Government policies influence the size of the economic pie and how it’s divided.

In its first year, the Liberal government sought to divide the pie more equally, by targeting policies more to middle- and lower-income Canadians. For instance, it directed transfers to families with children, seniors, and students to the lower part of the income distribution; made personal income tax rates more progressive; and expanded the reach of the Canada Pension Plan.

Now as the government begins its second year in office, its efforts have shifted to growing the pie over the long term. Last week, after a contentious debate in Europe, the government finally signed a major trade deal with the European Union. Shortly thereafter, in its fall economic statement (FES), the government announced the creation of two new agencies: one to fund infrastructure projects and one to attract foreign investment, and it announced measures to expedite high-skill immigration to Canada.

These moves follow the playbook developed by Dominic Barton (managing director of McKinsey) and the Advisory Council on Economic Growth. The government is sending clear signals that Canada is open for business and wants to actively engage with the rest of the world. At a time when many countries are turning inward, this sentiment is admirable. Moreover, given their key role in raising our long-term growth prospects, seeking new ways to boost Canada’s trade and business investment performance is what they should be focused on. Will this plan actually do that? It’s still too early to tell. Here’s a look at a few things that we’ve learned from the FES and some questions that it raises.

Weaker economic and fiscal outlook

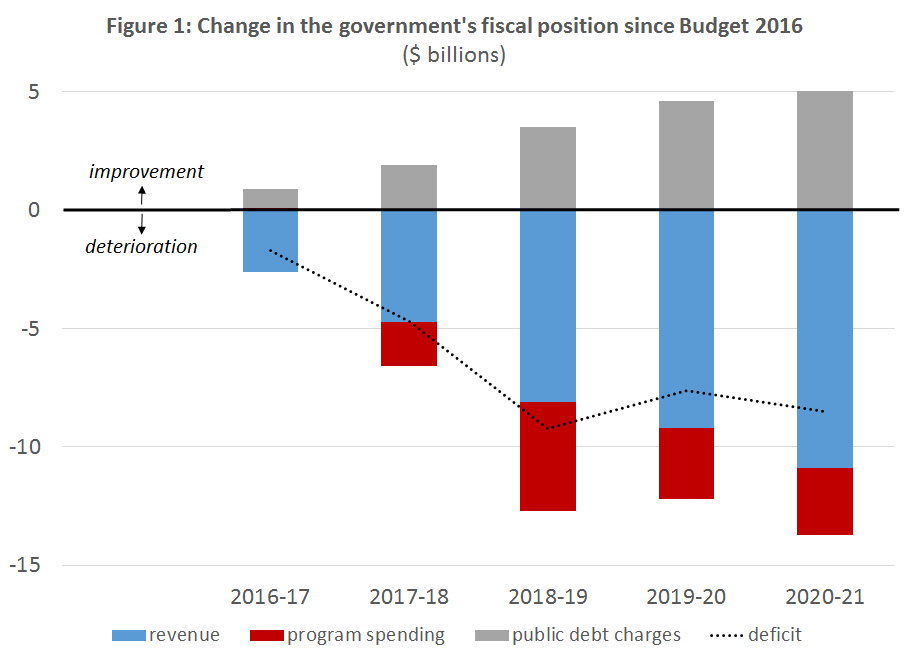

Over the next five years, Canada’s nominal GDP growth is now expected to average only 3.5 percent annually, down from the 3.9 percent anticipated in Budget 2016. With this slower growth outlook, the government expects to collect less revenue. Program spending will also increase, though this fiscal pressure is effectively offset by savings on public debt charges, which are due to lower interest rates (figure 1).

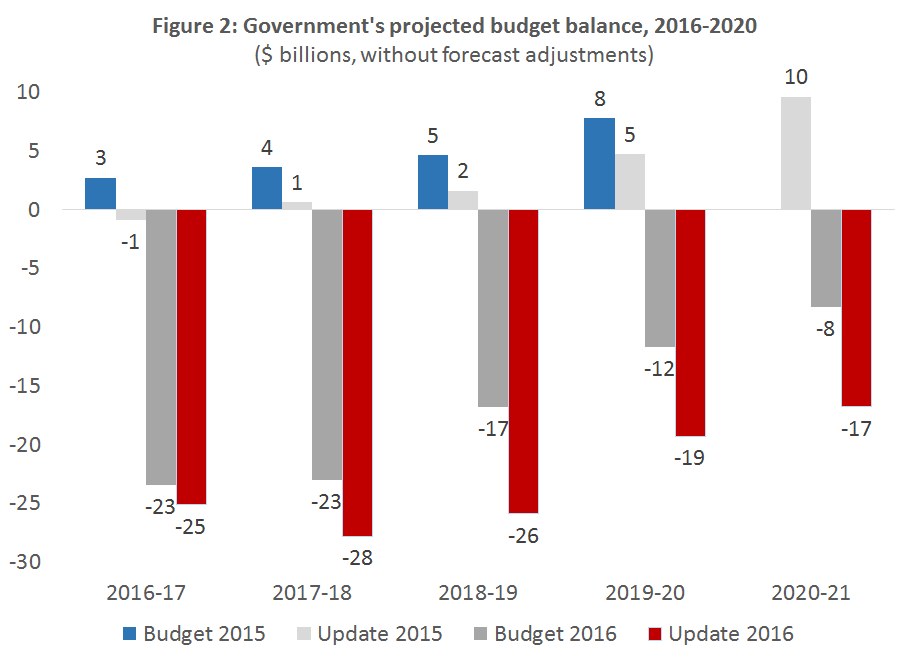

The end result of these recent adjustments is that, once again, Ottawa expects larger deficits. This continues the fiscal deterioration that’s occurred over the past 18 months (figure 2).

Interestingly, the largest increases in program spending over the five-year projection are scheduled to begin only after the next election, expected in 2019 — and they’re not due to infrastructure, but rather to CPP enhancement, and the eventual indexation of the Canada Child Benefit to inflation starting in 2020.

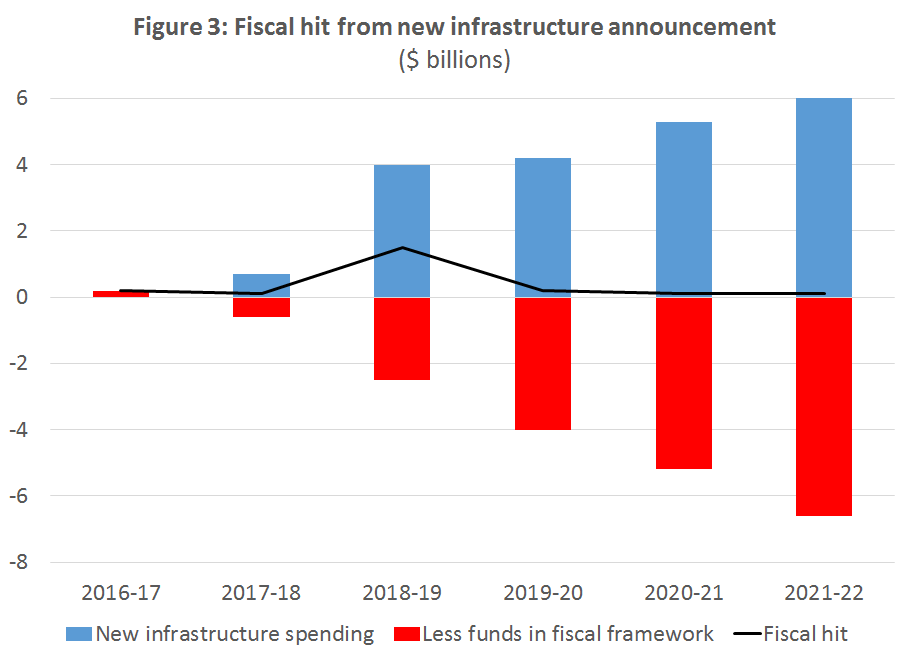

In fact, despite the large numbers highlighted in the FES on infrastructure spending ($81 billion over 11 years), Ottawa’s fiscal hit over the next five years from infrastructure is essentially negligible, since much of this “new” infrastructure money seems to have already been accounted for in the fiscal framework (see figure 3). It appears that this big announcement effectively draws from funds previously earmarked for phase 2 of the infrastructure plan that was announced in Budget 2016.

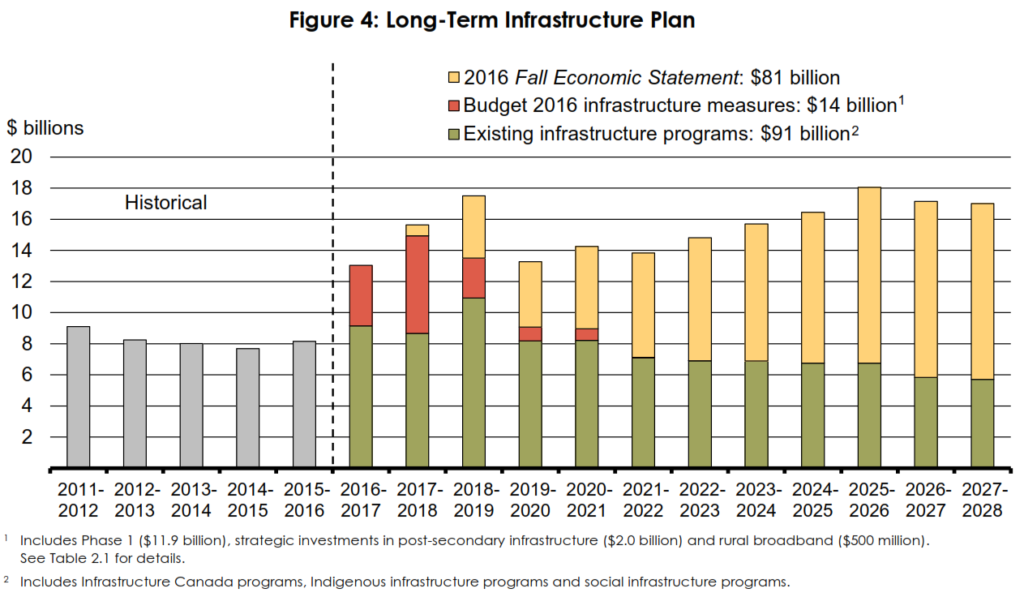

Looking beyond the typical five-year budgeting horizon we can see the extent to which this newly announced infrastructure spending is back-end loaded (figure 4, from the FES). As such, the FES is really committing not this government but the next one to continued increases in infrastructure spending.

Creation of an infrastructure bank

The “innovative financing” part touted in the government’s infrastructure plan is the creation of the Canada infrastructure bank (CIB). The basic rationale for the CIB can be found in the Advisory Council on Economic Growth brief that says Canada has a large infrastructure gap — we’re currently not spending enough on productive infrastructure that could improve our long-run growth. Public infrastructure in Canada is largely owned by cash-strapped provincial and municipal governments, which lack the means to significantly scale up their investments in big projects of national importance.

At the same time, long-term institutional investors (such as pension funds, banks and insurance companies) have lots of money they need to invest somewhere. In this low-interest-rate environment, these investors would be keen to work with government to invest in long-term capital projects, including building or maintaining highways, bridges, rail, ports, airports, broadband capacity or power transmission. But they are holding off, we’re told, because they need:

- a pipeline of large potential projects with clear timelines;

- assurances of independence from political interference in selecting and managing projects (e.g. an entity that operates at arm’s length from government);

- financial experts in government with whom they could conduct these deals; and

- a way to generate on-going revenue from public assets (e.g., through user fees).

Attracting private sector money, it is argued, will dramatically increase the overall amount of infrastructure spending.

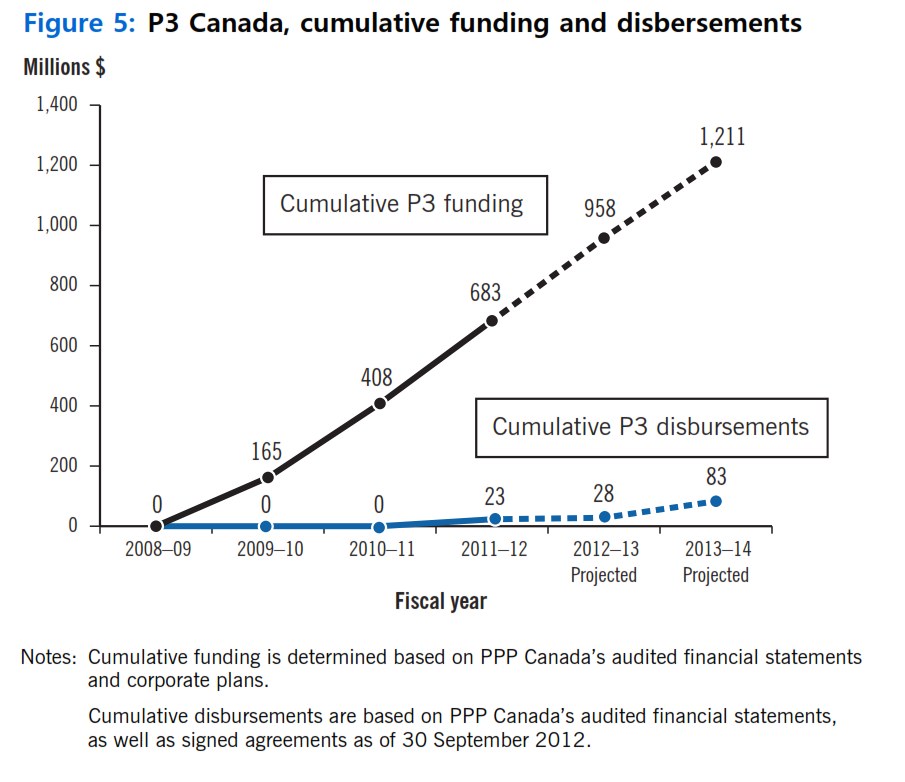

Of course, these considerations and the stories of vast infrastructure opportunities waiting to be unlocked by private capital aren’t new. Back in 2008, the Harper government created a new office, PPP (Public-Private Partnerships) Canada. While PPP Canada manages a smaller pot of money than is being proposed here (roughly $1.2 billion instead of the proposed $35 billion for the CIB), it may nonetheless be instructive to look at the early experiences of this entity. A Report of the Auditor General (AG) of Canada in 2013 found that the agency’s activities were slow to get going. The AG estimated that PPP Canada would eventually receive its total pot of money five years after its creation in 2008, at which point, it would have distributed less than 7 percent of the total funds available (i.e., just over $80 million of $1.2 billion, see figure 5, taken from that report). The AG’s report also raised concerns that the early investment returns for PPP Canada were below the government’s borrowing costs. David MacDonald of the Canadian Centre for Policy Alternatives cites similar concerns from an AG’s report for the Ontario government’s PPP agency, and he warns that the CIB could significantly raise borrowing costs for the provinces and for municipalities.

Perhaps things have improved at the federal level since that AG report, but even my cursory analysis raises questions. For instance, why is a new federal Crown corporation needed to fund infrastructure projects, when it seems that a similar entity was created only eight years ago?

Then there’s the perennial issue of timing: can we expect many new large projects that are funded by the CIB to break ground before, say, 2020? Over the past decade in Canada there have been repeated lapses on infrastructure spending for cost-shared projects (i.e., funds Parliament allocates that are unspent during the fiscal year).

On the mandate of revenue generation from CIB-funded assets — which some have called “privatization” — what assurances are there we won’t largely be privatizing gains for institutional investors, while socializing any potential losses for taxpayers? My primary concern at this point is that the public material provided in the FES and the Advisory Council on Economic Growth brief don’t yet fully address the issues I raise here, and many of the figures provided, which involve huge sums of public money, don’t appear to be based on very thorough analysis.

Some positive changes on open and transparent government

The FES also contained measures to make government more open and transparent in areas such as parliamentary procedures, enshrining the functional independence of the chief statistician and the parliamentary budget officer in legislation, clarifying reporting on government spending, and incorporating gender-based analysis in future budgets. The overall direction of these moves is positive.

What was missing?

Three things were notably absent in the update: risk adjustments, any mention of balanced budgets, and long-term economic and budget projections.

This time around, the government didn’t explicitly adjust its forecast for risk. Previous risk adjustments — which critics, such as the Parliamentary Budget Office, called “excessive” — had added up to $6 billion a year to reported deficits. Abandoning this practice (this was despite continued downward revisions to the growth outlooks for the global and Canadian economies in recent years) provides an immediate, though merely cosmetic, $30 billion “improvement” to the government’s bottom line over the next five years, versus past reporting practices; it also makes the government’s projections more transparent and easier to follow.

The notion of eventually balancing the budget was absent. That commitment was included in Budget 2016 but was never fully embraced by the Liberals. As Paul Boothe of the Institute for Competitiveness and Prosperity observes, it’s now crystal clear that the government’s primary fiscal objective is to stabilize the federal debt-to-GDP ratio over the medium term (more specifically to hit 31.1 percent or lower by 2020-21). Based on the current growth outlook, they can achieve this goal while running annual deficits of roughly 1 percent of GDP, on average, over their mandate. Indeed, that’s exactly what the current fiscal plan calls for. In other words, given its fiscal target, the government has no fiscal room left at this time. Perhaps this explains the missing risk adjustment.

By providing more five-year-ahead details, the FES was significantly more transparent than was Budget 2016 — for example, there was a much clearer explanation of economic and fiscal changes in the interim. Unfortunately, the FES did not include long-term fiscal sustainability analysis, as was recommended by the Auditor General and the PBO. Given that critics are highlighting the absence of a plan to return to budget balance, this omission is a missed opportunity for the government to provide more clarity on its long-term fiscal position.

In its fall economic statement, the government appears to have exhausted much of its available fiscal room, as it pivots policy attention from families and distribution toward the private sector and growth. It is signalling to foreign and domestic investors, and to the private sector more generally, that Canada is open for business. Only time will tell whether this new growth strategy will pay off. At this point, there are only more questions.

Photo: Adrian Wyld / The Canadian Press

Do you have something to say about the article you just read? Be part of the Policy Options discussion, and send in your own submission. Here is a link on how to do it. | Souhaitez-vous réagir à cet article ? Joignez-vous aux débats d’Options politiques et soumettez-nous votre texte en suivant ces directives.