Asked on Friday to grade Quebec’s 2015-16 budget I gave it an 8 / 10 because I feel that it does a fair job of taking the necessary steps to bring revenues and expenses into line, while also providing some optimistic (though limited) signs about how the government intends to improve the province’s economic and fiscal competitiveness in coming years. The budget plans to modestly lower the tax burden on individuals and corporations by 2020, and begins to implement key reforms recently proposed by the expert commission led by Université de Sherbrooke economist Luc Godbout. These are encouraging signs.

That said we should be clear about what the budget does and does not do. In media reports following its release last week, several talking points have been repeated that I feel need to be put into context.

Here are four things you need to know and may not have heard so far:

1. Taxes are higher (for some)

In early December Finance Minister Carlos Leitao tabled a fall Economic Update that was essentially a mini-budget. At that time, the government introduced a number of immediate measures to change corporate taxation. This included a number of changes to reduce the generosity of various tax credits, raise the tax rate on the capital of insurance companies, and establish a new ”œtemporary” surtax on financial institutions. Compared to the $11 million of measures announced last week to lower the corporate tax burden this year in select sectors, the government will generate more than $250 million in additional revenue in 2015-16 as a result of the two changes announced in December regarding taxation of the financial sector alone. This increased fiscal room is larger than all of the changes announced last fall with respect to the financing of subsidized daycare (which will save $193 million).

Since the revenue changes announced in December took effect before the tabling of the budget last week they are built into the baseline. This allows the government to correctly claim that taxes are not being raised in the new fiscal year. Reality is somewhat different. Although businesses can expect meaningful tax relief starting in 2016-17, some companies will pay more this year than last year simply because of changes in tax rates.

Timing matters.

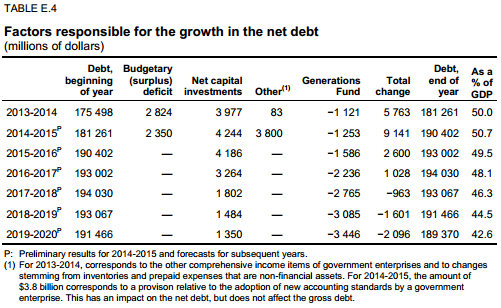

2. Debt is higher

Another point often repeated is that the overall level of government debt will finally decline for the first time in years. This assertion depends entirely on what we’re measuring. It true that as a share of GDP the relative level of total (gross) government debt will drop from 54.3% in 2014, to 54% by 2016. However, this is mainly because of slightly faster economic growth. In terms of absolute levels, both gross and net debt will increase between now and the end of fiscal year 2017-18.

Source: The Quebec Economic Plan, 2015-16, p. E11.

While the relative debt level is an important sign of credit risk, it is the absolute value of debt that affects interest payments and obligations on the operating budget. If total debt rises, government spending on debt goes up, and more revenue is drained away from spending on programs. With more debt being taken on this year and interest rates likely to rise in the next 24 months, the budget forecasts debt-service charges will increase by approximately $450 million in 2016-17.

The government has expressed a strong desire in coming years to turn its attention to Quebec’s massive debt burden. If we are to measure Minister Leitao by the standard set in Ottawa during the fiscal consolidation of the 1990s and early 2000s, the absolute value of debt will need to fall in appreciable terms.

3. Quebec is limiting spending on health but it’s in line with other provinces

Many commentators have noted just how aggressively the budget restrains spending in the two main program areas of health and education. The essentially flat-line allocation to education will necessitate major changes within schools, but the 1.4% increase in spending for health care is probably more manageable than it might seem. While it is true that a 1.4% increase still sets the bar quite high, in Quebec as in most provinces, health spending growth has slowed in recent years thanks to hard bargaining with doctors and nurses, along with changes in pharmaceutical purchasing and management structures. Whether this pace can be continued without a reduction in frontline service remains to be seen, but Quebec’s target of 1.4% is certainly not the tightest in the country based on what we know so far of other provincial budgets. Saskatchewan plans for an increase in health spending of 1% next year, while Alberta will actually lower spending by 0.8%

4. Economic growth in 2016 will still disappoint

For the first time in years, 2015 will see Quebec’s real GDP grow at the national average of 2%. While this is somewhat better than forecast in previous budget plans, Quebec’s rise in the economic leader-board will be short lived. For 2016 growth will remain around the 2% level at the same time as Ontario moves ahead of the national average, the U.S. market accelerates and western resource provinces likely experience a rebound from the current downturn in commodity markets.

In a sense, this isn’t surprising given the province’s demographic and structural challenges but it just goes to reinforce the importance of how quickly the government will have to move in order to improve economic competitiveness. Small cuts in personal and corporate income taxes, as forecast in the budget for 2016 and beyond, are a good starting point. But the government will have to be bolder.

Quebec should be proud that it will likely balance its budget sooner than many other provinces, but let’s not pour the champagne just yet. The biggest tests lie ahead.