Canada faces several economic challenges over the coming years, and most of the rich, developed economies face broadly similar ones. Though Canada is better positioned than most countries to face them, Canada’s economic road ahead will not be completely smooth. The sooner we act sensibly to address these challenges, the more prosperous our future will be.

I focus here on four broad economic challenges, though it would be easy to expand this list considerably. They are debt and demographics, climate change, productivity, and trade and globalization. Each is challenging in its own right, but linkages between them add to the overall policy complexity.

The recent financial crisis and recession has had a double impact on the fiscal position of Canadian governments. First, as the level of economic activity fell in late 2008 and early 2009, government tax revenues declined. Second, the depth of the recession underlined the need for governments to stimulate the economy by increasing spending and to offer assistance to Canadians through targeted tax reductions. The predictable result was that budget surpluses from previous years quickly disappeared, to be replaced by large budget deficits. The current forecasts suggest that the consolidated government sector will show budget deficits for several years. Since the recession may have shifted downward the growth path of potential GDP, some observers debate whether even a solid economic recovery over the next few years will be sufficient to restore tax revenues and balance government budgets.

Most Canadian governments are strongly committed to returning to balanced budgets, but are also wary of the dangers of removing fiscal stimulus before a solid recovery is under way. To withdraw the new fiscal measures too quickly would be to put economic recovery at risk; but to continue with unnecessary stimulus would threaten an undesirable accumulation of government debt, thus imposing costs on future taxpayers.

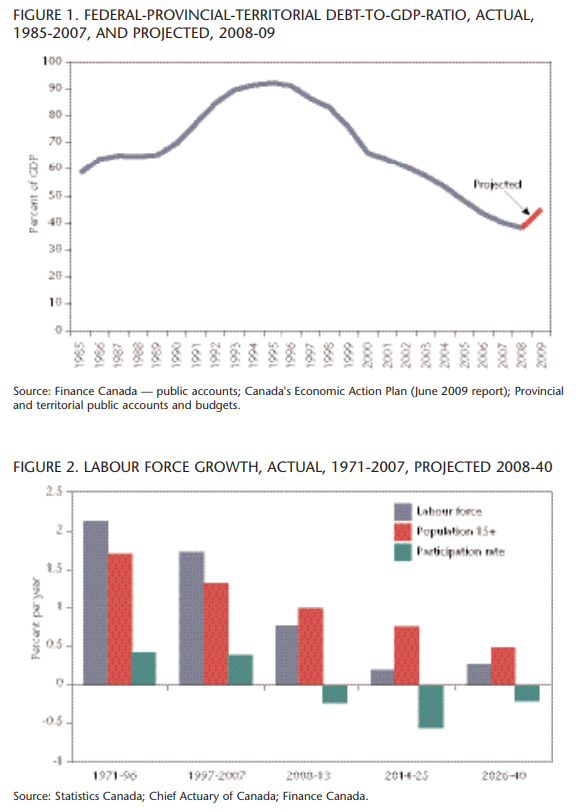

Some Canadians might question the need to return quickly to balanced budgets. In doing so, they would probably point to the fact that Canada has made great strides in reducing its public debt, especially when viewed in proportion to the size of the overall economy. As figure 1 shows, the combined federal-provincial-territorial debt-to-GDP ratio has declined markedly, from about 92 percent in 1995 to 38 percent in 2008. (The more familiar statistic is the federal debt-to-GDP ratio, which declined from 68 percent to 29 percent over the same period.) Since Canada has done so well over the past decade, what is the urgency in restoring balanced budgets?

To understand this urgency, it is necessary to think not just about the next few years but about the next few decades, when Canada will experience dramatic demographic changes. Born between 1946 and the early 1960s, the baby boom generation has disproportionately influenced the music, literature, food, clothing and lifestyles of Canadian society. Not surprisingly, the continued aging of this generation, combined with the prolonged decline in fertility rates, will have profound effects on the Canadian economy. Specifically, there will be a large impact on our governments’ fiscal positions — Canada’s coming “fiscal squeeze.”

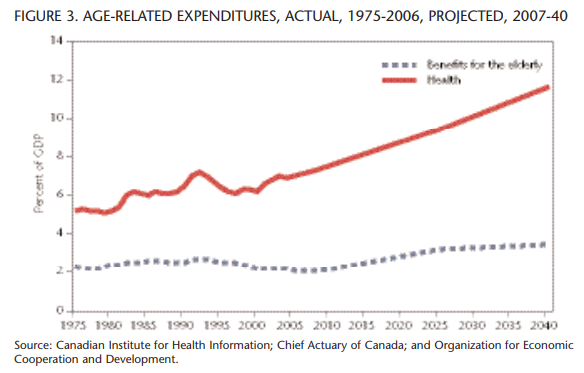

The first part of the fiscal squeeze is the slowing of the per capita tax base due to population aging. As the baby boom generation eventually retires, the share of the Canadian population participating in the labour force will naturally decline. It follows that Canada’s labour force will grow more slowly in the next few decades than it has over the past several, as figure 2 shows. But labour force growth has traditionally been an important source of growth for the Canadian economy. The slowing of the labour force will therefore lead to slower growth in the level of economic activity and thus slower growth in the tax base.

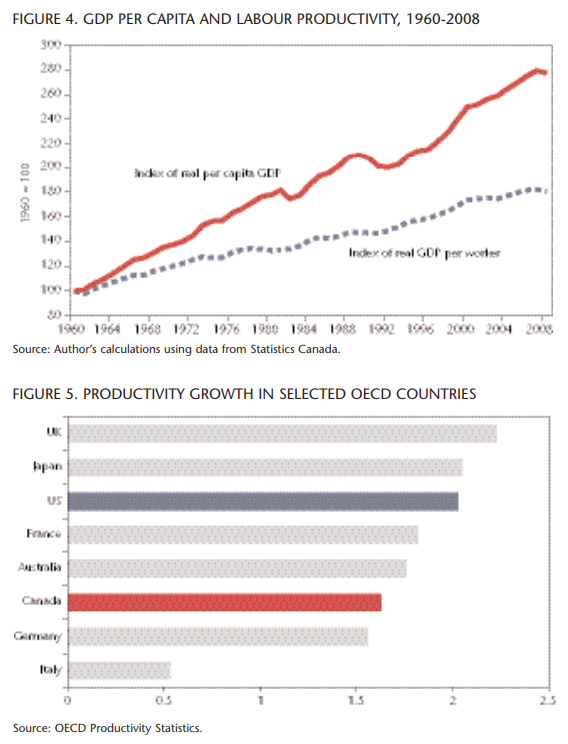

The second part of the fiscal squeeze is that government expenditures will increase significantly on a per capita basis as a result of population aging. As the baby boomers age and retire, they will naturally require an increase in health care services. More demands will also be placed on the various income support programs designed for the elderly. Current estimates suggest (see figure 3) that government spending on health care and other age-related programs will rise by approximately 3.5 percentage points of GDP between 2020 and 2040.

Faced with these demographic forces, what choices are available to Canadian governments? Some Canadians might advocate a reduction in “other” government spending, thus freeing up room in government budgets to accommodate the rising health care needs of the aging population. These advocates might be surprised at the difficulties involved in cutting existing government programs. Other Canadians might advocate a rise in future tax rates in order to finance the necessary health care expenditures, although they would need to face the growth-retarding effects of some tax increases. Still others might advocate more immigration or increases to the traditional retirement age, but they would soon learn that the scope of the fiscal squeeze is so large that such policy measures, while helpful, are not sufficient to address the challenge.

It is impossible to predict with any accuracy how the coming fiscal squeeze will be apportioned between the various levels of government; much will depend on the politics and the personalities at play over the next few decades. In any event, the fiscal squeeze applies to Canada as a whole, and it is useful to focus here on the consolidated government sector rather than being distracted by how fiscal capacity will be shared between the different levels of government.

To make matters a little more challenging, Canada’s coming fiscal squeeze will create new tensions between the federal and provincial governments. The vast majority of the rising health care expenditures will come directly from provincial government budgets. But if past behaviour is any predictor of the future, significant pressures will be placed on the federal government to increase financial transfers to the provinces in order to meet these growing demands.

It is impossible to predict with any accuracy how the coming fiscal squeeze will be apportioned between the various levels of government; much will depend on the politics and the personalities at play over the next few decades. In any event, the fiscal squeeze applies to Canada as a whole, and it is useful to focus here on the consolidated government sector rather than being distracted by how fiscal capacity will be shared between the different levels of government.

Governments at any level typically find it difficult to cut spending programs or increase taxes. In contrast, borrowing at least provides a way of postponing these tough decisions. For this reason, Canadian governments faced with the future fiscal squeeze are likely to allow their public debts to increase, at least by some amount. That is, they may satisfy at least part of the increasing demands on their budgets by running budget deficits and thus accumulating debt. To get a sense of how much debt this might involve, consider the case where governments keep tax revenues and non-age-related spending constant at their current shares of GDP. In this case, the fiscal squeeze would add about 35 percentage points to the total stock of government debt between 2020 and 2040.

This brings us back to the current fiscal situation, and the need to restore budget balance to the government sector as soon as possible. If Canadian governments will incur a significant amount of new debt in the future as they respond to the needs of an aging population, debt must be reduced in the very near future in preparation for those future demands. Failure to significantly reduce the consolidated government debt-to-GDP ratio by 2020 could lead within 20 years to a return of the mid-1990s fiscal situation when Canada’s consolidated government debt was over 90 percent of GDP and the problems of excessive debt were apparent. In other words, reducing the debt ratio in the very near future can make room for future increases in debt driven by population aging.

Achieving sufficient reductions in the debt ratio by 2020 will require that the forecasted budget deficits be eliminated within a few years, to be followed by a string of moderate budget surpluses for several years. This will be challenging, but certainly possible. The longer we delay in making this fiscal adjustment, the more difficult it is likely to be.

And then there is the challenge of climate change. Most scientific evidence now points to a clear causal link between the burning of fossil fuels (coal, oil and natural gas), the rising concentration of carbon dioxide and other greenhouse gases (GHGs) in the atmosphere and increases in the earth’s average temperature. As a result of this global warming, the polar ice caps have been melting significantly, the world’s deserts have been gradually increasing in size, and extreme weather events appear to be getting both more frequent and more severe. The effects of climate change will be felt in many countries, but many of the most dramatic effects are likely to be experienced in the lowest-income countries least prepared to shoulder the burden.

At the heart of the climate change problem is what economists call an “externality.” Through their everyday activities of production and consumption, firms and households emit GHGs into the atmosphere and thus impose costs on others “external” to their market transactions. The emitters are not required to bear the full costs of their actions, and the predictable result is excessive GHG emissions. In situations of this kind, government action is necessary to force emitters to face the full cost of their actions. In a 2008 open letter to Canada’s political leaders, 230 university economists argued that a government policy attaching a price to GHG emissions is a necessary first step in addressing this daunting challenge.

The world’s annual emissions of GHGs have been increasing steadily, broadly in line with the growth of the world economy. In the absence of policies aimed at reducing these emissions, they are predicted to increase by over three times by 2050. Yet the weight of scientific evidence suggests that in order to stabilize the atmospheric concentration of GHGs (at a level well above today’s), and thus to stabilize the earth’s average temperature (at a level 1 to 2 degrees Celsius above today’s average temperature), annual emissions will need to fall by approximately 80 percent from their current levels by sometime around 2050. The scale of the technological challenges (to say nothing of the political challenges!) involved in making such dramatic emissions reductions should not be underestimated.

Since the burning of fossil fuels is one of the most efficient ways to produce energy, and since energy is a crucial input to the production and distribution of most goods and services, it is not surprising that a close relationship exists between the growth of economic activity and the growth of GHG emissions. Reducing emissions by reducing world GDP is both unrealistic and undesirable, however. As the world’s population continues to grow, and the people of the developing world strive to increase their per capita incomes to levels closer to ours, there will inevitably be a rise in global GDP.

The more realistic way to reduce GHG emissions is to reduce our reliance on energy and, in particular, our reliance on those forms of energy that release GHGs into the atmosphere. But since energy use in some form will continue to rise along with the level of economic activity, the fundamental challenge is not one of reducing our total energy demand but rather one of switching our energy sources away from GHG-emitting sources and toward nonemitting sources. Such a switch involves an immense technological challenge because it requires, first, developing the non-emitting technologies that can be used dependably and on a large scale and, second, inducing millions of firms and consumers in every country to switch significantly toward these non-emitting technologies as part of their daily activities.

Most economists argue that any effective climate change policy must involve either the direct imposition of a tax on GHG emissions or the restriction of the amount of total emissions accompanied by the creation of a market in which firms can trade their emissions permits (a cap-and-trade system). Either policy approach will increase the costs associated with emitting GHGs and thus will create incentives for firms and households to switch toward non-emitting forms of energy. Incentives will also be created for the further development of nonemitting energy sources such as solar, wind, nuclear and hydroelectricity.

Canada is committed to reducing its annual GHG emissions by 20 percent (below 2006 levels) by 2020, and by 60 to 70 percent by 2050, and is actively engaged in designing an effective policy framework to achieve these objectives. But the geopolitical nature of the challenge means that Canada’s policies must at least be consistent with those in the rest of the world. In current international negotiations working toward emissions reduction targets, Canada must act responsibly to ensure that the overall targets are satisfied and also that each country faces its appropriate share of the burden. At the same time, we must be cognizant of the economic costs associated with reducing GHG emissions, and thus the need for designing our climate change policies in a manner that minimizes these costs.

Given the importance of fossil fuels in any modern economy, it should not be surprising that any policy that attaches a significant price to the emission of GHGs will have dramatic economic effects. In general, labour and capital will shift away from those sectors that rely most heavily on fossil fuels and shift toward sectors that rely more on non-emitting energy sources. These adjustments will not happen instantly, nor will they be painless.

More than just changing the pattern of economic activity, however, any effective climate change policy will also reduce the economy’s overall growth rate. It is almost inconceivable that a significant increase in the cost of using fossil fuels could occur without affecting our overall ability to produce goods and services. This is why we must think carefully about how we design our climate change policies. A small reduction in the Canadian economy’s growth rate may be a price worth paying to do our part in stabilizing the earth’s climate and thereby preventing future catastrophic events; a much larger reduction in the growth rate may be a needless price to pay, and one that makes the medicine worse than the disease.

If we seek an explanation of why living standards rise or fall modestly from one year to the next, the economy’s position in the business cycle is of central importance. But for understanding why we are significantly better off today than were our great-grandparents a century ago, the business cycle is irrelevant. Long-run changes in average living standards are mostly driven by the long-run growth in productivity — our steadily improving ability to produce more and better products with less effort and fewer resources.

The importance of productivity growth is not just for the raising of average living standards, however. It also facilitates the implementation of public policies designed to address any growing inequality in the distribution of income. Policies that involve transfers to lower-income Canadians are easier to afford in a world in which the average size of the economic pie is growing every year.

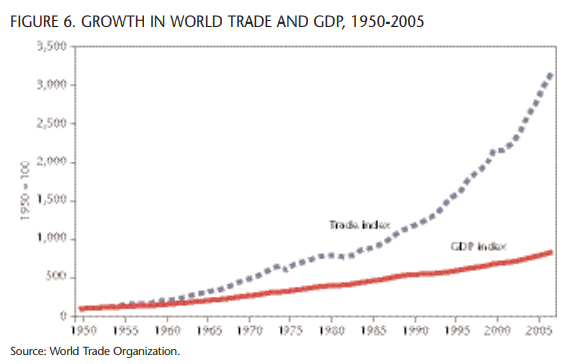

Figure 4 shows the performance of Canadian labour productivity and Canadian real per capita GDP since 1960. Real income per person (the blue line) has grown by 180 percent since 1960, an average annual rate of 2.2 percent. Growth in labour productivity (GDP per worker) has accounted for just under half of this overall growth (the red line). The rest has been due to a rising fraction of the population in the workforce, a fraction that will decline significantly with the aging and eventual retirement of the baby boom generation.

For the purposes of comparison, figure 5 shows productivity growth over the past decade for Canada and several other developed countries. Canada’s average productivity growth rate has been 1.6 percent, whereas productivity in the United States, the United Kingdom and Japan has grown at an average rate of over 2 percent. This difference may seem unworthy of emphasis, but even small differences in annual growth rates lead after many years to large differences in average real incomes. It is worth noting that higher rates of productivity growth in other countries do not harm Canadian living standards, and thus figure 5 should not be interpreted as showing that Canadians are becoming worse off over time. The truth is quite different. Canadians on average have been getting steadily richer over time, as figure 4 shows; figure 5 shows that the average residents of some other countries have simply been getting richer a little more quickly.

The productivity comparison with other countries is nonetheless informative because it shows what might be possible in Canada. By international standards of comparison, for example, Canada and the United States have similar economic structures, political and legal systems, and much else. So if the United States can achieve a particular rate of productivity growth over the long term, it is at least conceivable that Canada could achieve the same growth rate.

Having a faster pace of productivity growth would always produce benefits for Canada, but with the challenges we face in terms of demographics and climate change, improving Canada’s long-run rate of productivity growth takes on even greater importance.

The importance of productivity growth is not just for the raising of average living standards, however. It also facilitates the implementation of public policies designed to address any growing inequality in the distribution of income. Policies that involve transfers to lower-income Canadians are easier to afford in a world in which the average size of the economic pie is growing every year.

As for the demographic challenge, the decline in the growth of the labour force that will result from declining fertility and the aging of the baby boom generation will inevitably lead to a decline in the growth rate of average per capita income. The reason is simple: the fraction of the total population gainfully employed will fall, meaning that the amount of income available for the country as a whole will come from a steadily shrinking fraction of the population. In such a world, the path of our living standards will be determined by a crucial horse race between two principal contenders. Population aging will be pushing to reduce our average living standards while productivity growth (as always) will be pushing to increase them.

Policies that place a price on greenhouse-gas emissions will inevitably reduce the growth rate of GDP, at least for the many years required before the economy makes a significant transition to non-emitting energy sources. For a given pattern of population growth, the lower GDP growth implies a reduction in the growth of average living standards. The latter can be offset to some extent with an increase in the rate of productivity growth. There will still be a real and significant economic cost associated with the reduction in greenhouse gases, but this cost could more easily be absorbed with faster productivity growth.

As important as productivity growth is to our rising living standards, it is perhaps surprising how little we know about its sources. Governments are fairly certain about two things, however. First, there is no clear productivity “lever” that governments have at their disposal, with a pull in one direction sending productivity on a predictably faster upward trajectory. In contrast, economies with faster productivity growth have an entire array of institutions and policies that differ from those in countries with lower growth. Second, many of those factors that appear to be related to high productivity growth do not come cheaply. Policies designed to increase Canada’s rate of productivity growth will likely involve significant public spending and/or significant tax reductions, and the direct effect will be to exacerbate Canada’s future fiscal challenges. Consider the following examples.

There is ample evidence that healthier workers are more productive, and this relationship suggests that general improvements in health outcomes may be an effective way of increasing the economy’s long-run growth rate. What is less clear, however, is how governments can use taxpayers’ resources to improve average health outcomes in a cost-effective manner. Should the focus be on the operation of the health care system, or should effort instead be devoted to ensuring that Canadians live healthier lives and thus have less need for formalized health care?

There is also considerable evidence that a more educated workforce tends to have higher levels of productivity; at the micro level, it is undoubtedly true that income is closely related to years of education. But creating enduring improving the quality of education has proven very challenging for school boards and provincial governments across the country. Improving the “quantity” of education usually means improving Canadians’ access to post-secondary education by reducing tuition fees or improving the accessibility or generosity of student loans. A university education is a very costly thing to produce, however, and both reduced tuition fees and more generous student loans translate into higher costs for taxpayers, reductions in other public services or an increase in taxes.

A key element of a nation’s productivity is its “technical knowledge.” Government policies can support research and development in universities and the private sector, but such investments are inevitably undertaken with an uncertain future return. A different approach involves reducing tax rates for businesses in the belief that the private sector will undertake more research and development activities when the after-tax payoff from such activities is increased. Canadian governments have actively pursued both approaches, but further action on these fronts would clearly make the public fiscal position more challenging.

The process of “globalization” is best described as the reductions in the costs of transportation and communication that have been occurring for centuries, but with especially remarkable speed since the Second World War. These declining costs have permitted firms to locate their production facilities wherever unit costs are lowest and then move them to wherever they are needed, either to the final consumer or to the next stage in a multi-stage and multinational production process. As figure 6 shows, the growth in world trade (blue line) has vastly outpaced the growth of world GDP (red line) over the past 60 years. Globalization has indeed made the world a much smaller place and, through its effect on the flow of international trade, has been a crucial factor in our rising living standards.

Canada benefits from globalization and free international trade in two complementary ways. First, because they are based in a country with a relatively small population, Canadian firms need access to large world markets in order to reap the benefits of the inherent scale economies in their production processes. But gaining access to large foreign markets generally requires that we give foreigners’ equivalent access to our market, and so Canadian firms are in close competition with foreign firms both at home and abroad. This international competition is an important force driving invention and innovation. The eventual outcome is higher productivity for Canadian firms, leading to higher profits, higher wages and more domestic employment.

Canadian consumers also gain directly from accessing world markets in which they can purchase a whole range of products unavailable in Canada at the same price or quality. The purchasing power of the typical Canadian household would be vastly reduced if all of its purchases of coffee, fresh vegetables, cotton shirts, leather shoes, software and electronic devices could be provided only by higher-cost Canadian producers.

These truths have been known by Canadians for many years, and the importance of international trade to Canadian prosperity has always been near the political agenda. Not surprisingly, we have developed most fully our trading relationship with the United States, by far our largest trading partner. But Canada does a great deal of trade with other countries as well, including China, Japan, the countries of the European Union and increasingly the countries in Central and South America. Given the importance of international trade to Canadian prosperity, we have a keen interest in ensuring that existing trade barriers are reduced wherever possible and that new barriers are not erected.

The current economic situation presents challenges for advancing the agenda of trade liberalization. An unfortunate truth is that economic recession usually brings forth protectionist arguments as a means of maintaining domestic jobs and income. Yet the compelling evidence points in exactly the opposite direction — that increasing tariffs or non-tariff barriers in one country usually leads other countries to do the same, resulting in a tariff war that reduces both the volume of trade and overall employment. For this reason the G20 leaders agreed in Washington in November 2008 to refrain from introducing new protectionist measures.

Looking a little further ahead, there is a danger that some countries’ attempts to implement effective climate change policies will create obstacles to the flow of international trade. Domestic firms often claim “unfair competition” when confronted with low-priced foreign products, and they aggressively lobby governments for protection. It is difficult enough in normal times to resist these pressures. But in an era in which politicians are looking to acquire better environmental credentials, domestic firms may try to conceal their arguments of raw trade protection behind the veil of environmental stewardship. Political leaders may find these new pressures more difficult to resist. Inside the European Union, where climate change policies are more advanced than in North America, these pressures are already evident.

Canada’s interests in international trade are advanced along four tracks. First, and most important in a quantitative sense, is advancing the free flow of goods, services and assets between Canada and the United States. With the Canada-US FTA in 1989 and its expansion to NAFTA in 1994, the tariffs on most goods and barriers to trade in services crossing the 49th parallel were eliminated. But with the heightened security concerns generated by the 9/11 terrorist attacks, the Canada-US border has “thickened,” slowing the cross-border flow of trade. Governments must search for ways to improve the flow of trade between Canada and the United States while maintaining all necessary security measures.

The second track is the multilateral one, currently the Doha Round of the WTO negotiations, at the heart of which is government support for agriculture. Developing countries are pressing the rich countries to stop protecting and subsidizing their agricultural producers on the grounds that such actions drive down world prices and make it nearly impossible for the developing countries to enter these markets. Many rich countries recognize the case against subsidizing their own agricultural producers, but seem unable to terminate the high levels of support, certain of the political backlash that would come from the small but highly organized share of the electorate closely connected to agriculture.

Canada has consistently argued for the elimination of government subsidies to agriculture but simultaneously has argued the need to maintain our supply management in the dairy and poultry industries. Producers in these industries receive support not directly from government subsidies but indirectly through quota systems, which restrict output and thereby raise prices to consumers. Several countries accuse Canada of having a contradictory position, suggesting that real advances in the Doha Round may require Canada to reconsider its negotiating stance.

The third track for advancing trade liberalization is the bilateral one. Canada has struck free trade agreements with several countries over the past decade and could continue on this path, slowly expanding the set of countries with which Canadians can freely trade. Though these agreements expand Canada’s potential gains from trade, a danger exists that the government will exhaust its political capital setting up such small free trade agreements, only to remove its efforts from the multilateral agreements that hold far more potential benefit for Canada.

The final and simplest track is the unilateral one, whereby Canada simply reduces or eliminates its remaining tariffs on specific products without engaging in any international negotiations. In other words, this track involves Canada receiving no quid pro quo from any other country. From a pure economic perspective, such a policy delivers clear gains to Canadian consumers of the imported products, many of whom are domestic producers who use the imports as inputs and whose competitiveness is therefore improved by such tariff reductions. But from the perspective of international politics, such actions are often viewed as giving something away for “free,” thus making it more difficult to extract similar concessions from trading partners in the future.

Each of these four economic challenges is complex, and will involve difficult choices for Canadians. The challenge of debt and demographics will force Canadians to choose how best to address the growing future demands on the health care system, through reductions in other spending programs, increases in public indebtedness or increases in taxes. Policies to effectively address global climate change will increase the costs associated with the burning of fossil fuels and have significant effects on the structure of the Canadian economy. Both of these economic challenges underline the importance of improving Canada’s rate of productivity growth as a means of increasing our future living standards. But there are no simple or inexpensive ways of improving productivity, and Canadians will need to think carefully about which policies are likely to be the most effective. Improving Canadians’ benefits from globalization is complicated if for no other reason than that improving access to global markets generally involves multi-party international negotiations, where economic issues are blended together with political, security and environmental agendas.

Not only is each of the four challenges sufficiently complex in its own right, but linkages between them add to the overall complexity. Policies to improve education or health outcomes will lead to a more productive workforce and improve long-run living standards; but these same policies will cost real resources and thus exacerbate the existing fiscal challenge. Policies to reduce Canada’s GHG emissions will reduce the growth rate of the economy and the tax base, worsening the coming fiscal squeeze. Policies to improve Canadians’ access to global markets may increase productivity and help raise our long-run living standards, but gaining improved access may require the elimination of politically entrenched policies, for which there may be a significant fiscal cost.

Canada has a number of real economic challenges in its future, and it is crucial that we face them head-on, rather than pretending they do not exist. Meeting these challenges in a sensible and coherent way will not be easy, and patient and clear communication about difficult choices will be an essential part of the process. There is no time like the present to begin the necessary work.

Photo: Shutterstock