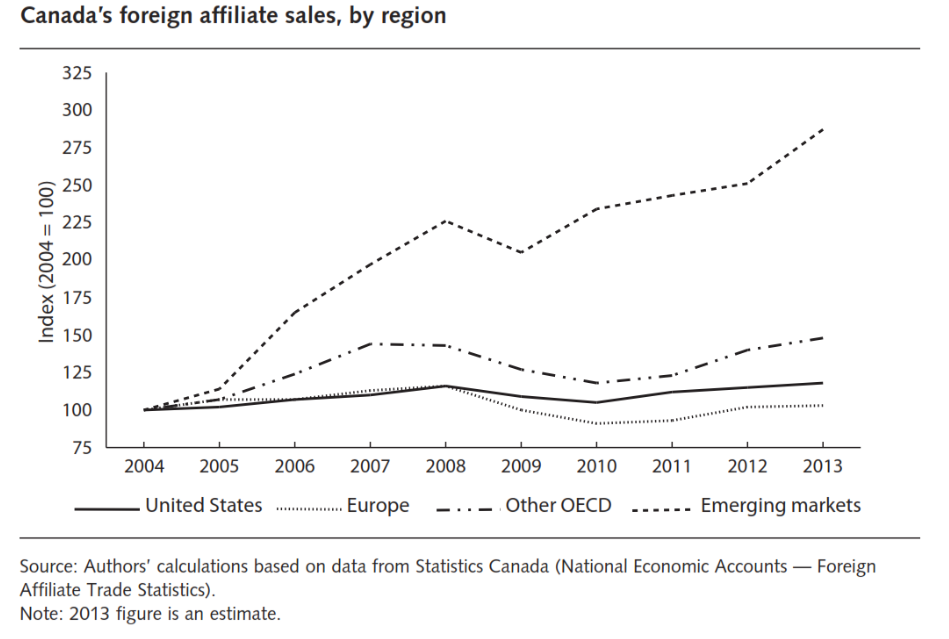

Canadian foreign affiliate growth is strongest in emerging markets and services

The authors find that Canadian firms are increasingly relying on foreign investment and foreign affiliate sales– with the latter increasing at a rapid pace in emerging markets (figure 5).

Figure 5 Foreign affiliates may conjure up images of factories that produce goods cheaper overseas, but increasingly foreign affiliates are performing a wide range of services– such as financial intermediation, marketing, logistics, and after-sales service.[2]

Foreign affiliates may conjure up images of factories that produce goods cheaper overseas, but increasingly foreign affiliates are performing a wide range of services– such as financial intermediation, marketing, logistics, and after-sales service.[2]

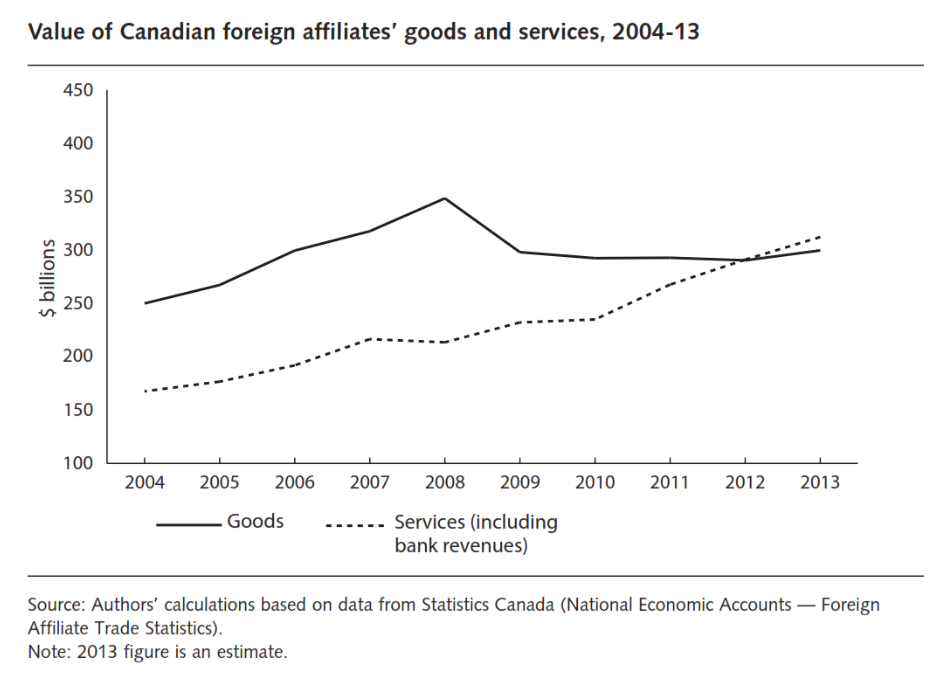

Figure 6 shows that the value of foreign affiliate sales of services now exceeds that of goods production (and is also twice large as Canada’s services exports).

Figure 6

In addition to the data analysis, the EDC authors also conducted two dozen interviews with supply chain executives and these qualitative findings shed additional light on what’s driving these trends.

In addition to the data analysis, the EDC authors also conducted two dozen interviews with supply chain executives and these qualitative findings shed additional light on what’s driving these trends.

Respondents often said that having an overseas presence is critical to their company’s overall success. And the empirical evidence generally supports this– companies with a broader global footprint are more productive, innovative and experience stronger, more sustainable growth.

The results suggested that the increased use of overseas investment and foreign affiliates relates a desire to: cut production costs; capture consumption growth in emerging markets; tap South-South supply chains; and overcome market access roadblocks.

Offshoring in the manufacturing sector has likely also played a role– but even here, the need to satisfy North American timelines and avoid costly delays means that some critical elements of production processes cannot or will not be off-shored. Respondents also said that some activities are coming back to Canada after failed experiments abroad.

Revisiting Canada’s US dependency and knowing where to look

It is often argued that Canada needs to diversify its exports beyond the US market and into faster-growing emerging economies. The nuance of this chapter is to show that these changes have been underway over the past decade for Canadian businesses abroad and are likely to continue. However, they’ve probably been less noticeable because they’ve occurred more through the foreign investment channel than through the export channel.

This is not saying that the US market will become unimportant for Canada, but that subtle shifts are occurring that haven’t been well-detected. Going forward, the bulk of our exports will likely be bound to the US-first, but in time we can expect more exports overseas and more investment and foreign affiliate sales designed to serve those markets as they mature.

The EDC authors’ conclusion on our US dependence is consistent with findings from a recent paper by the School of Public Policy at the University of Calgary. The scope of that paper was different– they examined Canada’s exports by country destination and product relative to other countries, not exports in tandem with foreign investment patterns. They concluded that global export patterns are largely driven around the regional value chains within the global economy of North America, Europe, and Asia. They found that Canada’s export attachment to the US was not unusual and, they argued, was not cause for concern.

Combining the export/investment approaches can help explain some apparent puzzles. For instance, a recent Bank of Canada discussion paper found that Canadian exports to the US may have been weaker-than-expected because they were taking place via foreign investment and foreign affiliate sales in some sectors (motor vehicle parts and forestry) rather than via exports. In these situations knowing where to look helps piece together clues and make better sense of abnormal trends.

Lastly, the EDC chapter calls for broader consideration of Canada’s international engagement with the world. Doing this more regularly and systematically requires more comprehensive, comparable and timely data– particularly on value-added trade and foreign affiliate sales. That would help better understand these on-going trends and analyze how Canada compares against other counties.

***************

The next chapters to be released are from the second theme of the IRPP trade volume: firm-level trade. They will provide an overview of recent developments in international trade theory and present new empirical results for Canada on the links between trade and productivity.