One of the things I admire most about Canada is its commitment to equality as a social value. You simply couldn’t have a meeting like this one in the United States. Oh, perhaps you could assemble 30 people at a liberal think tank like the Brookings Institution for a discussion of inequality. But the idea that hundreds of high-level government officials might take time out to listen to professors talk about this subject—that would be unthinkable in the current climate. Nor does that climate promise to change soon. Concern about income and wealth inequality in the US, never high to begin with, has diminished sharply in recent months. A New Yorker cartoon sums up the prevailing mood.

“I know we live in troubled times…” a husband remarks to his wife as the two lie comfortably sunning themselves on a lushly landscaped terrace next to their Olympic swimming pool, “…but I don’t feel troubled.” Like that couple, many who came to Washington in the wake of the 2000 presidential election don’t seem to regard inequality as a serious social problem. And many influential members of the American economics profession share this view.

These people may concede that poverty is a problem and that something should be done about it. But why, they ask, should policy-makers be concerned about middle income-families whose incomes are higher now than they used to be? Behind this question lies the implicit assumption that human well-being depends, or ought to depend, exclusively on absolute income. Absolute income is indeed an important determinant of human welfare; and although the median income in the United States hasn’t grown much in the last 20 years, it has grown some. Yet considerable evidence suggests that relative income is also an important factor in human well-being. People in the middle class have experienced a small improvement in their absolute living standards over the last several decades, but a large decline in their relative living standards. For reasons I will discuss presently, this change has imposed significant real costs on the middle class.

I begin by asking you to consider a simple thought-experiment in an attempt to coax out some of your intuitions about whether relative income, by itself, is something people care about. This experiment asks you to imagine having to choose between two hypothetical worlds. In World A, you would earn $110,000 a year, while everyone else would earn $200,000 a year. In World B, you would earn only $100,000, $10,000 less than in World A. But everyone else in World B would earn only $85,000. In short, your absolute income would be a little lower in World B, but your relative income would be much higher. Prices are the same in the two worlds, so the income differences represent real differences in living standards. If you choose World A, your house will be 10 per cent bigger than the one you’d be able to afford in World B, you’ll be able to eat out 10 per cent more often, and so on.

If you think the only important economic determinant of human wellbeing is absolute income, World A would be the uniquely correct choice. Yet when questions like this have been posed to people in a variety of settings, most seem to regard the choice as a difficult one. And after agonizing over it a bit, most of them end up choosing World B. I don’t claim that in doing so they necessarily make the right choice. But it is an intelligible one, and I will try to describe some of the forces that may lead them make it.

But first let me mention some descriptive statistics. Nothing in the raft of numbers you were shown by other speakers this morning conveyed the truly spectacular nature of what’s happened at the top of the income ladder. As Statistics Canada’s Michael Wolfson said, growth in inequality has occurred because people in the top five per cent have moved sharply to the right while most of the rest of the income distribution has stayed roughly where it was, in absolute terms. But what that leaves out is that within the top five per cent we see almost exactly the same pattern. It’s the people at the very top of that group who’ve experienced the lion’s share of the gains. Incomes of the top one per cent in the United States have more than doubled since 1978. If we could look at a group more finely partitioned than that—say, the top one-half of one percent—we would see an even sharper increase. One measure that tracks a subset of this group over time is the annual Business Week survey of CEO pay. According to that survey, the CEOs of a large US corporations earned 475 times as much as the average worker in 1999, up from only 42 times as much in 1980.

The results are even more skewed when we look at changes in wealth. Many believe that the spectacular run-up of stock prices in recent decades has been broadly shared, a perception fed by the widely reported fact that roughly half of all US citizens now own stocks. That’s an impressive figure, yet the distribution of asset ownership is actually much more concentrated now than in the recent past. New York University economist Ed Wolff reports that only the top one per cent of US wealth holders have seen their wealth grow significantly since 1983. This group collectively now holds as much wealth as the bottom 95 per cent of wealth-holders in the US

The Forbes 400—the list of the wealthiest 400 Americans published by Forbes Magazine each year—had 13 billionaires in 1982, five of them children of H.L. Hunt, the Texas oil tycoon. By 1998 there were 243 billionaires on the list, up from 170 just a year earlier. Together, the Forbes 400 have one trillion dollars in total wealth—more than the national income of China, a country with one billion people. Wealth growth has also been substantial, if a little less spectacular, if we move down a few notches on the ladder. There were four million people who had one million dollars or more in net worth in 1998 in the US, up 20 per cent from 1995; 274,000 people had net worth of $10 million or more in 1998, up from 190,000 in 1995. But if we move a little further down the ladder, we see little or no growth in wealth at all.

In sum, there has been a remarkable increase in both income and wealth inequality during the last several decades. Of course, the world has also changed in a host of other ways during that period, many of them obvious improvements over life in the old days. But from the perspective of a middle-class family, this much is clear: the economic climate is a lot more like that of World A than it was 30 years ago, a lot less like World B.

Why, exactly, is that a problem? There is first the issue of inequality’s psychological toll. Adam Smith wrote more than 200 years ago that it’s not just how much you consume but how much you consume relative to community standards that’s important for your sense of self-respect. Consider the following passage from his The Wealth of Nations.

By necessaries I understand not only the commodities which are indispensably necessary for the support of life, but whatever the custom of the country renders it indecent for creditable people, even of the lowest order, to be without. A linen shirt, for example, is, strictly speaking, not a necessary of life. The Greeks and Romans lived, I suppose, very comfortably though they had no linen. But in the present times, through the greater part of Europe, a creditable day-labourer would be ashamed to appear in public without a linen shirt, the want of which would be supposed to denote that disgraceful degree of poverty which, it is presumed, nobody can well fall into without extreme bad conduct. Custom, in the same manner, has rendered leather shoes a necessary of life in England. The poorest creditable person of either sex would be ashamed to appear in public without them.

The absolute standard of living in the developed world today is of course vastly higher than it was in Adam Smith’s 18th-century Scotland. Yet Smith’s observations apply with equal force to contemporary industrial societies. Consider, for instance, The New York Times correspondent Dirk Johnson’s recent account of the experiences of Wendy Williams, a middle-school student from a low-income family in a highly prosperous community in Illinois. Both of Wendy’s parents are employed at low-wage jobs, and the family lives in Chateau Estates, a trailer park at which her school bus picks her up each morning.

Watching classmates strut past in designer clothes, Wendy Williams sat silently on the yellow school bus, wearing a cheap belt and rummagesale slacks. One boy stopped and yanked his thumb, demanding her seat.

“Move it, trailer girl,” he sneered.

It has never been easy to live on the wrong side of the tracks. But in the economically robust 1990’s, with sprawling new houses and three-car garages sprouting like cornstalks on the Midwestern prairie, the sting that comes with scarcity gets rubbed with an extra bit of salt …

To be without money, in so many ways, is to be left out.

“I told this girl: ‘That’s a really awesome shirt. Where did you get it?’” said Wendy, explaining that she knew it was out of her price range, but that she wanted to join the small talk. “And she looked at me and laughed and said, ‘Why would you want to know?’“

A lanky, soft-spoken girl with large brown eyes, Wendy pursed her lips to hide a slight overbite that got her the nickname Rabbit, a humiliation she once begged her mother and father to avoid by sending her to an orthodontist.

For struggling parents, keenly aware that adolescents agonize over the social pecking order, the styles of the moment and the face in the mirror, there is no small sense of failure in telling a child that she cannot have what her classmates take for granted.

“Do you know what it’s like?” asked Wendy’s mother, Veronica Williams, “to have your daughter come home and say, ‘Mom, the kids say my clothes are tacky,’ and then walk off with her head hanging low.”

In absolute terms and viewed in an historical context, the income level of Wendy Williams’ family is not low. By more than a small margin, it exceeds the poverty threshold published by the Bureau of Labour Statistics. Yet in their upscale Midwestern community, they are a strikingly low-income family in relative terms. An adolescent in 18th-century Scotland would not have been much embarrassed by having a slight overbite, because not even the wealthiest members of society wore braces on their teeth then. In the intervening years, however, rising living standards have altered the frame of reference that defines an acceptable standard of cosmetic dentistry.

Many modern economists seem quick to dismiss psychological costs of inequality, perhaps on the grounds that concerns about relative income involve negative social emotions such as envy. This is a curious position for a profession that has always warmly embraced Jeremy Bentham’s insistence that “a taste for poetry is no better than a taste for pushpins.” In any event, inequality’s toll on individuals like Wendy Williams seems to have little or nothing to do with envy. On what grounds might we insist that this cost is unimportant because it occurs in psychological rather than explicit monetary terms?

Relative income isn’t everything. Wendy and her family are indeed better off in many important ways than even the richest families living 200 years ago. In Adam Smith’s day, for example, a rich family might see three of its five children die before reaching the age of ten. Yet the plain fact is that there are many real costs of being near the bottom of the income ladder.

Some of these costs stem from the way the human nervous system is hard-wired to perceive things. To survive, one must be able to absorb and interpret information from the surrounding physical and social environment. Is a potential predator fast or slow? Is a destination near or far? Is an obstacle big or small? Such questions cannot be answered successfully without first choosing a suitable frame of reference.

Suppose, for example, you ask someone whether it’s hot or cold outside. Pose that question on a 60-degree day in November in Havana and people will think you’re stupid for having to ask. Just look outside at the people huddled around fires trying to get warm! Of course it’s a cold day! But if you ask that same question on a 60degree day in February in Montreal, people will think you asked a stupid question, too, but this time the answer’s precisely the opposite. How could anyone think it’s cold with all those people out there celebrating the mild weather in their shirtsleeves?

Of course, if it gets cold enough or hot enough, then context doesn’t matter much. But across a very broad band of temperatures local context is a decisive determinant of whether people think it’s hot or cold outside. And you’re not a bad person if you think it’s cold on a 60-degree day in Havana. It’s OK to think that, you’re wired to think that.

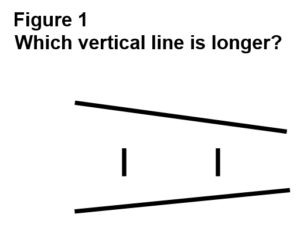

Which of the two vertical lines in Figure 1 below is longer? When we pose this question to people in laboratories all around the world, they insist that the line on the right is longer. Why are they so sure? It’s longer, they say, because it looks longer. And the reason it looks longer is that it bridges a larger share of the gap between the two horizontal lines in the figure.

Context matters when we’re interpreting physical phenomena like temperature and length. It matters no less when we evaluate the goods that we own. It’s natural to ask questions like, Is my car OK? Suppose your car is a 1985 Chevrolet Caprice. Is it OK? If you live in Havana, it’s not merely OK, it’s a great car. If you show up at a social gathering in Havana at the wheel of that car, it’s like appearing with a big sign around your neck saying, “I am a player.” That’s what such a car means in that context. But what if you’re an aspiring film producer in Bel Air, California and you show up in that same car at a gathering of prospective clients? Then the car is not OK. Arriving in it is like having a sign around your neck that says, “I am not a player.” Why would people want to hire you to produce their film if that’s the kind of car you’re driving? Successful producers make a lot of money, and most of them drive Porsche 911’s or other expensive cars. Context matters. The same car that is completely satisfactory in one setting is completely unsatisfactory in another.

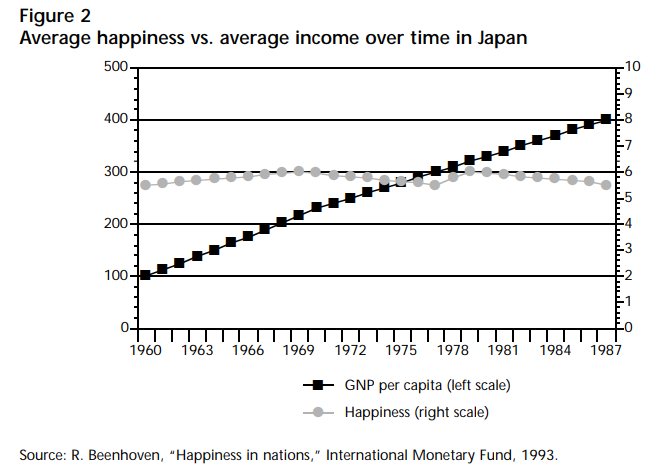

A large body of data from the behavioural science literature links human well-being to relative income. Michael Wolfson mentioned the research linking inequality and health, and there are also studies linking inequality and broader measures of well-being. Behavioral scientists have developed a number of different ways to measure human well-being, and these measures have been used in a large body of research that probes the links between income, wealth and well-being. One basic finding is that once a country passes a relatively low threshold of absolute income, across-the-board increases in income and wealth do not produce measurable increases in happiness. The chart for Japan in Figure 2 below is representative of findings of this type. Income goes up steadily over time, yet the happiness measures just bump along at roughly the same level year after year.

We see a very different picture, however, when we examine the relationship between happiness and relative income. Here the basic finding is the individual happiness levels within a country at any given moment are strongly positively correlated with relative income. The chart for the US in Figure 3 below is a representative example.

Unlike Figure 2, which tracked what happened when everybody’s income went up, Figure 3 tracks what happens when some incomes are different from others at the same time in the same place. People with high incomes are much happier, on the average, than people with low incomes, just as economists always would have imagined. But their happiness seems essentially a consequence of their high relative income rather than their high absolute income. Needless to say, there are plenty of rich people who are unhappy, and plenty of poor people who are happy. Figure 3 merely depicts broad average tendencies. But social policy is always based on averages, and the relationship shown in the figure is compelling.

Several years back I clipped a cartoon showing a man driving by when he sees a man standing in the rain at an outdoor phone booth. “I was sad that I had no on-board fax…” the motorist thinks to himself, “…until I saw a man who had no onboard phone.” This cartoon, which appeared at a time when mobile phones were still something of a luxury, is showing obvious signs of age. In many environments today, being without a portable telephone entails more than psychological costs.

Because people often expect to be able to reach you right away, valuable opportunities are sometimes lost if they cannot. There are still some environments today—remote Himalayan villages, for example—in which one doesn’t need to have a car. If you live in a city such as Los Angeles, however, you cannot meet even the most minimal demands of social existence without one. As these examples illustrate, what we need depends on context. It is not simply a matter of envious people fretting about their inability to keep up with the Joneses.

Directly or indirectly, increased spending by those at the top of the economic pyramid has changed the context in which middle-income families lead their lives. This change has entailed real costs. One is that rising inequality has made it much more difficult for middle-income families to send their children to schools of even average quality. Parents who want their children to go to the best possible school must buy a house in the best neighbourhood they can afford. In the US, that’s partly because real estate taxes are the principal source of school revenue, so the better schools are those situated in the neighbourhoods with the highest real-estate prices. But a similar rule of thumb applies even in countries where school finance is independent of local real estate taxes. Studies consistently show, after all, that your children’s performance rises with the overall socio-economic status of their classmates. For middle-class parents, the difficulty is that the average new home built in the US now has more than 2200 square feet of living space, up from only 1500 square feet in 1970. So a middle-class family that wants its children to attend a school of at least average quality must now spend much more on housing than in the past, even though this family’s real purchasing power has risen only slightly in recent decades.

What does inequality have to do with the increase in average house size? Begin with the simple fact that because people at the top have much more money than before, they are currently building much bigger houses than before. That’s not a moral indictment of them; indeed, people at every point along the income scale choose to live in larger houses when their incomes grow. When the people at the top build bigger houses, the people just below them who used to think their own 10,000-square-foot houses were big enough now think they need to build an addition. And their actions in turn cause people below them to build a little larger, and so on all the way down the income ladder. The upshot is that if you want to send your child to a school of at least average quality—a plausible ambition for the median family in the income distribution—you must now carry a mortgage almost 50 per cent bigger than your counterparts in 1970. Of course, you still have the option of buying the 1500-square-foot house that your budget could more comfortably carry. But because that would entail sending your children to below average schools, it’s an option you might well refuse, even if you had no other reason to care that others lived in larger houses than yours.

Consider too the question of which car you should buy. Suppose you visited the Honda showroom and were impressed by the many fine attributes of the new Honda Civic. It gets good gas mileage, it has many new safety features, it’s extremely reliable. You’re almost set to buy one, and then you think about what will happen if your family happens one day to be struck by the new Ford Excursion. The Excursion is Ford’s latest salvo in the sport utility vehicle arms race. It’s a full ton heavier than the Chevrolet Suburban—formerly the largest SUV— which weighs about 5,500 pounds. The Excursion is 19 feet long, and if it were an inch wider than its current width of 80 inches, it would need special wide-load running lights. You don’t want to be in a 2500-pound Honda Civic when it gets hit by a Ford Excursion. You might have thought the Civic was the perfect choice if most other people were also buying small cars. But you can’t control what others buy. And given what they buy, your best choice may be a 4,000 pound sedan.

As a further illustration of the importance of context, consider the question of what gift to give. You’ve been invited to dinner by a colleague who you know likes wine. You want to bring a bottle of wine as a gift, but you don’t know which one. The Wall Street Journal’s weekly wine columnists, John Brecher and Dorothy Gaiter, tackled exactly this question in one of their recent columns. The singular feature of their column is its unpretentiousness. Unlike the many writers who rate wines on a 100-point scale and sprinkle their descriptions with mysterious polysyllabic adjectives, Brecher and Gaiter use simple language and employ only four ratings categories—ranging from “ugh” to “delicious.” Their advice was to ask a respected wine merchant to suggest an unusual wine, one that your host is unlikely to have tried before. And plan on spending about $30—that is, about $45 Canadian.

Why so much? After all, with recent advances in winemaking methods, there are now many $10 Cabernets that are probably far better than the wines drunk by the king of France 200 years ago. But a gift bottle is about more than just how the wine tastes. It is also a statement about how you feel about your relationship with your host. Your host might interpret a $10 bottle as a sign that you don’t think your relationship with him is important. So unless that’s how you really feel, it’s probably worth it to spend the extra $20. Similar issues arise when choosing a wedding gift for your best friend’s daughter. Here, too, the amount you’ll want to spend depends on what others are spending on gifts for such occasions. Your gift is in part a statement about how strongly you feel about your friendship.

The increased prosperity of those atop the economic pyramid has naturally led people in this group to spend considerably more on gifts than in the past. And as in the case of houses, their spending has set in motion a chain of responses all the way down the income ladder. When others spend more on gifts, we must either spend more on gifts as well, or run the risk of injuring relationships we care about. That trade-off cannot be escaped by trying to master your psychological demons, real or imagined.

Utilitarians once argued for redistribution from rich to poor on the grounds that an extra dollar of income produces more utility in the hands of a poor person than in the hands of a rich person. But critics countered that redistribution cannot be justified on these grounds, because we simply have no valid way of comparing how different people experience having an extra dollar of income. The latter view seems to have prevailed in the economics profession. Yet it is difficult to resist noting that certain expenditures by the very wealthy must not seem especially urgent, even to them.

Consider, for example, the $2.7 million Patek Philippe Calibre 89, to date the most expensive watch ever produced. It’s a mechanical timepiece with a number of special features that make it considerably more accurate than other mechanical watches. One of these is a tourbillon, a small gyroscope inside the watch that rotates about once a minute. Its purpose is to keep the mechanism of the watch at odd angles to the earth’s gravitational field, thereby eliminating an important source of distortion. The tourbillon works. But even with the Calibre 89’s ensemble of accuracy-enhancing features, the watch is less accurate than a simple $20 battery-powered quartz Timex. The accuracy of battery-powered quartz watches, it turns out, is not adversely affected by the earth’s gravitational field.

Even with the recent explosion of income and wealth at the top, not very many people are buying $2.7 million watches. (Only four Calibre 89s were produced.) But sales of mechanical watches costing $40,000 and up have been growing very rapidly. The gears inside these watches are invisible to the naked eye. And since they are no more accurate than battery-powered watches, why are people willing to spend so much for them? A conversation recently overheard by William Unger, a Manhattan jeweler, provides a clue. The conversation occurred between two men having lunch in an expensive midtown restaurant. Mr. Unger noticed that as each speaker gestured occasionally to emphasize a point, his sleeve seemed to retract strategically, in the process revealing a five-figure wristwatch. “It’s all about who has what,” said Mr. Unger. “The friend sees his friend has a [Patek Philippe] Pagoda, and these are people who have a certain intuitiveness; they know how much things cost. They ascertain what a guy’s capability or monetary status is by looking at his watch. They know if he’s a player. Or they think they know.”

The men who purchase these expensive mechanical wristwatches (a clerk at the Cartier showroom in New York once told me that women almost never buy them) often own several, which confronts them with a special problem: Although the watches are self-winding, they will stop if put aside for a few days. So the owner of multiple watches must reset each one before wearing it!

One could hardly expect men of means to tolerate such a problem for long. And sure enough, there is now a ready solution for it. On display in Asprey & Garrard showrooms, discerning buyers will find a finely tooled, calfskin-leather-covered box with a golden clasp whose doors open to reveal six mechanical wrists that rotate just often enough to keep the mechanical wristwatches stored upon them up and running. Its price? Only $5700.

There is something inescapably inefficient about all this. When the capacity of a good to satisfy depends on context, each person’s increase in expenditure renders the expenditures of others marginally less effective. In analytical terms, the incentives are much like those confronting nations embroiled in a military arms race. Countries don’t buy bombs because they’re stupid; they buy them because it’s bad not to have bombs when the other side has bombs. But while it is not stupid for individual nations in that situation to buy bombs, it can be extremely beneficial for them to forge agreements to limit the number of bombs they buy— provided each side can police the effort and make sure that the other lives up to the agreement.

Similarly, while the evidence suggests that we would be happier if we all bought smaller houses and cars, and spent what we saved in the process on a variety of less conspicuous forms of consumption—cleaner air and water, more time with family and friends, safer roads and highways—that is not an option open to individual consumers. Again, the problem is that each family can control how much it spends, but not how much others spend.

Looking ahead, there is little reason to think this spending imbalance will cure itself, and much reason to expect it to grow worse. The imbalance has been growing because of the tendency for income and wealth to become more concentrated among top earners. This tendency, in turn, owes much to the spread and intensification of what Philip Cook and I have called “winner-take-all markets.” These are markets in which small differences in performance translate into extremely large differences in reward.

Such markets have long been familiar in entertainment and sports. The best soprano may be only marginally better than the second-best, but in a world in which most people listen to music on compact discs, there is little need for the second-best. In such a world, the best soprano may earn a seven-figure annual salary while the second-best struggles to get by. In similar fashion, new technologies allow us to clone the services of the most talented performers in a growing number of occupations, thereby enabling them to serve ever broader and more lucrative markets.

The market for tax advice, for example, was once served almost exclusively by a large army of local practitioners, but is increasingly served by the developers of a small handful of software programs. Scores of programs competed for reviewer approval in the early stages of this transition. But once opinion leaders anointed Intuit’s “TurboTax” and Kiplinger’s “TaxCut” as the most comprehensive, user friendly programs, competing programs faced a nearly impossible task.

A constellation of factors helps us understand why similar shakeouts have occurred in industry after industry. The information revolution has made us more aware of product quality differences than ever and puts us in direct contact with the world’s best suppliers. Sharply reduced transportation costs and tariff barriers enable these suppliers to ship their products to us more cheaply than before. Research and development costs and other fixed costs now constitute a larger share of total costs, making it harder for small producers to achieve efficient scale.

In short, the forces that have been causing inequality to grow seem to be gathering steam. Amazon.com and other online booksellers now sell about five per cent of the books sold in the US, up from less than two per cent in 1997, and investors are betting that the displacement of local booksellers is far from over. As these processes unfold, the concentration of income and wealth at the top will continue to grow, and with it the imbalance in our current spending patterns.

My point is not that we haven’t all benefited greatly from the processes that are creating the spectacular gains for the people at the top. The technical changes have been prodigious and wonderful, and the wealth they generate is more than enough to reinvigorate our schools, fix our roads and bridges, provide universal health insurance, clean up the environment, and more generally to boost all those inconspicuous consumption categories that the evidence suggests are getting short shrift at the moment. Shifting our spending patterns in these ways would entail little or no psychological penalty if we all did it. All it would entail is postponing the upgrade of the mansion to the next largest size, postponing the upgrade from the $40,000 car to $60,000 model, and so on. Absent any collective commitment to postpone those spending upgrades, however, what’s in store for us is more of the same. As incomes continue to grow at the top and stagnate elsewhere, we will see even more of the national treasure devoted to luxury goods, the main effect of which will be to raise the bar that defines what counts as a luxury.

One of my own recent forays into the marketplace provides a glimpse of how fast the standards are escalating. My goal was to replace the inexpensive gas grill that I’d bought in the 1980s with a new one roughly like it.

I quickly discovered, however, that the menu of choices in this particular product category wasn’t anything at all like what I’d seen when I originally shopped for my $90 grill (see facing page). The entry pictured at left—the Viking Frontgate Professional —was one that caught my eye.

Above the grilling surface of the Viking Frontgate sits an infrared bar, in front of which is a rotisserie that can turn two 20-pound turkeys to perfection, while at the same time you’re cooking up to 40 hamburgers on the large cast-iron grill. Then inside there’s another feature that my old Sunbeam did not have: a smoker system that—I’m quoting from the brochure here— “utilizes its own 5,000 BTU burner and watertight wood-chip drawer to season food with rich woodsy flavor.” But what impressed me most were the two ancillary range-top burners that sit off to the side. Each could generate 15,000 BTUs of heat—roughly twice as much as a burner on a standard kitchen range. Why 15,000 BTUs? It turns out that if you want to do flash ethnic stir-frying, the extra heat helps to sear the flavors in. Or so I was told. The price of this grill, not including shipping and handling, was $5,000. Constructed of gleaming stainless steel with enamel accents, it was seven feet across and had ample storage underneath.

It was more grill than I wanted. When I passed on the chance to buy it, the salesman showed me a “value” model. It was smaller, lacked the rotisserie and smoker, and had only one 15,000 BTU burner, but could deliver professional results at a value price of $1,160. What amused me was that after the $5,000 grill, the $1,160 model seemed like a perfectly plausible candidate to replace my Sunbeam. And although I also passed on this model in the end, it was easy to see how someone who bought it might actually think to himself what a prudent shopper he’d been.

In the end, I settled on a new Weber charcoal grill, a unit that cost two-and-a-half times as much as my original gas grill. Out of curiosity, I ordered the Frontgate catalog a year later, just to see what they had on offer. At the high end they were offering the same Viking Frontgate Professional model as before, but this time the basic unit was embedded in a fixed island that a contractor would construct in your back yard. The ancillary range-top burners in the new unit were set well off to the left side. Still further to the left, there was a tiled bar with a handsome canvas umbrella, and off to the right there was a wood-fired pizza oven. This unit is offered for $13,769.

There are more expensive units now available. One has a lobster steamer and an electric 35,000 BTU wok built into it. Why use only 15,000 BTUs to sear the flavor in when you could use 35,000?

In the summer of 1999, both houses of the US Congress voted for a bill that would have slashed personal income taxes in the United States by almost $800 billion, a measure that was not enacted only because Congressional leaders could not muster the votes to override President Clinton’s veto. Two years later, Republican President George W. Bush is pushing for a tax cut more than twice as large. A disproportionate share of the tax relief granted under these measures—45 per cent under the House plan, 30 per cent under the Senate version, and about 40 per cent under the Bush proposal—would go to the wealthiest one per cent of households, those currently earning more than $300,000 a year.

In their defense of these proposals, tax-cutters claim the moral high ground. “It’s a matter of principle,” said Bill Archer, chairman of the House Ways and Means Committee, “to return excess tax money in Washington to the families and workers who sent it here.” “Tax cuts should go to taxpayers,” said Texas Senator Phil Gramm, explaining why his proposal would deliver most of the tax reductions to those with the highest incomes.

Would tax cuts like the ones proposed provide budget relief for cash-strapped American families? Their initial effect would be to stimulate still further private spending by the upper income families whose tax liabilities would decline the most. But for the reasons discussed, higher spending by these families would set in motion a chain of additional spending by other families, all the way down the income ladder. Accordingly, the tax cutter’s promise of relief for American families in financial distress is largely illusory. Most of these families feel pressure not because they’re poor in any absolute sense, but because they’re trying to match consumption standards that are beyond their reach. In the wake of the proposed tax cut, struggling middleclass families would simply have to meet tougher standards.

In short, a massive tax cut targeted at the nation’s wealthiest families would appear, at this particular moment in history, to be a dumb idea. Why, then, is President Bush so intent on seeing this measure enacted? Cynics see it as a quid pro quo for the wealthy contributors who backed his successful run to the Presidency. But I’ll close with a story that suggests an alternative possibility. Emboldened by the bilingual standard with which our meeting began this morning, I’ll attempt to tell this story in French.

Il s’agit d’une conversation que j’imagine entre George W. Bush et Jean Chrétien et qui a lieu la semaine prochaine à Washington:

George Bush : « Jean, j’ai constaté que vous avez rassemblé une équipe extraordinaire en Canada—tout le monde chez vous est très intelligent, très capable. Moi, j’ai eu beaucoup de mal à trouvé une telle équipe ici. Est-ce que vous pouvez me donner un petit conseil sur la manière de m’y prendre? »

Jean Chrétien : « C’est simple, George. J’ai un truc qui marche à tous les coups. Je vais vous en faire la démonstration. »

Chrétien décroche le téléphone et il fait le numéro de Michael Wolfson, son statisticien génial: « Allô, Michael, ici Jean. Je te pose une question : Il y a une personne qui est l’enfant de ta mère et l’enfant de ton père, mais ce n’est ni ta sœur ni ton frère. Qui est-ce? »

Michael Wolfson, après avoir réfléchi un instant, répond : « C’est simple, Monsieur Chrétien … c’est moi ! »

Jean Chrétien: « Ah bon! Jete garde ! » …

George Bush, impressioné, lui demande : « Cet homme-là, comment s’appelle-t-il? »

Jean Chrètien : « C’était Michael Wolfson, un homme très intelligent. » George Bush : « Ben, ouais, évidemment ! Michael Wolfson ! » Jean Chrétien : « Voilà mon truc, Georges. Vous n’avez qu’à poser cette question, puis vous renvoyez ceux qui ne peuvent pas la répondre, et vous gardez les autres. »

George Bush, plein de reconnaissance : « Merci beaucoup, Jean. J’essayerai de suivre votre conseil. »

Le lendemain, George Bush décroche le téléphone et il fait le numéro de Larry Lindsay, son économiste en chef : « Bonjour, Larry, ici George. Je veux te poser une question : Il y a une personne qui est l’enfant de ta mère et de ton père, mais qui n’est ni ta sœur ni ton frère. Qui est-ce? »

Immédiatement, saisi d’anxieté, Larry Lindsay demande à George Bush : « Pouvez-vous me donner un délai de 24 heures, Monsieur le Président? Je dois y réflechir. »

Consentant, George Bush répond : « Bien sër, pas de problème, Larry. À demain »

Sans perdre un instant, Larry Lindsay convoque une grande réunion d’économistes d’extrême droite, mais ne trouve personne parmi eux qui soit capable de répondre à la question de Bush. En désespoir de cause, il passe un coup de fil à Milton Friedman et lui pose la fameuse question: « Milton, il y a une personne qui est l’enfant de ta mère et de ton père, mais qui n’est ni ta sœur ni ton frère. Qui est-ce? »

Sans hésiter, Friedman répond : « Facile, Larry! C’est moi! »

Soulagé, Larry Lindsay donne un coup de fil à George Bush. Il lui dit : « J’ai la réponse, Monsieur le Président ! C’est Milton Friedman ! »

George Bush : « Mauvaise réponse, Larry. Désolé. C’était Michael Wolfson ! »

Et voilà, our team that proposes a $1.6-trillion tax cut for the rich in the midst of the biggest increase in income inequality in modern history.

Photo: Shutterstock