Global energy demand will grow significantly in the period to 2050, driven by population increases as well as the desire of those in the developing world to improve their standards of living. Hydrocarbons will continue to play a very significant role in meeting this growth in energy demand, and unconventional sources of oil and gas (including the oil sands) will become increasingly important. Innovative technological development will be necessary to address the challenges of increasing supply and social and environmental issues. The latter are local/regional (e.g., water use and land impacts) and national/international (e.g., greenhouse gas [GHG] emissions).

Canada is uniquely advantaged in having abundant unconventional hydrocarbon resources. Canada’s oil sands deposits are mainly located in northern Alberta, and at present 170 billion barrels are considered economical to develop. Another 145 billion barrels are not at this time considered economically feasible to develop. The oil sands are recovered by surface mining and in situ techniques; the latter process is similar to conventional production techniques.

The energy sector is a major economic driver for Canada. The oil sands alone currently contribute 112,000 jobs across Canada, and over the next 25 years it is expected to contribute over 11 million person years of employment to Canada and $1.7 trillion to the Canadian economy — spread all across the country. As well as contributing greatly to the economy of Canada, the oil sands provide a secure and reliable source of energy, for Canada and for North America.

There is an environmental impact associated with oil sands development, and this paper explores GHG emissions, air pollutants, tailings ponds, biodiversity, water use and quality, and surface land disturbance, all as they relate to the oil sands.

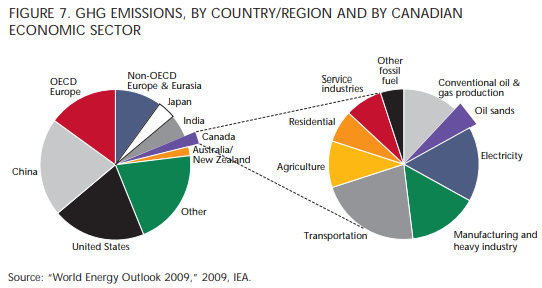

It is important to put the environmental aspects of oil sands production in context — GHG emissions for the oil sands are 5 percent of Canada’s total emissions, compared with 22 percent coming from transportation. As Canada’s total GHG emissions are 2 percent of global emissions, oil sands GHG emissions represent 1/1,000th of global GHG emissions. While this emissions level will grow as production increases, it is important to note that emissions, on an per barrel basis, have declined in the past 20 years. And technology will, as it progresses, continue to reduce GHG emissions per barrel, and significantly reduce absolute emissions as compared with the business-as-usual case.

Other environmental issues are also being addressed. Tailings ponds are strictly controlled by regulation in Alberta. New technology is being deployed to accelerate movement to dry tailings. Water use has been and will continue to be reduced in the extraction process. Regulations and monitoring are in place to assess the health of rivers and lakes in the oil sands region.

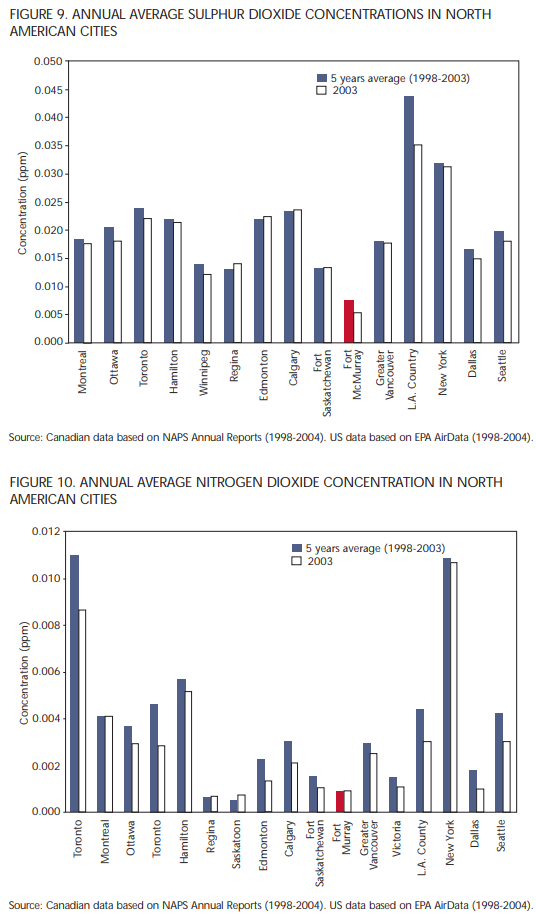

Land disturbance, especially in mining areas, is not pretty, but producers are by law required to reclaim any land disturbed by development. The areas disturbed are currently relatively small, with only 602 km2 having been affected to date by mining activity, and with 67 km2 under active reclamation. Air quality in the oil sands region is constantly rated better than major Canadian cities such as Vancouver and Montreal.

There is no question that the environmental performance of the development of the oil sands must continue to improve. This will be done largely through transformative technological change. Significant progress has been made to date, but in many areas — including GHG emissions reduction, water use, tailings ponds, and in-situ-upgrading-technology development — much remains to be done. Industry and governments are focused on environmental monitoring and performance improvement.

The oil sands impact on the environment has become one of the main drivers of scientific research and technological development in Canada. It is important for Canada and the oil sands industry to accelerate the takeup of technological innovation and implement environmental performance improvements.

The oil sands positively and negatively affect the social fabric of nearby communities. These communities benefit greatly from the economic activity associated with oil sands development. However, they are also most directly impacted by social, housing, infrastructure and other pressures arising from increased activity in the region. Efforts are being made to make up the infrastructure and labour deficits in this part of northern Alberta. Concerns about health conditions for local residents have prompted numerous studies, and the monitoring of the health of those living downstream from oil sands should continue.

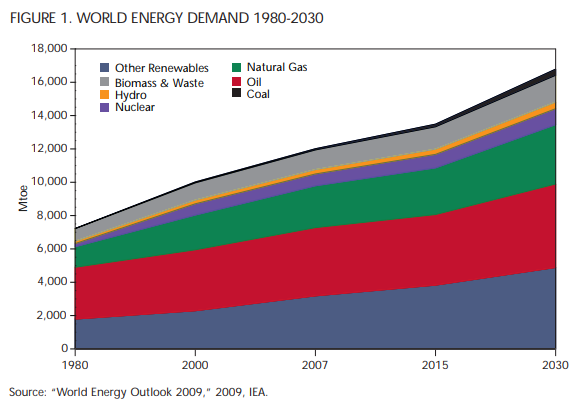

Any discussion of the oil sands needs to begin with a broader overview of global energy supply and demand (figure 1). An International Energy Agency (IEA) 2009 report concludes the following:

- Global energy demand will grow significantly in the period to 2050, driven by population growth and the need for energy to improve standards of living in much of the developing world. For example, there are 1 billion cars on the world’s roads today, and that number will double by 2050.

- While renewables will become an increasingly important part of the future energy supply mix in Canada and globally, hydrocarbons will provide the majority of the world’s energy supply for many years to come.

- With the decline of conventional hydrocarbon supplies, unconventional sources of oil and gas (including oil sands) will become more important.

- Massive capital investment is required to enable the necessary growth in energy supply.

- Environmental and social challenges associated with energy development of all kinds will become more significant.

- There will be an increasingly important role for technology, both in enabling economic development of supply and in addressing environmental and social challenges.

- On a global scale, reducing GHG emissions is the most significant environmental challenge that must be addressed going forward.

The energy sector is a major economic driver for Canada. The oil sands alone currently contributes 112,000 jobs across Canada, and over the next 25 years it is expected to contribute over 11 million person years of employment to Canada and $1.7 trillion to the Canadian economy — spread all across the country.

The IEA’s 2009 report presents the results of two scenarios — the “Reference Scenario,” which provides a baseline picture of how global energy markets would evolve if governments made no changes at all to their existing energy and environment policies; and the “450 Scenario,” which depicts a world in which collective policy action is taken to limit the long-term concentration of GHGs in the atmosphere to 450 parts per million of CO2.

Here are the main points of the Reference Scenario, assuming no significant energy and environmental policy changes:

- World primary energy demand is projected to increase by 1.5 percent per year between 2007 and 2030 — an overall increase of 40 percent.

- Fossil fuels remain the dominant source of primary energy — oil is the single largest fuel in the mix. â— World electricity demand is projected to grow at an annual rate of 2.5 percent to 2030 — with the largest increases in China — and coal is the major fuel in this sector.

- There is a rise in use of modern, nonhydro, renewable energy technologies — wind, solar, geothermal, tide and wave, and bio-energy.

- There is a projected decline in energy investment that would have serious consequences for energy security, climate change and energy poverty; the question therefore is: Will the investment needed to meet growing world energy demands be mobilized? The cumulative investment is estimated to be $26 trillion.

- The result of the Reference Scenario is a rapid and dramatic increase in GHG emissions.

- Security of energy supply is a major issue resulting from the Reference Scenario.

- The electricity needs of the world’s poor are not met.

The 450 Scenario assumes policy action to promote a low-carbon future.

- It is argued that the most effective route to reach this goal is through energy efficiency in buildings, industry and transport, especially new vehicle technologies; decarbonization of the power sector, where coal-based electricity generation is reduced by half; and nuclear and renewable energy.

- In order to reach this goal, there must be a massive financial investment of $10.5 trillion more than in the Reference Scenario. However, this investment should result in financial saving to the developed and developing world through economic, health and energy security benefits.

- There will be a dramatic increase in demand for natural gas (17 percent between 2007 and 2030), with the most rapid increase in China, India and the Middle East, but the cost of developing these resources will increase as well.

- The key energy markets of the future will be China and India, plus the Association of Southeast Asian Nations; global energy activity will be refocused toward Asia. Given the continuing economic issues faced by the developed world and the results of the COP15 meeting in Copenhagen, it is very doubtful that the 450 Scenario will be realized. Similarly, even though the Copenhagen Accord is perhaps less than some anticipated from the COP15, it is unrealistic to believe that developed and developing countries will take no action to reduce GHGs, will not increase renewable energy sources, and will not develop policies to promote and enhance energy efficiency.

Since the time of the writing of the current paper, which formed the basis of the oil sands dialogues, the IEA has published its World Energy Outlook 2010. This is an important report, as it helps put the oil sands dialogues in a global energy context. The IEA indicates that energy demand will increase globally by 36 percent between 2008 and 2035. Developing countries will account for 93 percent of that projected increase, with China contributing 36 percent to it. Fossil fuels, oil, coal and natural gas will remain the dominant energy sources to 2035. Regardless of what measures are taken globally to address climate change, oil will remain the dominant fuel. Specifically, IEA mentions the contribution of the oil sands to this scenario. It states,

Unconventional oil is set to play an increasingly important role in world oil supply through to 2035, regardless of what government do to curb demand…output rises from 2.3 [million b/d] in 2009 to 9.5 [million b/d] in 2035. Canadian oilsands and Venezuela extra-heavy oil dominate the mix. The report recognizes that renewable energy use will triple during the period, raising its contribution from 7 percent to 14 percent by 2035.

These two scenarios and their inherent differences, plus the 2010 IEA report, highlight the conundrum facing policy-makers, the industry and the public with respect to decisions about the nature of our future energy system.

The Western Canada Sedimentary Basin, which underlies most of Alberta and parts of Saskatchewan, British Columbia and the Northwest Territories, is the primary source of Canadian crude oil.

Canada’s oil sands deposits are divided into three major regions in northern Alberta, referred to as the Athabasca, Cold Lake and Peace River deposits (figure 2). The Alberta Energy Resources and Conservation Board (ERCB) estimated at year-end 2009 that these areas contain established reserves of 170 billion barrels that are economical to develop, given current technology.

On the basis of geological evidence, there is additional oil that is recoverable using current technology, but not economic in current conditions, and could raise Canada’s bitumen resources up to 315 billion barrels.

Of the remaining 170 billion barrels in established reserves in Alberta, 135 billion barrels, or 80 percent, are considered recoverable by in situ methods, and 35 billion barrels (20 percent) by surface mining. In situ recovery is similar to conventional production techniques. It includes primary production, whereby the bitumen can be recovered without addition of heat, and other recovery methods, whereby steam, water or other solvents are injected into the reservoir to reduce the viscosity of the bitumen, allowing it to flow to the surface to a vertical or horizontal well.

There are also smaller deposits in northwest Saskatchewan, next to the Athabasca oil sands deposit. The Saskatchewan Ministry of Energy and Resources has estimated that 2.7 million hectares of land has oil sands potential, but the resource base has not officially been determined.

Recovery of raw bitumen using in situ methods is set to surpass production using mining methods in the middle of this decade. In light of the integrated nature of the developments and their scale, most mining production is upgraded in Alberta. Currently, of the in situ projects in operation, only the Long Lake Project, operated by Nexen Inc., has integrated upgrading facilities. Also, production from the Suncor Firebag and MacKay River projects is upgraded at Suncor’s facilities. Otherwise, the majority of in situ bitumen production is not upgraded prior to reaching markets in the US.

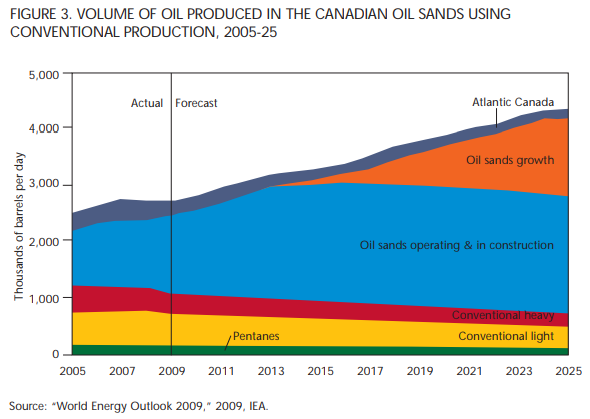

In 2009, Canadian oil production was 2.7 million barrels per day (b/d), with 2.5 million from western Canada. The growth case put forward by the Canadian Association of Petroleum Producers (CAPP) shows production expected to reach 4.3 million b/d by 2025 (figure 3).

The crude oil forecast released by CAPP in June 2010 is designed to provide an objective view of the changes in crude oil supply over the next 15 years. This forecast is similar to that of the previous year. In the first quarter of 2010, world oil prices increased to US$70-85 per-barrel range, a range that meets the required threshold for the economic viability of many oil sands projects. As a result, projects that were “put on the shelf” during the economic downturn are being returned to active planning and development.

This improved outlook for the industry coincides with new investments in oil sands projects by major Chinese companies. This will contribute to renewed activity and future production growth. CAPP’s estimate for industry capital spending on oil sands development is $13 billion for 2010.

Oil sands production currently makes up 55 percent of western Canada’s total crude oil production. Under the growth case, production is expected to grow from over 1.3 million b/d in 2009 to approximately 2.2 million b/d in 2015 and to about 3.5 million b/d in 2025.

The development and operating costs of the oil sands continue to be toward the high end of the range of costs for oil projects on a global basis. Although growth in global demand is expected to continue to provide impetus for oil sands development, this is a competiveness issue for Canadian producers and reinforces the importance of technology development to lower unit costs.

Energy supply and development in its many different forms underpin the economic aspirations of every region of Canada.

The energy sector represents the largest single private investor of capital in Canada and continues to attract the single largest slice of foreign direct investment, and these investments are spread across the country.

The energy sector is a major economic driver for Canada, accounting for 6.8 percent of Canada’s GDP in 2008 and directly employing 276,000 persons, or about 1.9 percent of total direct employment in Canada. In 2007, oil exports alone generated nearly $70 billion for the Canadian economy.

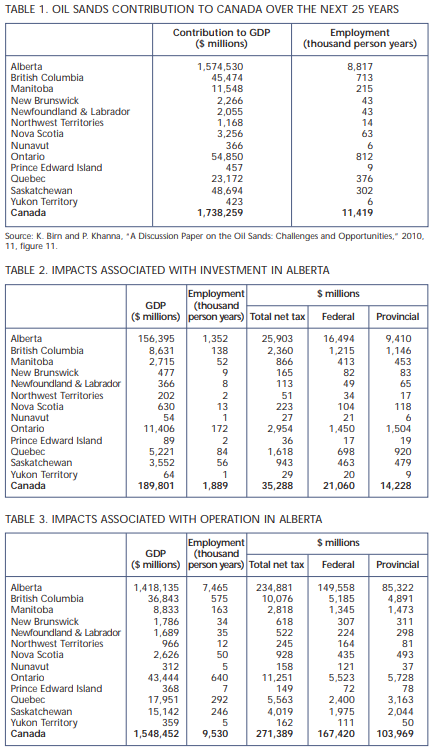

The Canadian Energy Research Institute (CERI) estimates that the oil sands industry alone will add 3 percent to Canada’s GDP by 2020 and will create, during the period to 2020, 5.4 million person years of employment, 44 percent of which will be outside Alberta (table 1).

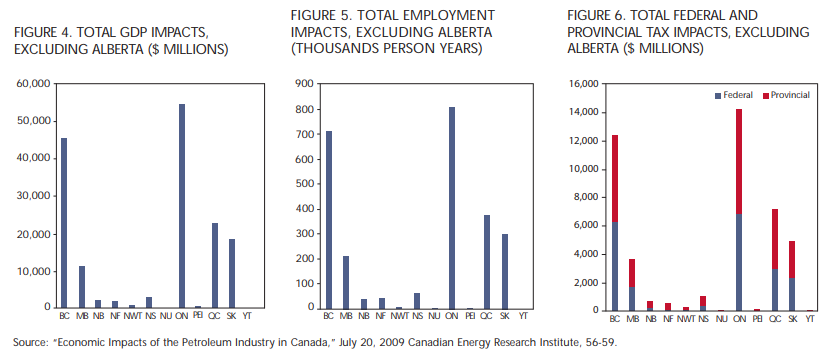

Currently the oil sands industry contributes toward 112,000 jobs across Canada and, according to CERI, over the next 25 years it is expected to contribute over 11 million person years of employment to Canada and $1.7 trillion to the Canadian economy (figures 4-6).

While Alberta accounts for the largest portion (90 percent), the impact across Canada will be significant. It is estimated that the Alberta oil sands industry will purchase roughly $170 billion in supplies and services from other Canadian provinces over the next 25 years. This includes $54.9 billion from Ontario, $45.5 billion from British Columbia and $23.2 billion from Quebec.

Looking at the economics of the oil sands from another point of view, it is helpful to see where they fit into the production curve when compared with other energy sources. Tables 2 and 3, developed by the IEA in 2009, illustrate that the oil sands are somewhere in the middle of the cost curve for development of energy sources.

There is, and should be, a considerable amount of focus on the oil sands in terms of their economic contribution and their role in providing secure and reliable energy supply. It would be an understatement to say that, along with the economic discussion, a great deal of attention is being paid to the oil sands environmental impact. Emission of pollutants and GHGs, tailings ponds, biodiversity, water quality and use, land disturbance and the boreal forest — virtually everything about oil sands development has an environmental dimension. These issues range from the local and regional to the international. In particular, the oil sands have become an icon for those who oppose development and the use of fossil fuels.

Due to its very large oil sands resource, stability and adherence to democratic principles, Canada is at the forefront of the dialogue and debate about hydrocarbon resources and climate change. This also places Canada, Alberta and the oil and gas industry at the forefront of efforts to concurrently advance economic benefits, energy security and responsible environmental performance. The oil sands are at the epicentre of this dialogue.

It should be noted that oil sands development, like other resource developments, takes place within a substantive regulatory regime, with shared responsibilities between the federal and provincial orders of government.

CERI, in its May 2008 report “Green Bitumen: The Role of Nuclear, Gasification and CCS in Alberta’s Oilsands,” states that in 2007 the oilsands industry accounted for 5 percent of Canada’s total GHG emissions, compared to 24 percent coming from the transportation sector. Canada’s emissions are 0.5 percent of those of the US and 1/1,000th of global GHG emissions. According to Environment Canada, since 1990 emissions have been reduced by 39 percent per barrel. By 2015, according to CERI, the oil sands could account for 8 percent of Canada’s GHG emissions, assuming current technology continues unchanged.

This is very unlikely to materialize, given the research and development of new technology in this area.

While it is important to put the oil sands GHG emissions in context, and there has been significant improvement in their per barrel discharges over the past 20 years, oil sands GHG emissions are expected to rise in absolute terms for the foreseeable future. The increase in production drives an increase in GHG emissions in absolute terms, although the per barrel discharge is declining significantly and emissions are considerably lower than the business-as-usual case.

The energy sector is a major economic driver for Canada, accounting for 6.8 percent of Canada’s GDP in 2008 and directly employing 276,000 persons, or about 1.9 percent of total direct employment in Canada. In 2007, oil exports alone generated nearly $70 billion for the Canadian economy.

In 2002, Alberta began taking steps to establish the first compliance carbon offset system in North America. The 2002 Alberta Climate Change Emissions Management Act (CCEMA) required large emitters to record and file statements of annual GHG emissions beginning in 2003. In 2007, Alberta became the first jurisdiction in North America to legislate GHG emissions reductions for large industrial facilities. Any facility, including oil sands, that emits more than 100,000 tonnes of GHGs per year is required to reduce its emissions per barrel by 12 percent below 2003-05 levels starting in 2007. Facilities that fail to meet this target have the option of buying Alberta=based carbon offsets, or paying the Climate Change and Emissions Management Fund C$15 for each tonne that exceeds reduction targets. The Fund supports projects and technologies aimed at reducing GHG emissions in the province. Measures implemented by Alberta are targeted to reduce GHG emissions by 50 percent by 2050, as compared to existing operational practices. The first group of projects has been selected, and CCEMC is currently soliciting proposals to increase energy efficiency.

The Alberta Energy Research Institute (AERI) in 2009 conducted a study and released two reports on the life cycle analysis of North American and imported crude oils. These “well to wheel” impact reports compared Alberta oil sands with other oil producing regions to provide a baseline for emerging and new technologies and their potential to reduce GHG emissions. Oil sands pathways generally have 10 percent higher emissions than conventional crudes. The report also concluded that when oil sands production pathways are given credit for electricity cogeneration, the emissions from the oil sands can be comparable to emissions from conventional crudes entering the United States market.

AERI concludes its analysis by stating that technological advances will further decrease GHG emissions for oil sands crudes. It is important to note that, in addition to the application of carbon capture and storage (CCS) in some projects, there is great potential to reduce the GHG emissions intensity of oil sands operations through improvements in the efficiency of subsurface recovery processes and in ongoing energy efficiency improvements in producing operations.

The Alberta Ingenuity Centre for In Situ Energy (AICISE) involves the development and deployment of in situ processes. It has five major themes: catalysis, integrated recovery processes, advanced simulation, bitumen characterization and reservoir characterization, all with the intent to change the nature of in situ mining to radically reduce GHG emissions.

As well, the Alberta Ingenuity Centre for Oil Sands Innovation is a partnership between Imperial Oil and the University of Alberta that focuses on mining for the oil sands. It is researching nonaqueous extraction of oil sands, which would avoid water consumption, and new upgrading technology, which would integrate extraction and upgrading.

In addition to the individual researchers working in the areas of engineering, biology, chemistry and geology, business and law, the University of Calgary and the University of Alberta are engaged in a number of initiatives and organizations related to the oil sands (figure 7).

The Wabamun Area Sequestration Project (WASP) is the largest-scale geological study in Canadian history for the permanent underground storage of millions of tonnes of industrial GHGs. The WASP study assessed the geological and technical requirements, economic feasibility and technical and regulatory issues related to the potential to safely store up to 1,000 megatonnes of CO2. The University of Calgary partnered with AERI; the Natural Sciences and Engineering Research Council; and industry partners TransAlta, TransCanada Corporation, ARC Energy Trust and Penn West Energy Trust.

The air quality in Fort McMurray, the closest urban area to the Athabasca oil sands, was rated “good” 98 percent of the time during 2008. Air quality in the oil sands region is consistently rated better than in major Canadian cities such as Vancouver and Montreal.

It is important to note that, in addition to Alberta-based scientists and researchers, there are many others across Canada and internationally engaged in addressing the challenges associated with oil sands development and operations.

Tailings ponds associated with oil sands mining present a significant reclamation challenge.

Tailings are a result of any mining process, and for oil sands they are a mixture of fine clay, sands, water and residual bitumen produced through the oil sands extraction process. As tailings settle, a portion will eventually form mature fine tailings, a substance that has historically taken many decades to firm up sufficiently for reclamation. Existing tailings ponds cover approximately 130 km2 of land. The first tailings pond to be reclaimed will be Suncor’s Pond 1, in 2010.

Recent technological developments, an example of which is the tailings technology now being applied by Suncor, could result in the transformative changes needed to ensure land reclamation at an accelerated rate. The Suncor process results in dry tailings ponds, allowing more rapid reclamation to occur.

In addition, Canadian Natural Resources Limited (CNRL) has developed and instituted a process whereby CO2 is injected into tailings to accelerate fines separation. It allows for faster water recycling with less water use and some capture of C02. Syncrude has introduced centrifuging tailings to accelerate fines separation, also resulting in less water use and reducing the ponds.

The aim of all this is to reduce the water use in tailings ponds. This would go beyond the 2009 Alberta Energy Resources Conservation Board directive designed to reduce the amount of liquid tailings — thereby speeding reclamation.

The Oil Sands Tailing Research Facility (OSTRF) is a University of Alberta incubator for faculty and students to work with the oil sands industry. Research projects at OSTRF — many of which are designed and managed by graduate students — investigate ways to handle oil sands tailings, with the goal of being able to reclaim the oil sands landscape directly following mining.

A major focus of oil sands research is reducing water use through recycling, with a goal of zero liquid discharge. Just a few years ago, 10 barrels of water were required to produce 1 barrel of oil. Now it is 2 to 3 barrels of water per barrel of oil for mining and half a barrel of water for every barrel of oil for in situ techniques. Today, 5 percent of water used in Alberta is by the oil sands.

Strict limits are placed on industry’s water use through the Water Management Framework for the Lower Athabasca River. This framework is one of the most protective policies to apply to year-round water withdrawals in a northern climate anywhere in the world. Strict water monitoring is also maintained through the Regional Aquatics Monitoring Program (RAMP), a community-based environmental monitoring program that specifically assesses the health of rivers and lakes in the oil sands region of northeastern Alberta. All this is to ensure that oil sands development does not negatively affect human health.

The federal government, recognizing the concern about seepage issues as they relate to tailings ponds, and water quality issues related to oil sands development more generally, has introduced a scientific program that includes state-of-the-art analytical equipment to perform chemical fingerprinting of any contaminants in the Athabasca River. This would allow identification of any chemicals produced in oil sands operations that are found in the surrounding environment.

While oil sands operations currently impact only a very small portion of Canada’s expansive boreal forest, concerns have been expressed regarding the adequacy of protected areas and the potential impact of oil sands development on certain species at risk, such as caribou populations.

Canada’s oil sands are found below the surface of 142,200 km2 of land, an area smaller than the state of Illinois. The oil sands are located in the Canadian boreal forest, which is as large as 88 percent of the entire United States land area (figure 8).

The oil sands underlie 4.4 percent of Canada’s total boreal forest. Of this total oil sands area, only 3.4 percent is mineable, or 0.15 percent of Canada’s boreal forest area. This leaves almost all of the boreal forest untouched by oil sands activities. It also means that, to the greatest extent possible, wildlife, especially the caribou, remain protected.

Close to 97 percent of the oil sands area will be developed using in situ technologies. In situ projects resemble conventional oil development (i.e., wells/drilling) and do not require tailings ponds or mine pits. Land use impacts differ between mining and in situ recovery operations. In total about 4,802 km2 of oil sands are suitable for surface mining. To date, 602 km2 of land has been affected by mining activity, and 65 km2 is under active reclamation.

In more than 40 years, oil sands mining has disturbed about two hundredths of 1 percent of the Canadian boreal forest; a total land area about the size of the city proper of Chicago, or 2 percent of the greater Chicago metropolitan area. Oil sands producers are required by law to reclaim any land disturbed by oil sands development. Companies must have reclamation plans in place and approved prior to receiving approval to disturb any land. The government of Alberta requires financial guarantees to ensure that all reclamation is completed.

For the oil sands mining region, the area under active reclamation is 67 km2, and in March 2008, the first oil sands mining reclamation certificate was issued by the government of Alberta. Companies apply for reclamation certification when the vegetation matures, the landscape is self-sustaining and the land can be returned to the government for public use.

Today about 8 percent of the land disturbed by surface mining is considered reclaimed. According to approved reclamation plans for surface mines, the amount of reclaimed land will have increased six-fold by 2020 from its present level. Between 2020 and 2040 the land area reclaimed increases significantly, while the area disturbed remains the same size. To date the pace of land reclamation has been in line with expectations set forth in the projects’ approved reclamation plans.

The burning of fuels as part of the production and upgrading of the oil sands results in air emissions that have an impact on local air quality. Air quality is monitored 24 hours a day, every day of the year in the oil sands region. Improved pollution controls and regulations, plus new technologies such as flue gas scrubbers, have reduced the emissions per barrel of pollutants that can cause smog and acid rain. The air quality in Fort McMurray, the closest urban area to the Athabasca oil sands, was rated “good” 98 percent of the time during 2008. Air quality in the oil sands region is consistently rated better than in major Canadian cities such as Vancouver and Montreal.

Since 1995, monitoring in the oil sands region indicates that four out of the five key air quality pollutants used to calculate the Air Quality Index show an improvement or no change in long-term air quality trends. Only nitrogen dioxide demonstrated an increasing trend. As well, air monitoring has shown increases in hydrogen sulphide in the Fort McMurray area and near oil sands upgraders (figures 9 and 10).

In 2009 the Alberta Biodiversity Monitoring Institute (ABMI) began releasing a series of reports on the state of biodiversity in the oil sands region of Alberta. Its first core report, “The State of Birds and Vascular Plants in Alberta’s Lower Athabasca Planning Region,” released in February 2009, found a 7 percent overall human footprint — 3 percent for agriculture, 2 percent for foresting and 2 percent for energy. Biodiversity was 94 percent intact: birds were 94 percent and plants 95 percent intact.

There are two parts to the discussion of social aspects as they relate to oil sands. The first part deals with the importance of the oil sands to sustaining the quality of life in Canada. This includes job creation, both direct and indirect; the taxes and royalties levied on oil sands production that flow through government coffers, and the resources to fund equalization and other transfer payment programs. The second part deals with the immediate effect of oil sands development on the lives of those living and working adjacent to the resource.

One could argue that with the projected continual expansion of the oil sands and the relative decline of development and extraction of conventional sources of crude oil, the oil sands will occupy an increasingly important role in funding the social programs, including health care, that are so vital to Canadians’ way of life and social well being.

But job creation and the taxes flowing through Canada’s financial system that fund these vital programs have to be balanced with the other social issues arising from oil sands development and its effect on the day-to-day lives of those most directly affected. As well, development must be balanced with what has become known as “the social licence to operate” — weighing private rights and the overall public good.

It is vitally important when considering the social licence to operate that First Nations treaty rights be respected. First Nations must be consulted on all development within the oil sands area.

There are 18 First Nations, with a combined population of 16,000 people, living on reserves; and 6 Métis settlements, with approximately 6,000 residents, living within the oil sands area.

The “duty to consult” was introduced by the Supreme Court of Canada in 2004 and 2005, and it is currently the subject of ongoing litigation. No matter the outcome of these cases, cooperative engagement that meets the needs of industry and First Nations will be necessary under any scenario that envisages future oil sands development. Failing some form of cooperative engagement, oil sands development will slow down, putting in jeopardy the social well being that abundant energy has provided for Canadians.

On a positive note, in 2008 more than 1,500 Aboriginal people were directly employed in oil sands operations, about 10 percent of the oil sands workforce. In 2008 the value of contracts between Alberta oil sands companies and Aboriginal companies was $575 million, an increase of $150 million since 2006.

It is conventional wisdom that the environmental challenges raised by oil sands development will be met and overcome only through the development of “game changing” or “transformative” technology. The investment in CCS pilot projects by the federal and provincial governments; the Alberta Technology Fund; and the investment of government and industry in scientific research all speak to the importance placed on innovation.

Industry and government are also aware that oil sands challenges met in Canada through innovative technology will also form the base of “green” exports, especially to burgeoning markets in the developing world.

Recent OECD reports on innovation in Canada make it clear that the government of Canada, industry and scientific researchers must become better at commercialization and technological development and implementation, moving technology from the scientific research laboratory to actual commercial and industrial use. In order to accomplish this, we must also get better at attracting venture capital to Canada to fund experimental research that leads to the needed innovations. In order to do this, partnerships among industry, government, scientific researchers and financial institutions are vital.

Oil sands research and development sponsored by the industry focuses on a number of vitally important areas for example, reducing water input, achieving the maximum recycling of water, using nonpotable water sources and finding multiple uses for water once it is in the system. Regarding in situ methods, processes are being tested for using less steam by employing solvents (propane) or a solvent and steam mixture. This requires less energy and therefore reduces GHG emissions. Research is also underway to achieve higher recycle rates for water in mines and in situ, resulting in less water input into the system.

A secure energy future for Canadians is one in which energy development and investments in environmental protection are fully integrated, to the benefit of all Canadians. As the supply of conventional crude diminishes and becomes more difficult to access, the oil sands will have a crucial role to play in Canada’s future energy security.

While Canada is a net exporter of energy, enhancing our energy security must be addressed through the renewal of our aging energy transportation infrastructure — especially pipelines. Much of eastern Canada is dependent for oil on foreign imports. In fact, refineries in Quebec and the eastern provinces run primarily on imported crude oil. To reduce this vulnerability, pipelines would need to be reversed and extended, and the oil sands would be part of the mix needed to fill such pipelines. Energy security in Canada means more than providing energy to Canadians, it also means securing markets for the sale of our energy — especially from the oil sands — which means more jobs for Canadians. As a net exporter, and a country where a large percentage of GDP is dependent on energy production, Canada must discover and access new emerging markets. At present, Canada exports on average 1.88 million barrels of crude oil per day. In order to diversify markets for energy exports, especially to China, India, Japan and Korea, the necessary infrastructure will need to be built. Such infrastructure requires a long planning timeline, but when constructed it will assure Canada has access to markets other than the United States.

Several recent reports deal with the role of oil sands in the relationship between Canada and the United States. Most notable are the Council of Foreign Relation’s article “The Canadian Oil Sands: Energy Security vs. Climate Change,” CERA’s 2010 “The Role of Canadian Oil Sands in US Oil Supply,” and CERI’s 2009 “The Impacts of Canadian Oil Sands Development on the United States Economy.”

From the CERI report the following summary is instructive:

Canada and the US are major trading partners, and the results clearly show significant economic benefits to the US from increased economic activity in Canada. As investment and production in oil sands ramps up in Canada, the pace of economic activity quickens and demand for US goods and services increase rapidly, resulting in an estimated 343,000 new US jobs between 2011 and 2015. Demand for US goods and services continues to climb through-out the period, adding an estimated $34 billion to US GDP in 2015, $40.4 billion in 2020 and $42.2 billion in 2025.

Strategically, Canada is the leading supplier of foreign oil to the United States. Canada’s share of US crude oil import rose from 15 percent in 2000 to 27 percent in 2009, underscoring the deep and growing economic and trading relationship. In the third quarter of 2009, the oil sands were the third largest source of crude oil imported into the United States. Energy imports from Canada can be characterized as superior to imports from elsewhere. Canada has an open oil and gas investment climate, the oil sands’ capacity is not government controlled, their close proximity to US and a strict regulatory regime as well as capacity to increase oil sands supplies to the US all speak to this superiority.

It is obvious from the IEA’s and CAPP’s forecast for growth that increased production from Canada’s oil sands will make an important contribution to fossil fuel supply through 2050.

Therefore the contribution that further development of oil sands makes to the Canadian economy may well be secure for at least the foreseeable future. Revenues through royalties, taxes and job creation flow through Canada’s economy, into equalization and social transfers from the federal to provincial governments. With increased development, the energy component of revenue flow through to Canadians would seem to be secure.

However, as we try to balance energy and economy, the other leg of the three-legged stool is the environment, and the oil sands impact on it. There has been continuous improvement in environmental performance regarding GHG emissions reduction, movement to dry tailings and reduction in water use. The development of the oil sands has spurred on scientific research in a number of Canadian universities and other institutions. It is important for Canada and industry to accelerate the take-up of technological innovations and implement environmental performance improvements.

The prospect of oil sands development driving scientific research and technological innovations will, if successful, provide Canada with a platform to export our experience and new technology to the developing world. This is where the markets will be for Canadian products, if we take advantage through oil sands research to move to a greener economy.

Achieving a balance between energy development, increased economic performance and environmental improvement should help support Canada’s international position as an evolving green energy superpower.

Photo: Shutterstock

Do you have something to say about the article you just read? Be part of the Policy Options discussion, and send in your own submission. Here is a link on how to do it. | Souhaitez-vous réagir à cet article ? Joignez-vous aux débats d’Options politiques et soumettez-nous votre texte en suivant ces directives.