When economic historians look back at Finance Minister Jim Flaherty’s 2010 budget, it may well be that the creative and enduring legacy will be that the budget began, at long last, to address Canada’s persistent innovation and productivity deficits. Before this article elaborates on this perspective, attention will be directed to the more traditional budgetary themes. In the case of Budget 2010, this will include assessing whether Flaherty was able to steer the fiscal ship of state between the shorter-term need to continue stimulating jobs and growth and the medium-term necessity of bringing the Canadian government back to budget balance. As an appropriate preamble to all of this, the article will begin with comparing and contrasting James Flaherty’s fiscal challenge in 2010 with that faced by Paul Martin in 1995.

The relevant launch point is Canada’s inglorious string of 27 consecutive federal deficits, which finally came to an end when Canada recorded a surplus in fiscal year 1997/98, the first of many to follow. The fact that the deficit was over $40 billion only four years earlier, combined with the fact that Canada was alone among G7 countries in committing itself to the principle of running surpluses indefinitely, forced the global economic community to take due notice: Business Week called this the “Maple Leaf Miracle,” while the Economist labelled Canada the “fiscal virtuoso of the G7.” And over time, since no other G7 nation appeared to be able or willing to avoid spilling red ink, a budget surplus came to be referred to as a “Canadian fiscal value.”

However, after 11 consecutive surpluses, the Great Recession plunged Canada back into deep deficit in fiscal 2009/10.

At one level, Flaherty faced the same general challenge in 2010 as did Martin in 1995, namely how to convert a $40-billion deficit (for Martin) or a $54-billion deficit (for Flaherty) into a budget surplus. Beyond this common budget-balance objective, it would be difficult to conceive how their opportunities and constraints, both politically and economically, could possibly have been more different. On the political front, Martin’s challenge came from within his own party, whereas Flaherty’s struggle was with the opposition parties in a minority government. And on the fiscal/economic front, Martin had significantly more room to manoeuvre in terms of both expenditure reduction and revenue access than did Flaherty.

In more detail, and focusing initially on the politics of deficit reduction, the prevailing view of the newly elected (1993) Chrétien Liberals was that while debt and deficits certainly merited attention, the preferred approach was at most that Canada would adopt the Maastricht Guidelines for entry into the euro, namely deficits no larger than 3 percent of GDP and a debt-to-GDP ratio no larger than 60 percent of GDP. After all, the Liberals had been out of power for nearly a decade, and there was much to be done in terms of expanding the social envelope. Not surprisingly, then, Martin’s initial (1994) budget fell way short of Canadians’ expectations in terms of progress on the deficit/debt file. As already noted, Martin’s problem was to find ways to rein in his cabinet colleagues, especially those heading up the social spending departments. The fascinating series of events and initiatives that allowed Martin to implement deficit targets “come hell or high water” and that led to the 1997/98 surplus are well and readably documented in Edward Greenspon and Anthony Wilson-Smith’s Double Vision.

Unexpectedly, however, the lastminute clinchers came from south of the border. On January 11 and 12, 1995, the Wall Street Journal ran consecutive articles on Canada’s fiscal predicament. The first of these referred to the Canadian dollar as the “northern peso.” The second elaborated on this in an editorial entitled “Bankrupt Canada?” From Double Vision:

“Mexico isn’t the only U.S. neighbor flirting with the financial abyss,” the paper stated. “Turn around and check out Canada, which has now become an honorary member of the Third World in the unmanageability of its debt problem. If dramatic action isn’t taken in next month’s federal budget, it’s not inconceivable that Canada could hit the debt wall and… have to call in the International Monetary Fund to stabilize its falling currency.”

As if these shots from across the border were not warning enough, just two weeks before the February 27, 1995, budget, Moody’s placed Canada under a credit watch. The opposition within the Liberal cabinet and caucus evaporated.

In my view the strategy embraced by Budget 2010 was, at the same time, obvious and appropriate, politically and economically. Prime Minister Stephen Harper surely realized that reneging on year 2 of the Economic Action Plan was the only initiative (except for reintroducing the removal of federal funding for political parties) that was likely to unite the opposition and bring down the government.

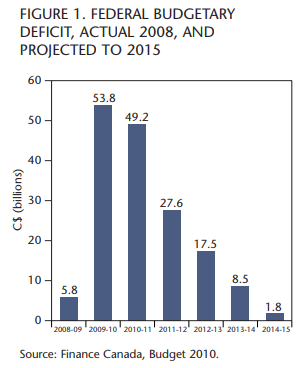

Fast-forward to 2010. The deterioration in Ottawa’s bottom line resulting from the Great Recession was unprecedented in both its immediacy and its magnitude. From a surplus of $10 billion or so in 2007/08 to a small deficit of $5.8 billion in 2008/09, the deficit ballooned to an estimated $53.8 billion in 2009/10 (see figure 1). But because of the iconic status that budget surpluses had achieved, and because fiscal restraint resonated so well with the living-within-one’s-means perspective of the Conservative rank and file, that Flaherty would return the books to budget balance was never in doubt. What was in doubt was how, and how fast. Led by Terence Corcoran’s monthlong “on the Chopping Block” exercise in the pages of the Financial Post the fiscal conservatives (presumably Conservatives for the most part) wanted to move immediately and aggressively, even to the point of reneging on some components of the year 2 stimulus of Budget 2009’s Economic Action Plan. Intriguingly, countering this right-of-centre, expenditure-reduction route to budget balance was a broadbased left-of-centre campaign to close the fiscal gap by increasing taxes on high-income Canadians and corporations.

In my view the strategy embraced by Budget 2010 was, at the same time, obvious and appropriate, politically and economically. Prime Minister Stephen Harper surely realized that reneging on year 2 of the Economic Action Plan was the only initiative (except for reintroducing the removal of federal funding for political parties) that was likely to unite the opposition and bring down the government. Moreover, opting for major tax increases in the midst of an uncertain economic climate would be highly questionable politically, not to mention that this would be akin to heresy from the vantage point of the Conservative faithful. Hence, the on the-ground reality suggested a temporal trade-off: first, continuing with (and supplementing) the already legislated stimulus in the initial year, and then embarking on a framework for achieving budget balance. What made this “stimulus now, restraint later” policy both credible and feasible was that Budget 2009’s two-year Economic Action Plan was expressly designed to be timely, temporary and targeted, rather than being rolled into the relevant expenditure and/or revenue bases. What this means is that when the stimulus terminates on March 31, 2011, this will lead automatically to a federal expenditure reduction of $19.152 billion (budget table 5.1), which would, on this score, account for the lion’s share of Budget 2010’s projection of a fall in the deficit from $49.2 billion in 2010/11 to $27.6 billion in 2011/12, as depicted in figure 1.

A few observations with respect to Budget 2010 framework for achieving budget balance are in order. The first begins with a presumption that in order to obtain the support of Canadians, and even their own constituency, Flaherty and Harper needed to ensure that the budget would indeed be in balance at the end of the budget planning horizon. Although Budget 2008 followed the Martin three-year planning horizon (i.e., the current fiscal year and the next two), Flaherty opted for a six-year horizon (the current year and the next five) for Budgets 2009 and 2010. Arguably, this was required because it is not until the sixth year that Budgets 2009 and 2010 are balanced (the deficit of $1.8 billion in 2014/15 in figure 1 being assumed by Flaherty to be equivalent to budget balance). However, this six-year budget framework puts the credibility of achieving budget balance in considerable doubt, and appropriately so. Flaherty may get off the hook by seeking consolation in the claim that as long as the private sector forecasts are accurate, then the budget’s forecasts are credible. But the underlying issue is that five-year forecasts, private or otherwise, are bound to be unreliable and, therefore, lack credibility. In my view a better, albeit roundabout, defence would be that the Budget 2010 forecasts represent the best-effort approach to capture the government’s commitment to return to budget balance. If the private sector forecasts turn out to be in error, then Finance Canada will take corrective measures, as early as in the 2011 budget if necessary. While it may be impolitic on my part to make such a defence on the Department of Finance’s behalf, it nonetheless seems to me that the majority of Canadians believe this and, therefore, this is where and why Budget 2010 derives its credibility.

A further comparative comment on the political front is that in aggressively pursuing budget balance Martin had the good fortune of having the Reform Party as the official opposition. No matter how far Martin moved in the direction of restraint, Preston Manning and company would have preferred that he go farther. Flaherty did not have this luxury. Yet in an important sense this was also fortunate, since the on-the-ground reality required a continued dose of stimulus before embracing restraint.

Interesting as the respective political environments may have been, the more striking contrasts were on the implementation front, where Martin’s opportunities and constraints were dramatically different than those facing Flaherty. In particular, the secret to Martin’s ability to achieve budget balance within four years was that he was able to offload Ottawa’s deficit to the provinces and to employment insurance (EI) contributors. In terms of the former, Martin cut the Canada Health and Social Transfer to the provinces from $18.3 billion in 1995 to $12.5 billion in 1997/98, and obviously on much more of a cumulative basis. Flaherty had no ability to follow suit, in part because the provinces were themselves also experiencing record deficits, in part because these transfers were shielded from cuts by virtue of Martin’s 2004 10-year federal-provincial accords on health and equalization, and in part also because this would have run counter to Harper’s principle of “open federalism.” Note that Martin’s accords also severely constrained Flaherty because they were rapidly driving up Ottawa’s program expenditures: health transfers were legislated to grow at 6 percent annually in an environment where inflation was running at best in the 2 percent range, and equalization transfers were being escalated at 3.5 percent annually, even through interprovincial fiscal disparities have lessened quite dramatically. The key message here is really for the provinces: enjoy these fiscal fortunes while they last because a fiscal shock is likely looming when the accords expire in 2014.

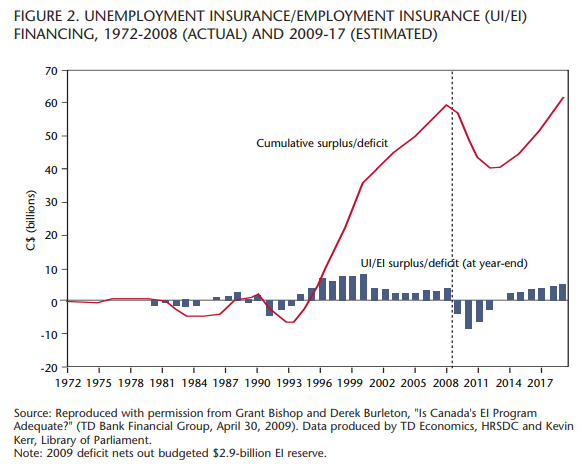

Martin’s offloading did not stop here: he siphoned off somewhere in the neighbourhood of $5 to $6 billion annually from the EI surplus (the excess of the EI premiums over EI benefits). As is evident from figure 2, the cumulative EI surplus that the Liberals brought into the consolidated revenue fund (CRF) reached a staggering $60 billion. In sharp contrast, figure 2 reveals that thus far Flaherty is absorbing EI deficits, not surpluses. While Budget 2010 seems to argue that the new arm’s-length Canada Employment Insurance Financing Board will set premiums to balance the account over the business cycle, the budget tables themselves tell a different story. From budget tables 4.2.4 and 4.2.5, the differences between EI revenues and EI expenditures (which will enter the CRF) for 2009/10 to 2014/15 are, in billions: $5.8; $-5.0; $+0.4; $+3.8; $+7.2; $+7.8. And the latter surpluses are likely to continue well after 2014/15 if the recovery is robust. This practice of bringing EI balances into Ottawa’s general revenues is creating major tensions not only on the federal-provincial front, but also between employers, employees and the federal government. If there is a potential “ticking time bomb” here, it is that there are now two challenges to the federal appropriation of these surpluses that have worked their way up to the Supreme Court.

Beyond these deficit-offloading initiatives, Martin found himself in a much more enviable position than Flaherty in terms of the prevailing economic environment. Arguably, the most important factor here was that at that time the US was in the midst of its strongest and longest postwar boom, whereas Flaherty was faced with a collapsed US economy. On the export front, the Canadian dollar depreciated from 89 cents per US dollar in 1991 to the low 70-cent range in the mid to late 1990s so that, in tandem with stellar US growth, exports to the US mushroomed in the Martin era. Again, Flaherty’s reality is in sharp contrast — the exchange rate appreciated from a low of 78 cents in early 2009 to over 97 cents on budget day, further accentuating the impact on Canada’s exports arising from depressed US growth.

By way of an interim assessment of the overall fiscal thrust of Budget 2010, it is instructive to begin with the observation that the extent of the public’s interest seemed to extend very little beyond the newspaper reports the morning after. To table a budget in these uncertain, even troubling economic times that becomes an immediate nonstory suggests that Flaherty has carved out an acceptable temporal trade-off in terms of the stimulus-restraint spectrum. On the one hand, the concentration of stimulus over the next year makes it too risky for the Liberals to join the other opposition parties in defeating the budget, since this would likely be interpreted as terminating the Economic Action Plan in mid-stream. On the other hand, if I am correctly interpreting the mood in the land, there is an expectation on the part of most Canadians that the real deficit-reduction exercise is yet to come, which, in turn, will play well with the Conservative supporters.

However, it is also the case that many Canadians were surprised and disappointed that Budget 2010 did not take action on public sector pensions. Perhaps the freezing of departmental budgets over the next two years served as an acceptable alternative in the context of a minority Parliament. This is especially so given that the 1.5 percent annual increase in public-sector wages pursuant to the collective agreement will now have to be paid out of these frozen departmental budgets. In effect, the result will be cuts in program spending, which Budget 2010 estimates will amount, cumulatively, to $6.8 billion by 2013/14. Beyond this, there is a promise that Budget 2011 will report on a “comprehensive review of government administrative functions and overhead costs in order to identify opportunities for additional savings.” In any event, Canadians still fully expect that any comprehensive review will address the issue of pension equity between the public and private sectors.

More speculatively, I would hazard a guess that Harper would be happy to take this budget to the voters. For reasons elaborated earlier, he probably cannot count on losing a budget vote in the House. There remains the option of governing as if he had a majority in the hope of triggering an election on an issue that might allow him to win one. While a majority Conservative government would be more aggressive in addressing expenditure reduction, the thrust of the above commentary is that further expenditure restraint is on the way in any event.

On a lighter note, being locked up for six hours with the slimmest budget in memory leads one to seek out distractions, in this case to select the most intriguing budget provision. Easily leading the pack was the proposal to create a federal red tape reduction commission. To be sure, there are some important reasons underlying this initiative: the Canadian Federation of Independent Business estimates that businesses in Canada currently spend over $30 billion a year complying with regulations. Nonetheless, some of us felt that governments would continue to cut red tape in the way that they always have — lengthwise.

My final comment on the debt and deficit front is that there is an important omission in Budget 2010, namely the lack of any reference to the fiscal plight of the provinces. This is especially problematic since the combined deficits of provincial-territorial governments are also running at record levels. Indeed, Ontario’s deficit for 2009/10 is currently larger than Ottawa’s in per capita terms, given that Ontario’s deficit is estimated to be roughly $25 billion, nearly half of the federal deficit, with barely one-third of the population. On the other hand, Budget 2010 ensures that the $14.4-billion provincial contribution to the stimulus in the two-year Economic Action Plan is made clear in several places (e.g., budget table 3.1.1). Overall, the result is a quite misleading impression of the combined deficits of Canada’s governments, and therefore it significantly underestimates the fiscal challenges facing Canadians. Flaherty’s 2008 budget did present a fiscal overview of the provinces and territories in annex 1 (entitled “Total Government Fiscal Performance”). Budget 2011 ought to rectify this omission.

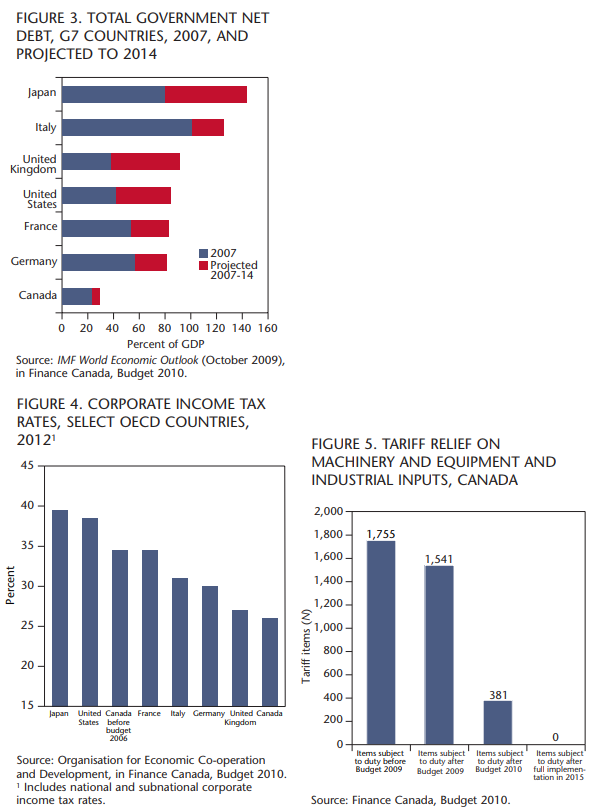

In the remainder of this essay, I want to return to my introductory sentence, which salutes Budget 2010 for creatively addressing Canada’s innovation and productivity challenges. Canada ranks at or near the top in international rankings across many facets of macroeconomic performance. As alluded to in the foregoing analysis and as flaunted in Budget 2010, Canada’s performance on the deficit and debt front represents the gold standard, as it were (figure 3). Budget 2010 predicts that by 2012 Canada’s corporate taxes will be the lowest in the G7 (figure 4). Moreover, Canada’s banks and systems of financial regulation are recognized internationally as being “state of the art.” In addition, the Bank of Canada also led the way in terms of implementing inflation targeting. And with the finance department and the Government of Canada also formally adopting the same inflation targets in their own policy planning, Canada is a model of fiscal and monetary harmonization. Plaudits all around to our macromanagers!

There is, however, one area, absolutely critical to our future growth and living standards, where we seem to be permanently underperforming, namely innovation and productivity. While pursuing high employment is an obviously important macroeconomic and income-distribution goal, over time maintaining a high and rising standard of living requires higher productivity growth and a more innovative economic environment than Canada has had in recent years. We are laggards in terms of investment in information and communication technology, the building blocks of the new global order. While we can and should take pride in stars like RIM, the overall picture is one where we are falling behind in developing Canadian-based multinationals. In the December/January 2006-07 Policy Options, Guy Stanley notes that in the Globe and Mail/Commerce ranking of the top 50 Canadian firms by revenues, almost all are resource-related, are in protected service sectors, are retail giants or are companies that focus on activities whose intellectual property, marketing and financial flows are mainly organized elsewhere. To be sure we have an important place in many global supply chains, but primarily at the “upstream” or raw-material end. We need to have a much greater presence higher up (downstream) in these value chains.

The surprising and most welcome news on the innovation/productivity front is that Budget 2010, presumably influenced by Compete to Win (the final report of the Competition Policy Review Panel, chaired by Red Wilson), has taken historic steps that will make Canada the first among the G20 partners to allow manufacturers to operate without bearing the costs of tariffs on their inputs of machinery and equipment. As figure 5 reveals, this is to be accomplished by eliminating the tariffs on 1,541 items, which, in turn, will reduce customs compliance costs, allow for the simplification of the tariff structure and eliminate the administrative burden of complying with rules of origin and drawback regulations. In other words, Canada will become a tariff-free zone for industrial manufacturers and perforce a more attractive location for investors.

However, Budget 2010 does not stop there: it goes on to alter the provisions of section 116 of the Income Tax Act to remove layers of red tape and taxes that foreign investors, especially venture capitalists, face in selling shares in Canadian companies. In effect, this measure narrows the definition of taxable Canadian property, so that it eliminates the need for reporting under section 116, thereby enhancing the ability of Canadian businesses to attract foreign capital, including innovative high-growth companies that contribute to job creation and economic growth.

The postbudget commentary on these provisions was uniformly positive, even enthusiastic. For example, in the Financial Post on March 6, Stephen Hurwitz, a specialist in Canada-US cross-border investment, termed the section 116 provision a “masterstroke” that, over the years, could unlock hundreds of millions of dollars of foreign capital that hitherto has been deterred from entering Canada. In the same issue, Terry Matthews (co-founder of Mitel but soon to be better known for hosting the 2010 Ryder Cup at his Celtic Manor Resort in Wales) proclaimed that this measure “will have an immediate, positive and direct impact on Canada’s ability to grow a robust Canadian technology industry.”

No doubt Canada has a long way to go to rank among the leaders in terms of innovation and productivity, but Budget 2010 has taken some unexpected and key initiatives toward this goal. Intriguingly, since one and all fully expected Budget 2010 to address the fiscal deficit, it may well be, as the introductory sentence suggests, that the creative and enduring contribution of Flaherty’s budget may be to have spearheaded a societal effort that addresses our long-standing innovation and productivity deficits.

Photo: Shutterstock