There has been some discussion recently about a proposal by the federal government to make employee health and dental plans taxable benefits. There are budgetary and ethical reasons to do so. One report estimated that taxing these plans could raise about $2.9 billion in federal revenues. From the ethical perspective, proponents of the tax argue that the existing tax-free status is unjust because these benefits plans are normally offered only by large employers in the private and public sectors, which tend to pay higher wages and provide more stable employment. People on the margins of the workforce, working on contract and in precarious positions, gain no subsidy for health and dental costs.

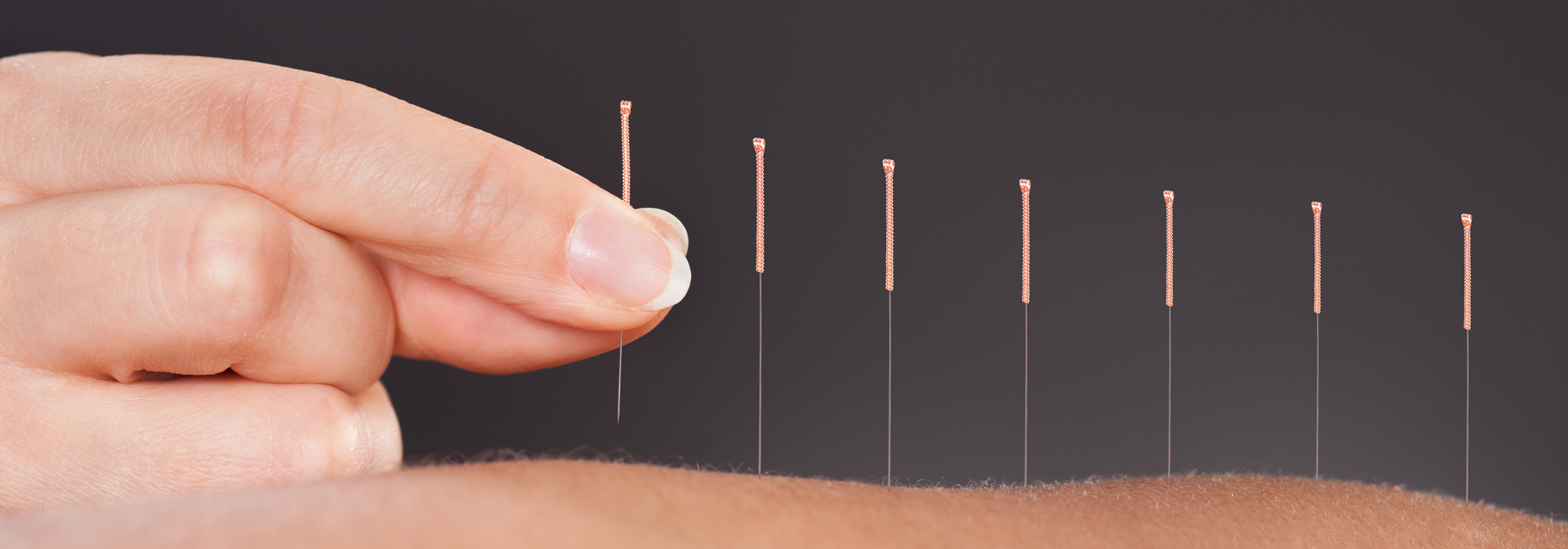

I want to raise another reason why the federal government should consider taxing these benefits plans. Namely, most of them include coverage for pseudo-scientific procedures, such as acupuncture, naturopathy, chiropractic treatments and even Christian Science. My own employer, Wilfrid Laurier University (WLU), offers a health and dental benefits plan that covers chiropractic procedures, naturopaths, osteopaths and Christian Science practitioners. I have looked a little into plans offered by other universities and I know that WLU is not alone in this. In fact, most universities offer these kinds of benefits.

Unions are unlikely to give up the scope of coverage in their collective agreements (and I can understand why), nor are employers inclined to see it as being in their interest to take on this challenge, given the pushback they will probably receive. However, this coverage makes up an important source of revenue for the well-meaning but misguided people offering these treatments. Toward the end of December 2016, I noticed dozens of alternative health clinics advertising their services with reminders for people to “max out their benefits” before the calendar year ran out.

It is difficult for the state t to intervene in this sphere and to prohibit behaviour that doesn’t immediately and obviously harm others. One strategy that governments have developed has been to channel alternative medicine into regulatory bodies, like the College of Naturopaths in Ontario. On the one hand, regulation gives the state a way to prevent gross abuses, but on the other hand, alternative medicine practitioners then use these measures as evidence of their legitimacy.

Precisely because it is so hard to regulate and prevent the spread of these pseudo-scientific non-treatments, we should be cracking down on one of their lucrative revenue streams by ending the tax-free status of workplace benefits plans that cover them. People should, at the very least, have to pay tax on pseudo-scientific treatments covered by their benefits plans.

Photo: Shutterstock.com

Do you have something to say about the article you just read? Be part of the Policy Options discussion, and send in your own submission. Here is a link on how to do it. | Souhaitez-vous réagir à cet article ? Joignez-vous aux débats d’Options politiques et soumettez-nous votre texte en suivant ces directives.