The term nation-building is usually associated with Canada’s first century. It evokes sepia images of men in stovepipe hats driving in the Last Spike of the Canadian Pacific Railway, or projects like the Saint Lawrence Seaway, the TransCanada Highway and the TransCanada Pipeline. In our second century, other megaprojects like James Bay, Churchill Falls, the oil sands and Hibernia all put their own stamp on Canada’s development.

These transformational infrastructure projects have a number of common elements. They took years to build and created massive employment and spinoff benefits during construction. They were financed with both publicand private-sector money, and over the years both sectors more than recouped their investment as the projects became profitable and stimulated the economies of entire regions. Each in its day was subject to intense scrutiny and stoked public debate, as is the nature of developments that change the fortunes of a nation.

We now find ourselves on the threshold of a new era of nation-building. With Canada’s enormous untapped resource wealth and planned megaprojects across the country, we have the means at hand to unlock that potential and secure new markets for our energy.

Two reports published by CIBC in the past six months describe a country on the threshold of an infrastructure “super-cycle” that could be the main driver of our economic growth over the next several years. The first, “Energizing Infrastructure,” found that with the recession-induced burst of government spending on municipal infrastructure projects now winding down, energy infrastructure projects will become a main channel of investment and job creation in the coming years. As governments reduce spending to lessen pressure on their balance sheets, the new fiscal reality has created the impetus for more effective ways to finance infrastructure development. New public-private partnerships (P3) will help ease the burden on government, transferring risks to the private sector and ushering in the next round of megaprojects. The report examined capital investment in the oil sands and pipelines, power generation, and electricity transmission and distribution, and concluded that these projects would create more than 1 million new Canadian jobs over the next 20 years.

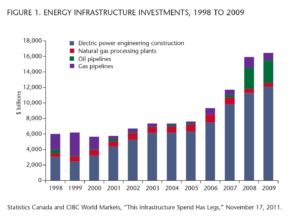

The second report, “This Infrastructure Spend Has Legs,” tallied up 28 current and proposed projects in the energy sector alone that together represent close to $75 billion in investment.

From west to north to east, the list of projects is truly impressive: Liquid Natural Gas (LNG) terminals for the British Columbia coast; the Site C hydroelectric development on the Peace River; Enbridge’s Northern Gateway project and Kinder Morgan’s proposal to twin its existing Trans Mountain pipeline through BC; the North West Upgrader in Alberta, which will add significant value to the oil sands bitumen before it leaves the province; the long-awaited Mackenzie Valley natural gas pipeline in the north; the Conawapa hydroelectric project in Northern Manitoba; the Romaine hydroelectric project and Petit-Mécatina complex in Quebec’s Côte-Nord region; the Lower Churchill hydroelectric project in Labrador; and TransCanada’s Keystone XL pipeline. And these represent only the most prominent of those 28 current and proposed projects.

We are talking about more than 1 million jobs when they are most needed and a network of pipelines and ports that will diversify our oil and gas markets beyond the United States,

adding value to our energy exports and increasing hydroelectric capacity to green North America’s energy production.

Given today’s political and fiscal realities, the private sector must take the lead in this development. And the fact that we can do this puts Canada at a tremendous economic advantage. While the European Union works through its debt crisis and while much of the developed world debates how much public money to borrow to create stimulus jobs, Canada stands alone in its potential to chart a different course. These private-sector-funded energy infrastructure projects will become a primary focus of investment and job creation in the coming years.

We are talking about more than 1 million jobs when they are most needed and a network of pipelines and ports that will diversify our oil and gas markets beyond the United States, adding value to our energy exports and increasing hydroelectric capacity to green North America’s energy production — all while maintaining one of the lowest debt-to-GDP ratios in the world.

This is Canada’s 21st century nation-building opportunity, right on our doorstep.

Nation-building projects throughout history have all had their share of controversy and challenge, and today’s projects are no exception. We can, how-ever, turn these challenges into tremendous opportunities. In this, the federal and provincial governments as well as the private sector all have work to do.

And governments do have a significant role to play.

Governments must support development with the use of innovative public policy tools. We need governments to support development through continued innovation. Good examples are the federal loan guarantee for Lower Churchill that will reduce the cost of the project without significant impact on current deficits and, in the case of the North West Upgrader, the tolling arrangements and the provincial commitment to process its own royalty share.

Governments must help secure access to export markets. The viability of many of these projects depends on access to energy markets, which is under threat. Increasing protectionism and other forms of political pressure are challenging access to the US for both our oil and hydroelectricity.

The US is a massive market for hydroelectricity. Right now New England produces 55 percent of its electricity from coal plants (contributing significantly to greenhouse gases) and only 13 percent from hydro and renewables. With existing and planned new capacity, eastern Canada will have far more hydropower than our domestic market can consume. It would appear to be a match made in heaven.

But some US jurisdictions are trying to nurture their renewable industries by setting renewable portfolio standards that shut out Canadian hydro. We need our governments to help persuade the various US states and the US federal government that shutting out the most abundant source of clean energy in North America in order to protect local clean energy companies is short-sighted. And that when Canadian hydro development grows, the US economy is a direct beneficiary — with regard to jobs and investment opportunities, and in the knowledge that there is a secure, reliable, affordable and environmentally responsible source of energy for US homes and businesses.

Having to rely on only one customer for our energy exports not only leaves Canada vulnerable to such political forces, but is also costly. Last year, at $50 billion, crude oil was Canada’s single most valuable export commodity. Our grand total of $91 billion in energy exports made up nearly one-quarter of all Canadian exports in 2010. But right now, both our crude oil and natural gas sell at a discount to international prices because we have essentially one customer for our exports. This while China’s middle class is expanding so rapidly that it will soon be larger than the entire population of the US. While the US will always be our primary energy customer, incremental demand is Asian: governments must focus on both ensuring US access and expanding access to Asian markets.

Governments must reduce regulatory impediments. Over the decades, Canada has evolved into a country where it is often far too difficult to get things built. This is often due to well-meaning but cumbersome multiple layers of bureaucratic regulations. Governments can help — not by ignoring the need for appropriate environmental and other regulatory review — but by streamlining, expediting and accelerating various regulatory approval processes for megaprojects. Governments can also help by fulfilling their special relationship with First Nations, for whom jobs and economic opportunities are especially important, and facilitating the necessary agreements.

Finally, governments must look beyond regional interests. The benefits of these megaprojects flow to the whole nation, not just the specific location of a deposit, plant, refinery, extraction process or dam. These megaprojects involve Canadians across the country through direct employment as well as jobs in the development, manufacture and supply of equipment and other goods and services sourced from every region — more so now than ever. Improved transportation, mobility and technology have increased the ability for people and enterprises in all regions of Canada to benefit, and that will only increase.

New England produces 55 percent of its electricity from coal plants (contributing significantly to greenhouse gases) and only

13 percent from hydro and renewables. With existing and planned new capacity, eastern Canada will have far more hydropower than our domestic market can consume. It would

appear to be a match made in heaven.

Our Constitution gives ownership of energy resources to the provinces, and dealings among them have not always been perfect. To fully take advantage of these national opportunities, we need provincial governments as well as the federal government to recognize that together the whole is, indeed, greater than the sum of its parts, and that we need to work much more closely and cooperatively together. There have been renewed calls for greater cooperation among the provinces. And I believe that it is time for the provinces of Newfoundland and Labrador, Quebec and Ontario to sit down and sort out how best to develop and transmit eastern Canada’s great hydropower resources.

As for the private sector, its key role is the funding and investment needed to build these projects. But it has other roles to play to address some of the challenges and to build public support.

Take the lead on the environment. In today’s low-carbon world, energy leadership and environmental leadership are two sides of the same coin. Canada will either be an environmental leader or have other jurisdictions dictate its environmental policies.

Alberta Premier Alison Redford has echoed this perspective. She said recently that “environmental sustainability is our most important shared outcome…Greening our energy is also critical on a global scale. More than ever, consumers are demanding environmentally responsible products. In refashioning Canada as an energy leader, we must fill their requirements.”

We do have examples with which to work, to highlight and to build on. One is the North West Upgrader near Edmonton, which, when built, will refine about 150,000 barrels of bitumen a day, adding significant value to the product before it leaves Alberta.

Importantly from an environmental perspective, half the output from the upgrader will be ultra-low sulphur diesel fuel, helping to green up the operations of customers in agriculture, transportation and other industries. The upgrading process itself will be a world first — the first to combine gasification technology with carbon capture and storage technology to capture 1.2 million tonnes of CO2 per project phase. The captured carbon, with its high purity, will be used for enhanced oil recovery before it is sequestered in the ground.

We need to see more projects like the North West Upgrader — projects with world-leading technology that are delivering on the promise of a sustainable oil sands industry. The sooner the private sector can bring these projects with their advanced environmental technologies to fruition, the better.

Continue to prove our efforts. As we improve our environmental record, we have to prove it to the world. Neither industry nor the federal or provincial governments can defend themselves without credible, science-based data. Industry needs to get out in front of its critics by setting tougher targets and benchmarks with respect to the impact on water, air and land; making the investments to meet those targets; and having the data to prove its successes.

Continue to communicate our actions at home and abroad. We must do right by the environment and we must prove that we are doing so. But it will not do much good for our markets and reputation if we do not then communicate it. We need to let more people know about the technological innovations under development in the oil sands that reduce the stress on the environment. Industry can highlight existing remediation successes and investments in renewables such as wind. And the fact that these environmental innovations and new technologies are themselves being exported and used to help improve the environmental sustainability of energy production processes elsewhere is good news.

We should also highlight that Canada is one of the world’s greenest energy producers due to the amount of hydroelectricity we already generate. And, looking forward, Canada has an estimated 25,000 megawatts of hydroelectricity that could be developed over the next 25 years. The Lower Churchill development, when completed, will displace more than 16 megatonnes of CO2 annually, which is the equivalent of taking 3.2 million cars off the road.

Since much of this hydropower will be exported to the US, it will substantially “green up” the continent’s electricity system. As noted, a significant amount of electricity in North America is generated at coal-burning power plants, the single largest contributor to greenhouse gas in North America. Reducing emissions from these plants is a top priority for both countries, and Canada’s 25,000 megawatts of undeveloped hydro capacity offers a clean, reliable and affordable solution — a strong positive message to send to the world.

If we are smart about this, governments and the private sector working together can unlock Canada’s vast untapped resource potential.

This slate of energy infrastructure projects across the country gives Canada a unique position in the world today. In a climate of global economic uncertainty, we in Canada don’t need to borrow money from our grandchildren to create temporary jobs when we can harness private-sector capital — without adding to deficit spending or public debt — to create permanent jobs and long-term prosperity. We can create more than a million jobs and strengthen and diversify our energy markets for long-term growth and wealth creation as a clean energy superpower, all while still maintaining one of the lowest debt-to-GDP ratios in the world.

The 21st century’s nation-building opportunity for Canada is here, now — a historic opportunity that we simply cannot afford to lose.

Photo: Shutterstock