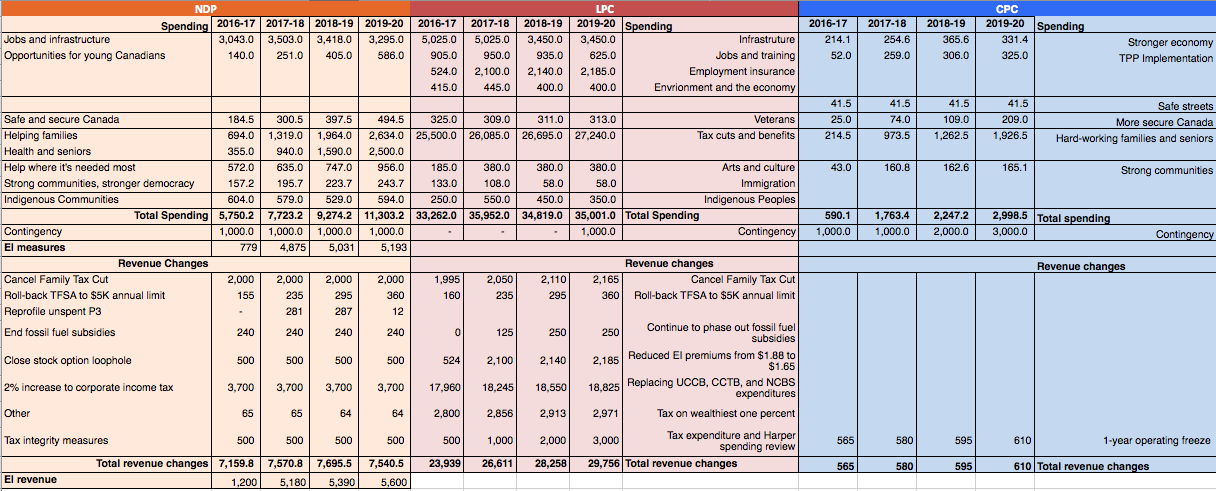

I think we can just call it a rule in Canadian elections: You have to have a platform book and you have to have costing. All three of the main federal parties have now traded the slow drip of “a-policy-a-day” for one, slick, packaged platform document. They did this last time too, and the time before that and before that too (but they didn’t always). In 2011, the NDP released the text (including a clip-out coupon on the back) and put out their costing soon after. This time the NDP put out their numbers before their text, which made it tough to make sense of what was on the table and why they had decided to use Stephen Harper’s 2015 budget as their baseline. Then the NDP challenged the Liberals to show their numbers and the Liberals did. And while the Liberal numbers raised a few questions of their own, different baselines make it tough to do comparisons between party platforms. Not that it doesn’t stop some of us from trying. Below, I’ve done what I can to summarize the platforms of each of the 3 main parties, using the numbers and terms they themselves used.

What becomes immediately evident when the numbers are lined up this way is the smallness of the CPC plan. In their most profligate year (projected at 4 years from now), they would only plan on $2.9 billion worth of new spending. This isn’t uncharacteristic though: Their 2011 platform topped out at just $3.1 billion in new spending in a year. These folks are for real about predictability and stability.

And yet, the CPC platform takes a full 159 pages to explain their suite of policy goodies meant to compete with “change” (real, ready or otherwise). What could possibly take 159 pages to explain but cost just $600 million (equivalent to about 0.2% of total federal spending) next year to deliver? To understand, I think you need to read their platform very carefully. And on closer reading, it becomes clear that this is a masterful example of electioneering.

First, notice the number of symbolic shackles like Balanced Budget Legislation (which as near as I can tell, bears exactly no relationship to fiscal balances or accuracy of projections when used at the provincial level). Or, for another example, “Tax Lock Legislation”, now in place in the United Kingdom where HM Customs and Revenue notes that it is expected to have no financial, economic or operational impacts at all. But the value of these symbolic commitments is less about their ability to realistically constrain a re-elected or replaced government. Instead these are showcase baubbles to help with far more valuable fundraising among party supporters. These are pithy promises with an appearance of face validity (if not the deeper kind) and the word “law” in there suggests something illegitimate if broken or threatened.

The platform is also well-stocked with law-and-order legislation with marketable brand names like “The Protection of Communities from the Evolving Dangerous Drug Trade Act”TM that will be (re-)introduced by a re-elected Conservative government. Others with expertise in criminal justice matters might marvel that these were not passed while this government held a strong, stable majority, particularly considering the 2011 platform section on criminal justice argued that the Official Opposition had “obstructed our reforms for the sake of an out-of-touch ideology”.[1]

More notable, in my view, is that the modest sums booked for “safe streets” in the platform (just $41.5 million next year) include exactly nothing for the cost of implementation and enforcement of these new laws.

There are also a host of boutique tax credits. Most of these are not new — the Mineral Exploration Tax Credit and the First-Time Home Buyers’ Credit have been around for a while. Some of them are new, such as the proposed $2,000 “equivalent-to-spouse” credit for single and widowed seniors. In fact, as near as I can work it out, 74% of the spending in the platform will arrive in the form of boutique tax credits; credits that, on balance, will help the already comfortable or reasonably well-off because these are non-refundable and demand a federal tax liability to start with; credits that, in some cases (such as buying or renovating a home) reward people for doing things they would almost certainly have done already; credits that have not, based on the published annual Tax Expenditure and Evaluation reports by the Department of Finance and the spring report from the Auditor General, been subjected to scrutiny for outcomes or impacts, yet are deemed worthy of expansion and renewal in this platform. Perhaps the clearest explanation of boutique credits I’ve ever heard came from a former colleague who described them as “social policy with other people’s money”. These are credits that can eat up space in 159 pages, offering stuff to put under headings, but individually they don’t take up much fiscal room (though cumulatively they can) and they look to both the selling political party and they buying voter like they are being paid for by someone else. But they are being paid for by all of us in forgone opportunity to use that revenue for other things and by larger compliance burdens through more complicated tax rules.

To be fair, other parties have also succumbed to the allure of the boutique credit in this election and campaigns past, but the Conservatives seem to be especially drawn by the siren song of the targeted tax credit. In fact, at least two campaign promises on credits (on the Mineral Exploration Tax Credit and the promise to study the Adult Fitness Tax Credit) will be familiar to readers of the 2015 Budget.

Which brings me to my next point, that some substantial share of what is booked here as new spending in this platform may be recycled. Comparing the text of the 2015 Budget and this platform, a reader is struck by several repeated promises, such as money to incentivize colleges and universities to teach curriculum that employers say they want. Likewise a promise to study on foreign speculation in Canadian real estate markets made its debut in April and is back again here in the platform. Promises of spending for local museums, Aboriginal skills training, Pacific salmon conservation, foreign credential loans and growth in the capacity of the Canadian Armed Forces likewise come back for encores. My concern isn’t the repetition. No, it’s the obfuscation about what is new vs old money in the fiscal framework.

For example, the platform promises $8 million a year for loans to help newcomers gain recognition for their foreign professional credentials. But the 2015 budget had already promised $7 million a year. The costing provided the Conservatives makes clear that Budget 2015 is already baked-in, so the $8 million per year in the costing may in fact be just $1 million more. Likewise, the platform promises $12.5 million rising to $196 million in new money for various operating and capital needs of the Canadian Armed Forces. But Budget 2015 had already announced a broad-based increase in the annual funding for the Department of National Defence — big enough to easily absorb the promises in this platform. Again, readers are left to wonder why money is booked as “new” in the platform that seems likely to be recycled from the last federal budget.

The Conservative platform also promises one more year of frozen federal operating costs. In fact this is the only revenue change they imagine in their platform and they project it will save about $560 million to $600 million a year in the next 4 years. I think they may be selling themselves a little short. This fiscal year, direct federal operating costs are projected at $76.1 billion and were expected to rise to $78.3 billion next year. Let’s say the operating freeze knocks next year’s amount back to this year’s ($2.2 billion less) but then lets operating costs go back on the same track projected before but without replacing the initial $2.2 billion. Well, that saves you a lot more money than what’s booked in the Conservative platform — I think about $9 billion over four years.

It may be that my estimate leaves out some inside information the Conservative platform was working with. As the party in power, they have a huge advantage in being able to re-purpose analysis and advice from the neutral non-partisan federal public service. All else being equal, the factual accuracy of their platform should be heads above the rest because they have had more time and more resources to get it right. So I found it weird that on page 6 they miss the mark in estimating the current rate of homeownership in Canada. The platform claims “one in seven Canadian households owns their own homes”. In fact, 62.5% of households own their home (see CANSIM Table 205-0002). The nod to ownership and assets sprinkled in the platform is, in my view, not wholly bad. But one wonders at the rationale behind a goal of adding another 700,000 to a pool of 9.1 million owners with regional market risks, mortgage debt loads that already make some bankers nervous and where housing wealth is pretty unequally distributed.

Finally, the platform is well-padded with the names of niche programs that won’t mean much to many voters. Are you voting based on the Industrial Research Assistance Program? Or perhaps the Agri-innovation Program? Maybe it’s the Forest Industry Transportation Program that gets you fired up in this election? These individual programs may well be doing useful things for the country but leaning on these insider-baseball measures smacks of a platform that is more inward-looking, cozy with the tools and rewards of being the government.

And maybe governmentitis is the best description for the dynamic just below the surface of this platform. When you have been the government for some time and feel you’ve kind of mostly got things rearranged the way you want them, it can be tricky to find shiny baubles to put in your shop window come election time. That said, it takes creativity and inventiveness needed to fill 159 pages with not much of anything new.

Note: An earlier version of the table was based on the NDP’s original costing document and did not include their estimates on EI measures. Thanks to Angella MacEwan for raising this point. I have reported these separate from other revenues and expenditures since the EI account is supposed to be separate from the CRF and this is how the NDP have treated EI in their own updated platform costing.

[1] Conservative Party of Canada (2011). “Here for Canada”, Election platform. Page 50.

Photo by: Αλέξης Τσίπρας Πρωθυπουργός της Ελλάδας / Some rights reserved